Quant chart: Has goodwill accounting gone bad?

In 2000, in one of the largest acquisitions in history, Vodafone acquired Mannesmann for USD 202.8 billion, and recorded a goodwill of USD 129.2 billion.1In this month’s quant chart, we highlight recent developments around goodwill and potentially substantial impairments, arguing that investors should be more aware than ever of the risks of high goodwill numbers on balance sheets.

What is goodwill? In an acquisition or merger, companies record goodwill on their balance sheets when they pay a premium for an enterprise over its net asset value. Once the deal is completed, this premium is included in intangible assets on the balance sheet and reflects the value of a company’s brand, customer relationships, employee relations, and other factors that contribute to its earnings power beyond just physical assets.

The treatment of goodwill in accounting after an acquisition has undergone a significant shift over the last decades. Historically, companies were required to amortize goodwill periodically, reducing its value on the balance sheet over time regardless of the actual value derived from the acquisition.

Moving to impairment only

However, a notable change in accounting standards, initiated by the Financial Accounting Standards Board (FASB) in 2001 and followed by the International Accounting Standards Board (IASB) in 2004, has moved toward an impairment-only approach. This model mandates that goodwill is tested annually for impairment rather than being systematically amortized. Impairments occur when the carrying amount of goodwill exceeds its estimated fair value, indicating that the expected benefits of the acquisition have decreased.

While proponents argue that these reforms improved financial reporting because financial statements better reflect the true economic value of the acquired assets, opponents counter that the new standards have resulted in relatively inflated goodwill balances and untimely impairments.2

Moreover, critics point to the subjective nature of impairment tests and suggest that managers are presumably reluctant to impair goodwill, as any impairment is likely to be interpreted as an admission that they overpaid for the associated business acquisition.

What the data tells us

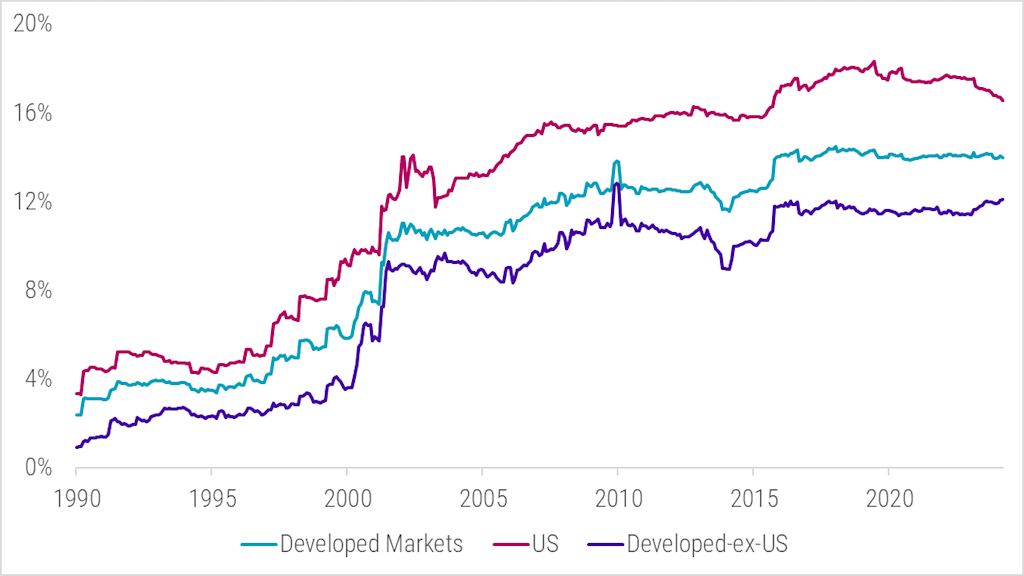

Figure 1 | Reported goodwill on balance sheet relative to total assets per region

Source: Robeco, Refinitiv. The figure shows aggregated reported goodwill relative to the aggregated total assets per region and over time. Both goodwill and total assets are winsorized at the 99% level to remove the effect of a few data errors. The investment universe consists of all non-financial constituents of the MSCI Developed Indices. Before 2001, we used the FTSE World Developed Index. The sample period is January 1990 to March 2024

But what does the data tell us about the development of goodwill over time? Figure 1 illustrates the aggregated reported goodwill on the balance sheet in relation to the aggregated total assets, focusing on developed markets and distinguishing between those outside the US and the US itself.

Before 2000, reported goodwill accounted for approximately 3% and 7% of total assets for developed markets outside the US and the US, respectively. However, following the accounting reforms in the early 2000s, these numbers quickly increased to about 11% and 15%. Looking under the hood of these aggregated numbers, we see that they aren’t driven by just a handful or a dozen stocks but a broader phenomenon. Sector-wise, the portion of goodwill is currently highest for information technology, health care, and consumer staples. However, we also see that the other sectors nowadays have higher levels than pre-2000.

While the increase in goodwill often reflects confidence in the value of acquired assets and anticipated synergies, it carries significant risks. Elevated goodwill figures may indicate over-optimism about acquisitions’ future profitability and integration success or a sign of earnings management. In periods of economic downturn or when acquisitions fail to meet expectations, significant impairments may occur, leading to substantial charges against earnings. For instance, Kraft Heinz wrote down the value of some of its best-known brands by more than USD 15 billion in 2019, resulting in a 28% decline in its stock.3

Similarly, shifts in leadership can prompt reevaluations of asset values, as seen when General Electric and British American Tobacco reported goodwill impairments of USD 23 billion in 2018 and USD 31.5 billion in 2023, respectively. 4,5

In general, we observe that the portfolio of goodwill on balance sheets has slightly come down in the US in the most recent years, a trend that might continue. In contrast, the goodwill portion on balance sheets of around 12% has remained relatively stable outside the US. However, the IASB published a proposal in March 2024, according to which companies would have to disclose more detailed information if acquisitions live up to their initial promise and in which segments the reported goodwill is reported.6 These proposals would help investors to evaluate the reported goodwill numbers better and might also lead to lower reported levels and higher goodwill impairments going forward.

In light of these recent developments and potentially substantial impairments, investors should be aware of the risks of high goodwill numbers on balance sheets. Understanding these risks is key to making informed investment decisions and navigating the potential financial instability they may introduce.

Footnotes

1 Institute for Mergers, Acquisitions and Alliances, February 2023, Goodwill in Mergers & Acquisitions.

2 Li, K., and Sloan, R., May 2017, Has goodwill accounting gone bad? Review of Accounting Studies, 22(2), 964–1003.

3 Giammona, C., February 2019, Kraft Heinz Plunges to Record Low on Writedown of Brands' Value, Bloomberg article.

4 Crooks, E., October 2018, GE’s $23bn writedown is a case of goodwill gone bad, Financial Times article.

5 Haigh, R., January 2024, Strategic Impairment at British American Tobacco, Brand Finance.

6IASB, March 2024, Business Combinations—Disclosures, Goodwill and Impairment, Proposed amendments to IFRS 3 and IAS 36.

Quant Charts

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会