最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Conventional wisdom has it that long-term outperformance is often a matter of limiting losses in down markets. One way conservative investors seek to mitigate losses in down markets is to keep a part of their portfolio in gold. But is this really the most effective strategy? Our research shows there are alternative options available.

Warren Buffet’s first rule of investing is to never lose money; his second is to never forget the first rule. This golden rule is key for long-term capital protection and growth. One oft-used strategy to limit losses in turbulent markets is an allocation to gold. Gold investing is widely regarded as a safe haven during extreme macroeconomic downturns in periods of war, hyperinflation, or major recessions.

But do such allocations to gold really provide the expected protection in practice? And even if so, are there any better ways to mitigate risks? To answer these questions, we revisited the strategic role of gold in investment portfolios and focused on its marginal downside risk reduction benefits relative to bonds and equities.

Our analysis, featured in a new research paper, focuses on annual real returns starting in 1975, when gold became truly tradeable. We took the perspective of a US investor who could strategically invest in equities, bonds, and gold and would care about a wide range of downside risk measures, including downside volatility, loss probability and expected loss.

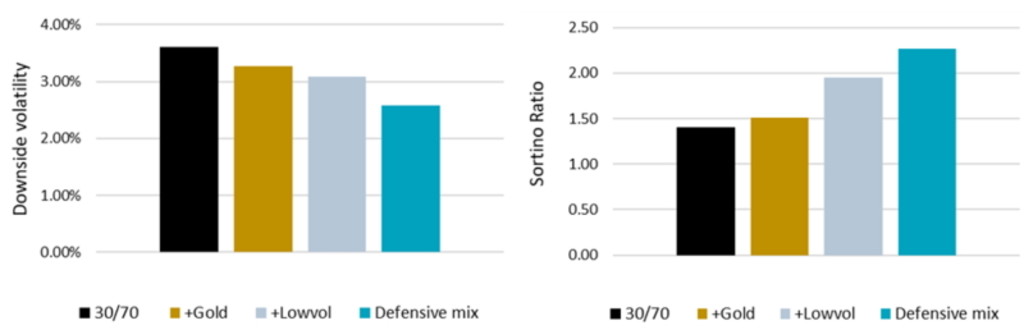

The key findings of our empirical study are that a modest gold allocation in a traditional mix of equities and bonds reduces the risk of capital losses by around 10% across a wide range of equity-bond allocations. Still, this also reduces the return, leading to a small increase in the return/risk ratio as shown in Figure 1 summarizing the main findings of this study.

Source: Lohre, H., and Van Vliet, P. (2023) “The golden rule of investing”, working paper.

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Importantly, however, our simulations show that the downside volatility can be reduced further by adopting a low volatility style in the equity investment and letting this defensive equity allocation replace part of the bond allocation. The portfolio with the lowest downside volatility on a one-year horizon consists of 45% bonds, 45% low-volatility stocks and 10% gold.

Our simulations show that the downside volatility can be reduced further by adopting a low volatility style

As a result, this defensive mix has significantly lower downside risk than a traditional equities/bonds portfolio, with higher returns leading to a large increase in the Sortino ratio. This defensive strategy therefore proves to be an effective way for investors to adhere to Buffet’s golden rule, while still delivering long-term capital growth.

Moreover, additional simulations and robustness checks show that these key findings hold not just for the one-year returns initially considered, but also for a wide range of investment horizons, ranging from one month up to 36 months. While these results are robust when gold futures are used instead of a direct gold investment, adding gold mining stocks is less effective in reducing the downside risk of a low-volatility equity portfolio. Lastly, we document that, while the risk mitigation role of gold is muted in a mean-variance setup, low volatility investing is considered just as relevant as when evaluated through a downside risk lens.

Recorded webinar

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会

重要なお知らせ 当社や当社役職員を装ったSNSアカウントやウェブサイト等を使った投資勧誘にご注意ください さらに表示