Conservative equities is our active approach to low volatility investing. It is based on the anomaly that low-risk stocks tend to deliver a higher risk-adjusted return than high-risk stocks, contrary to classical finance theories. An approach that leads to a portfolio that offers stable equity returns and tend to generate high dividends.

Stable equity returns tend to come with high income

We think it is unwise to select stocks purely based on risk considerations, ignoring the price you pay for them. This is why we also consider valuation and momentum factors to enhance returns. This approach leads to a portfolio that offers stable equity returns and tends to generate high dividends.

Dividends are a significant and stable source of equity returns

Dividend yield is one of the most defensive measures of value

High dividends help enhance long-term returns and limit drawdowns

Defensive Equities

Winning by losing less

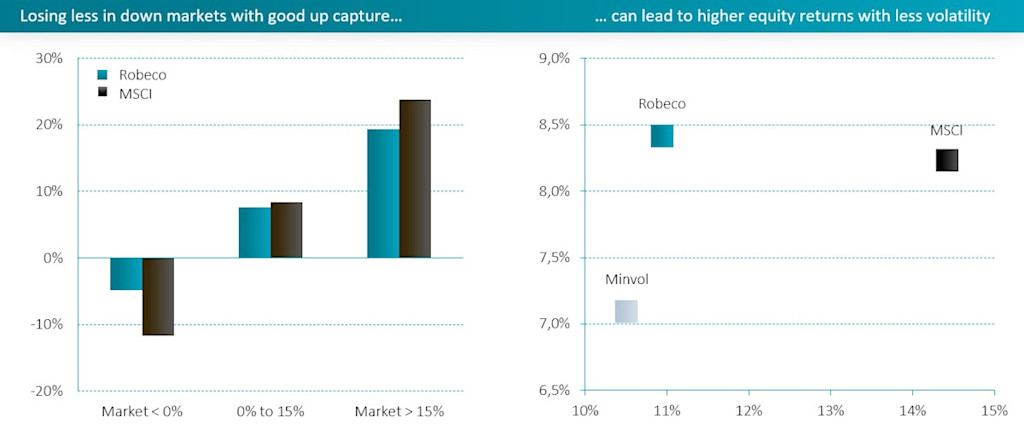

Winning by losing less in down markets

Better capital preservation can be achieved due to a significant reduction of losses during down markets. In a very bullish environment, the strategy could lag the overall market, while still delivering solid absolute returns. Once the market recovers, low volatility stocks have to make up less lost ground.

Source: Robeco Performance Measurement and MSCI as of 31 December 2024.

Past performance is no guarantee of future results. The value of the investments may fluctuate. Left-hand graph: The average 12m rolling return series. Right-hand graph: Annualized returns. All figures in EUR based on the net asset value of the representative account of the Robeco QI Institutional Global Developed Conservative Equities strategy since inception (October 2006), gross of fees. The account and reference index are unhedged for currency risk as of June 30, 2012. In reality, costs (such as management fees, transaction- and other costs) are charged. These have a negative effect on the returns shown.

How to apply the Conservative strategy in a portfolio

Risk reduction

A pension fund with a low funding level after the financial crisis replaced conventional equities with Conservative equities to reduce risk while not giving up equity returns.

Income generator

A bank decided to include Conservative equities in its defensive income model portfolio, as the strategy combines high dividend yield with lower downside risk.

Diversification

A family office added the Conservative equity strategy to its portfolio of higher risk equity funds, in order to stabilize the overall performance.

Sustainability integration

An environmentally aware pension fund wanted to limit the ecological footprint, increase the ESG profile and reduce risk and therefore invested in the connservative sustainable equity strategy.

Proven track record

For over ten years, we have been offering a distinctive approach to low-volatility investing, based on award-winning research.

First multi-factor models developed in 1994

First Conservative equity strategy launched in 2006

A wide range of strategies: global developed, European, emerging, all countries, US and sustainable