Meet the many trends shaping the future of commerce

Ecommerce benefited significantly from the Covid-19 shock. While mobility restrictions kept consumers away from traditional brick and mortar shops, online shopping adoption surged across geographies and age groups. But the great acceleration seen in 2020 is only one of the many changes shaping global consumer spending. Other sweeping developments are also redefining the future of commerce and the long-term winners of the digitalization trend.

まとめ

- Rising online sales is just one of the trends shaping the future of commerce

- Many consumer habits begun during pandemic are likely to stick

- We discuss some key recent developments in the retail sector

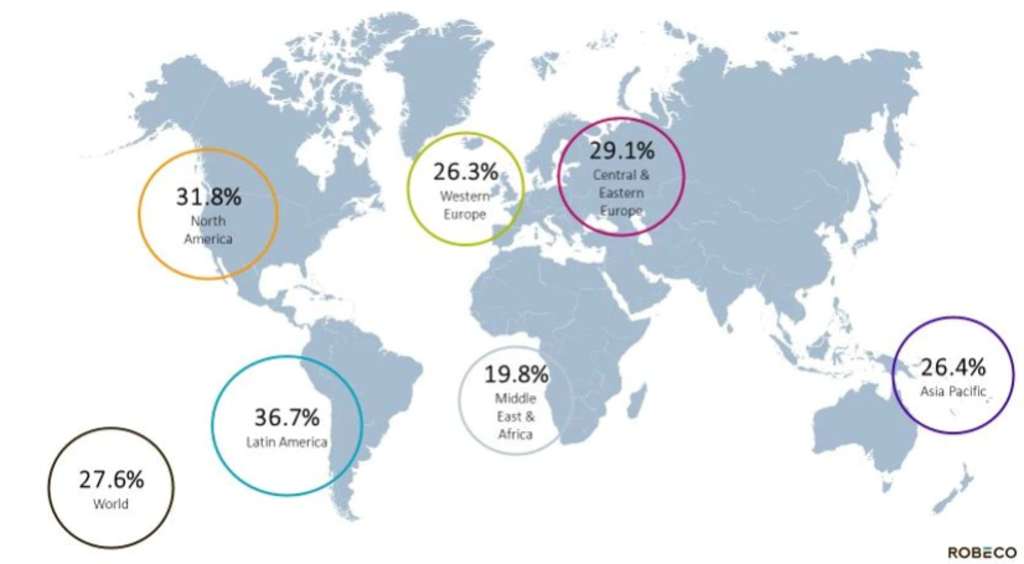

The Covid-19 pandemic triggered a broad-based global surge in digitalization, most dramatically in retail distribution. At the beginning of the first wave people stockpiled basic goods like toilet paper and items with a long shelf life like dried pasta. But as it became clear that the mobility restrictions would remain in place for longer than anticipated, consumers gradually started to change their purchasing behavior, moving online like never before (see Figure 1).

Figure 1: Retail ecommerce sales growth in 2020 by region

Source: eMarketer, Robeco, January 2021.

One key reason behind this surge is new cohorts joining the online ranks, in particular among older generations. People aged 65 and over were the fastest growing segment in terms of online spend last year in the US, according to NPD, a data and analytics firm.1 The array of goods bought regularly online also expanded. A recent survey by audit and consulting firm PwC showed no less than 53% of global consumers were now shopping fashion goods “more or exclusively online” versus in-store.2

Another notable catalyst of ecommerce adoption has been the dramatic rise of so-called ‘social commerce’, an ecommerce modality essentially driven by social networks. Social commerce typically includes sharing recommendations, discounts, games, and other types of content. This has been especially the case in China, where already increasing use of social commerce was further boosted by a spectacular boom in online community group-buying.

These shifts in consumer spending seen during the pandemic are expected to persist going forward, even as economies fully reopen and public health measures, as well as mobility restrictions, are gradually lifted. Despite renewed optimism from rapid vaccination campaign progress, safety concerns remain top of mind for customers. Only 59% of global consumers said they felt safe shopping in-store, according to recent data3 from Deloitte, another audit and consulting company.

But while the Covid-19 outbreak may have dramatically accelerated the digital transformation and propelled ecommerce to new heights, it has certainly also increased competition. For instance, many traditional brick and mortar wholesalers and retailers suddenly found themselves with their backs to the wall in the early stages of the pandemic, forced to move online in order to survive the crisis. Doing so, they started competing even more directly with more established ecommerce specialists.

The most explicit sign of rising competition within the ecommerce arena is the emergence of a series of regional champions. While Amazon may be the undisputed leader at global level, these regional champions are now increasingly in the driver’s seat in many countries. MercadoLibre in Latin America and Shopee in South East Asia are only two examples. Meanwhile, Alibaba dominates in China but nimble competitors like JD.com and Pinduoduo are catching up rapidly.

While ecommerce penetration into groceries had been lagging most other retail sectors, the outbreak suddenly knocked down many of the barriers to consumer uptake

Ecommerce expands into underpenetrated segments

Besides the general surge in ecommerce activity and competition, another key development has been the strong boost in online take-up seen for segments that remained relatively underpenetrated before the pandemic. Groceries is by far the most telling example. While ecommerce penetration into this segment had been lagging most other retail sectors, the outbreak suddenly knocked down many of the barriers to consumer uptake that had been hindering its expansion around the world.

But groceries were not only relatively underpenetrated segment to witness such a move. Non-essential items, such as fashion goods, health & beauty products and sports & fitness equipment, also experienced a strong rise in popularity from online shoppers.4Even pet care products moved online swiftly. Ecommerce specialists, saw their sales grow rapidly last year, as demand for pet products rose and as they gained market share.

Consumer Trends

A hybrid mix of on and offline shopping

In this context, the role of physical stores has been widely called into question, given the potential savings involved. However, what appears to emerge from current debates within the retail industry has more to do with an evolution than an outright demise of brick and mortar stores. For all the fuss around online shopping gradually displacing traditional commerce, customers still prize human interaction and physical shops.

Survey after survey, global consumers indicate that the convenience of the shopping experience remains crucial and that online cannot fully replace physical stores. In fact, data from the Adyen payments platform, a payments services company, also suggests that companies able to successfully integrate physical and digital commerce fared better than their pure-play counterparts during the pandemic.5 Therefore, the future of commerce will most likely be a mix of on and offline shopping.

Although actual consumer spending may not always reflect consistent behavior in this regard, awareness of the need to shift towards more sustainable consumption habits has now become widespread

Sustainability takes center stage

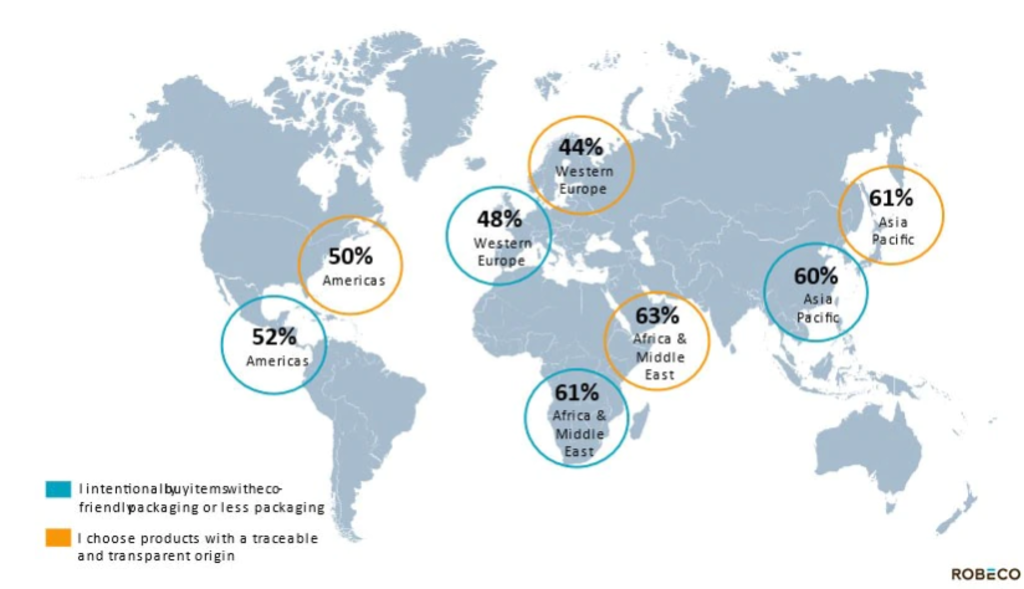

The emergence of companies such as Shopify also illustrates another phenomenon: the rise of the sustainable e-consumer looking for healthier, locally produced, locally distributed, and environmentally friendly products. Although actual consumer spending may not always reflect consistent behavior in this regard, awareness of the need to shift towards more sustainable consumption habits 6 has now become widespread. (see Figure 2)

Figure 2: Propensity to buy more sustainable products

Source: PwC Global Consumer Insights Pulse Survey, March 2021. Question asked: “Please indicate to what extent you agree or disagree with the following statements around shopping sustainability.” Net: Agree.

For example, the recent PwC consumer survey suggested that 55% of respondents were willing to pay more for healthier food and 50% of them were ready to pay more for locally produced groceries. As much as 46% said they would be ready to pay more for sustainable packaging.7 Interestingly, the survey also showed a gap between consumers working from home and those working away from home, with the former being more likely to prioritize sustainable products than the latter.

Footnotes

1Across retail (including grocery and general merchandise) shoppers aged 65 and over made 15% of their purchases online between January and October 2020, up from 10% in 2019, according to NDP Checkout data.

2Source: PwC Global Consumer Insights Pulse Survey, March 2021.

3Source: Deloitte, Global State of the Consumer Tracker, data as of 26 May 2021.4Source: PwC Global Consumer Insights Pulse Survey, March 2021.

5Source: Adyen, October 2020, “2020 Retail report”.

6See for example: LE Europe, VVA Europe, Ipsos, ConPolicy and Trinomics, October 2018, “Behavioural Study on Consumers’ Engagement in the Circular Economy”, report for the European Commission.

7Source: PwC Global Consumer Insights Pulse Survey, March 2021.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会