How investments in water utilities can combat market uncertainty and volatility

Regulated water utilities are often perceived as safe havens, offering quiet, predictable growth amid a market dominated by AI-driven noise, swings and uncertainty. Utility stocks provide a solid anchor for Robeco’s Sustainable Water strategy, which combines infrastructure-led growth in emerging markets with increasing cross-sector demand in developed markets, to create a resilient portfolio geared for both defensiveness and growth.

Sommario

- Utilities are characterized by distinct revenue models

- Natural monopoly status gives utilities a naturally defensive tilt

- Structural trends in EM and DM create robust growth potential

Water utilities function as natural monopolies primarily because competing companies could never achieve the scale necessary to be profitable. Moreover, lots of duplicate infrastructure crisscrossing underground would create additional tumult and headaches for municipalities. In order to cut costs, conserve resources and, above all, entice companies, regulators grant a single operator the exclusive right to provide water services. In exchange, companies agree to strict oversight of customer pricing, service standards, and capital expenditure (capex).

This contract makes utilities unique in several important ways. First, the business model is uncorrelated to the typical business cycles that drive revenues and returns across most economic sectors. Second, unit prices are largely set by the regulator and don’t dynamically shift based on fluctuations in customer demand. Third, water utilities’ growth depends partly on the size of its ‘approved’ infrastructure investments – the pipes, mains, treatment plants, and filtration technologies – needed to clean and safely distribute clean water.

… the [utility] business model is uncorrelated to the typical business cycles that drive revenues and returns across most economic sectors

Rate-based vs concession models

The most common methods for remunerating water utilities are ‘rate-base’ and ‘concession’ models. In a rate-based model, utilities submit multi-year investment plans to the relevant water regulator, outlining how they will expand networks, maintain service quality, and meet environmental standards. Regulators approve or modify these plans and set an ‘allowance’ that covers the capex and operating costs, plus a reasonable return on investment.

In a concession model, the government makes a tender, and water utility operators bid for a ‘concession’ – the right to offer water services for an extended period of time (usually 25-30 years). The winner tends to be the company that can deliver the services at the lowest cost.

A rate-base model prioritizes the rapid deployment of infrastructure investments as that will lead to faster increases in its regulated asset base (RAB), which in turn will lead to higher tariffs and overall revenues. At the same time, capex investments are also aimed at solutions that help save water or costs (e.g., smart metering). The efficiency gains and cost savings made by the utility company are then shared with customers via reduced tariffs.

Concession models prioritize the cost-efficient execution of infrastructure investments and strict control of operating costs. Any efficiency gains are kept by the company (and shareholders), not shared with the customers.

Powerful growth in emerging and developed markets

Rapid urbanization, industrial expansion and underdeveloped or aging infrastructure mean that water utilities in both developed and emerging markets are poised for substantial multi-year investment and upside potential. In emerging markets, some water utilities are being privatized (i.e., government selling majority stake). Given private companies run more efficiently this usually leads to reduced operating costs and improved company profits. Moreover, emerging market equities are back in focus, as investors seek to diversify away from the chaos, concentration and volatility of US markets and politics.

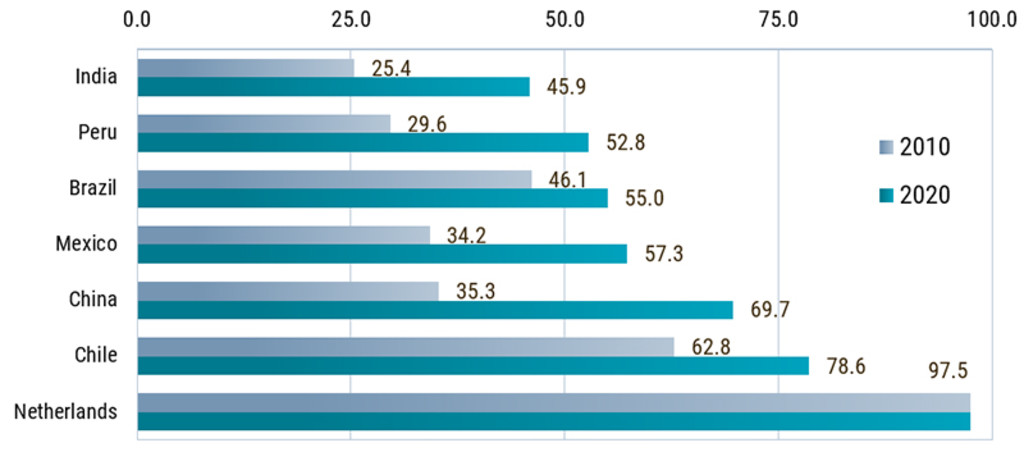

Figure 1 - Accelerated growth of sanitation services in emerging markets (%)

Percent of population using safely managed sanitation services.

Source: Brazil, SNIS, World Bank, Arcadis, Robeco, 2023.

This lends fresh capital and momentum to the EM region which should also benefit water utilities. The recent IPO of Maynilad1 in the Philippines raised a record USD 580 million when the company debuted in late October, demonstrating investor confidence in structural reforms and in management’s ability to deliver long-term revenue streams.2

… water utilities in both developed and emerging markets are poised for substantial multi-year investment and upside potential

Developed markets, in contrast, are less focused on infrastructure expansion and more on upgrades with, for instance, the rollout of smart metering for rapid leak detection or efficiency-enhancing data collection. Stricter standards for PFAS and other harmful micropollutants are also driving investments into ever-more sophisticated filtration systems.

Boring, but not risk-free

Water utilities may be boring but they are not risk-free. Regulation underpins the entire model; if regulators grant unfavorable conditions, it puts a utility’s earnings and investor returns in jeopardy. Regulatory scrutiny is often guided by political pressure over issues of affordability, public safety as well as environmental hazards. For example, in 2024, several water operators were significantly fined by the UK water regulator, Ofwat, for inadequate investments and infrastructure mismanagement after heavy rains and flooding caused sewage spillovers and public outcries.3

Interest-rate sensitivity is another risk factor. Utilities are often perceived as bond-proxies, because of their regulated/predictive nature, and their dividend yields are compared to the local government bond yield. In times of high interest rates, government bond yields rise. For the utilities’ dividend yields to match, share prices need to decline. This can lead to sector underperformance in times of increasing interest rates.

Finally, given the increasing frequency and intensity of extreme weather, utilities are also increasingly exposed to climate risks. Droughts reduce natural reserves and force utilities to ration, resulting in customer service disruptions. Or they must seek costly alternatives (e.g., new reservoir construction or desalination plants). Moreover, severe rainfall contributes to flooding and stormwater overflows, which in addition to asset damage, also endanger water quality and public health.

Leggi gli ultimi approfondimenti

Iscriviti alla nostra newsletter per ricevere aggiornamenti sugli investimenti e le analisi dei nostri esperti.

Conclusion

Though they are often overlooked, water utilities have the capacity to reliably convert capex into future earnings and steady shareholder returns. Robeco’s Sustainable Water strategy has long recognized and used the defensive qualities of utilities to create a resilient portfolio across diverse market environments.

Beyond utilities, the strategy also invests across the broader water value chain enabling exposure to growth from a well-diversified base of industries – from to pharma and biotech as well as textiles, chemicals and consumer goods – all of which demand water solutions related to advanced cooling, purification and analytics.

This leaves the strategy well positioned to benefit from modernization and innovation in developed markets. At the same time, its global focus means it can tap into structural growth in emerging markets, where privatization and regulatory reforms are creating multi-decade investment cycles and stable dividend prospects for shareholders. In nature and in markets, water possesses the capacity to shimmer and shine under the right conditions.

Footnotes

1Company/security disclaimer: The companies shown are for illustrative purposes only in order to demonstrate the investment strategy on the date stated. The companies/securities are not necessarily held by Robeco’s Sustainable Water strategy nor is their future inclusion guaranteed. Moreover, no inference can be made on the future development of the company. This is not a buy, sell, or hold recommendation.

2Maynilad shares steady on debut as Philippine growth disappoints. Bloomberg, November 2025.

3Thames, Yorkshire and Northumbrian Water face £168 million penalty following sewage investigation. Ofwat, 2024.

… water utilities have the capacity to reliably convert capex into future earnings and steady shareholder returns

Sustainable Water D EUR

- performance ytd (31-1)

- 2,62%

- Performance 3y (31-1)

- 5,40%

- morningstar (31-1)

- SFDR (31-1)

- Article 9

- Pagamento del dividendo (31-1)

- No