The benefits of combining fundamental and multi-factor high yield

In volatile times, a carefully managed approach to risk is essential.

Summary

- Combining high yield strategies can stabilize performance amid volatility

- Focus on high-quality issuers, applying fundamental and quantitative analyses

- Utilize experienced, active management to effectively navigate challenges

With central banks seemingly ending their rate-hiking cycle and some already cutting rates, geopolitical tensions and political uncertainty still challenge bond markets. The financial health of companies issuing high yield bonds is crucial as signs of a slowdown or recession could increase default risk due to margin pressure or debt burdens.

Combining a quantitative, factor-based high yield strategy with a fundamentally managed high yield portfolio offers several benefits. It allows investors to maintain their risk-return appetite while stabilizing relative performance. A combined strategy broadens the investment universe by not only investing in fundamentally covered names but also in model-covered names, increasing diversification. This is particularly valuable in periods of increased default risk. Additionally, combining both strategies leverages Robeco’s strong track records in both fundamental and quantitative high yield portfolio management.

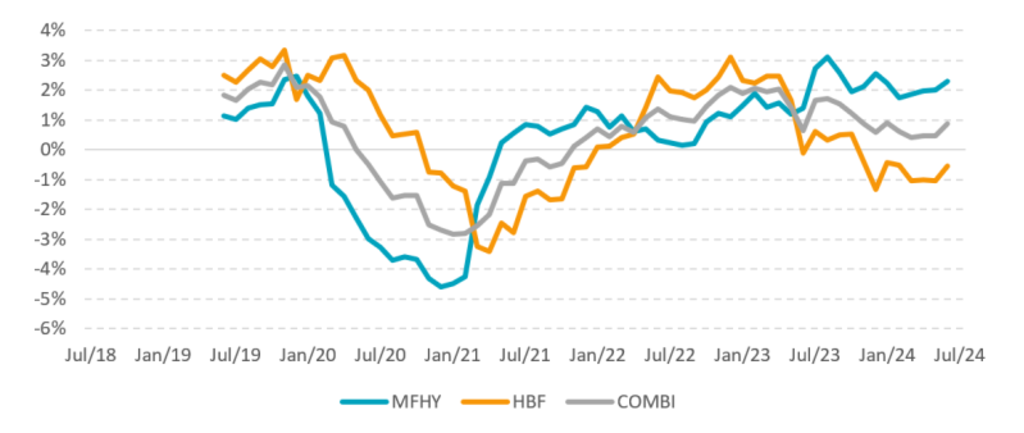

In Figure 1, we can observe volatility in the relative performances of Robeco’s fundamental high yield strategy (HBF) and Robeco’s multi-factor high yield strategy (MFHY). The chart covers the period from July 2018 (the inception date of MFHY) to June 2024. The significant dips in 2020 for both strategies took place in a period when the COVID-19 pandemic and recovery phase affected the market. We also show a combined strategy (COMBI) that invest 50-50 in both. This combined portfolio is the most stable among the three, with less pronounced dips and more consistent performance. With fewer fluctuations, it is a more risk-averse option that better maintains relative performance.

Figure 1 - One-year rolling performances of three different portfolios from July 2018 to June 2024.

MFHY = Multi-Factor High Yield (Robeco QI Global Multi-Factor High Yield IH EUR). HBF= Fundamental High Yield (Robeco High Yield Bonds IH EUR). COMBI=50-50 combination.

Source: Robeco, Bloomberg, July 2024. The currency in which past performance is displayed may differ from the currency of your country of residence. Due to exchange rate fluctuations, the performance shown may increase or decrease if converted into your local currency. The value of your investments may fluctuate. Past performance is no guarantee of future results. Performance is gross of fees, based on gross asset value. In reality, costs (such as management fees and other costs) are charged. These have a negative effect on the returns shown.

Active Quant: finding alpha with confidence

Blending data-driven insights, risk control and quant expertise to pursue reliable returns.

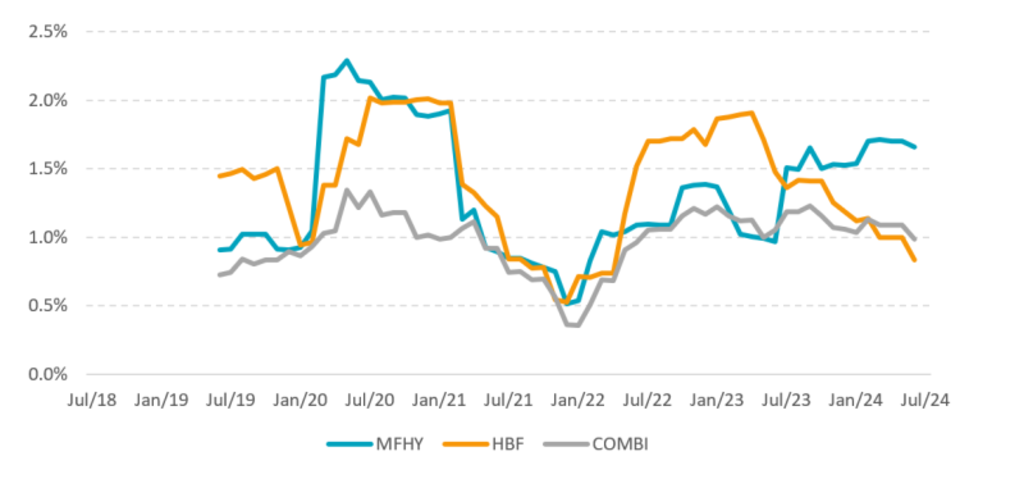

When examining the tracking error for all three portfolios in Figure 2 below, the relatively stable and low tracking error for the combined portfolio stands out, resulting in fewer deviations versus the benchmark. The stability of the combined portfolio is particularly noticeable in 2020, at the onset of the COVID-19 pandemic, and at the beginning of 2022 when Russia invaded Ukraine, causing market stress and contributing to inflationary pressure. And this relative stability is maintained in the first half of 2023 when the Fed continued raising rates. The improved stability of the combined portfolio is due to the integration of two different investment styles that have low correlation into a single strategy, enhancing diversification and lowering risk. Therefore, with lingering rate and geopolitical uncertainty continuing in 2024, taking a slightly more conservative approach with the combined strategy maintains closer alignment with the benchmark and reduces tracking risk.

Figure 2 - One-year rolling tracking errors of three portfolios from July 2018 to June 2024.

MFHY= Multi-Factor High Yield (Robeco QI Global Multi-Factor High Yield IH EUR). HBF=Fundamental High Yield (Robeco High Yield Bonds IH EUR). COMBI=50-50 combination.

Source: Robeco, Bloomberg, July 2024. The currency in which past performance is displayed may differ from the currency of your country of residence. Due to exchange rate fluctuations, the performance shown may increase or decrease if converted into your local currency. The value of your investments may fluctuate. Past performance is no guarantee of future results. Performance is gross of fees, based on gross asset value. In reality, costs (such as management fees and other costs) are charged. These have a negative effect on the returns shown.

Increased dispersion requires active management

Investing in high yield bonds offers several attractive aspects, such as a higher coupon rate and potentially higher returns than investment grade. However, high yield portfolio managers face several challenges, including limited liquidity, defaults, rating migrations, and callable bonds before maturity. These challenges underscore the importance of active, experienced fund management. Sander Bus and Roeland Moraal have managed Robeco’s fundamental high yield strategy since 1998 and 2003, respectively and Patrick Houweling has led Robeco’s quantitative credit strategies since 2003. Robeco’s Global Credit team has the largest number of credit analysts of any asset manager in Europe and Robeco’s Quant Fixed Income team is one of the largest globally. This extensive expertise and scale position Robeco as a leading force in the global credit and fixed income market.

What’s new in credits?

Stay ahead with our newsletter on the latest in credit investing.

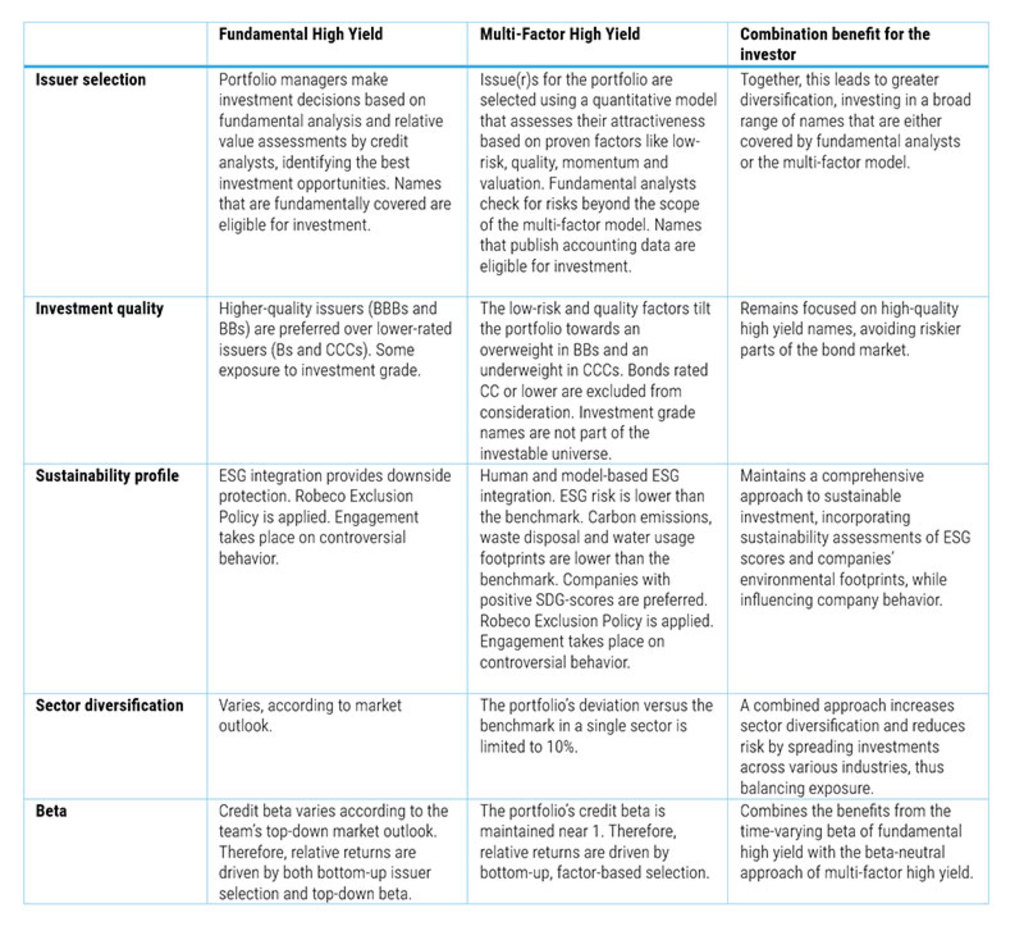

Investor benefits

The table below outlines the characteristics of the two strategies—fundamental high yield and multi-factor high yield—and highlights the benefits of combining these approaches.

Conclusion: enhancing stability and performance

Combining Robeco’s multi-factor high yield strategy with a fundamental high yield bond portfolio presents a strategic approach to navigating market volatility. This combination, blending fundamental credit analysis with a quantitative, evidence-based methodology, offers more resilient performance, especially during periods of market stress. This unique combination not only charts a steady course through challenging economic landscapes but also serves as a robust buffer, mitigating risk and enhancing portfolio stability amidst market turbulence.