Indices insights: Do ESG ratings align with popular thematic impact strategies?

In the second article of the Indices insights series, we shed more light on the shortcomings of ESG ratings. We find that investee companies in popular thematic impact strategies often have low to mediocre ESG ratings. By contrast, we observe that the same firms perform better when assessed in terms of Robeco SDG scores.

概要

- Holdings in thematic impact strategies don’t necessarily have good ESG ratings

- But they exhibit a stronger link with SDG scores

- Thus for investors seeking alignment with positive impact, SDGs scores trump ESG ratings

In practice, sustainable investing is often associated with mitigating exposure to ESG risks. However, we see that our clients are increasingly shifting their focus towards impact investing. This approach enables them to avoid controversial firms that have a negative impact on the environment and society, while allocating capital to those that offer positive solutions to promoting sustainable economic growth, advancing social inclusion and safeguarding the environment. As ESG ratings are still the dominant metric used in sustainable investing, we assessed if they provide investors suitable guidance to align with positive impact, or whether there is a better alternative.

In the first ‘Indices insights’ article,1 we scrutinized the sustainability ratings of companies that are explicitly earmarked by large institutional asset owners as being harmful for society. In our analysis, we found a weak relationship between the firms that are on exclusion lists and their respective ESG ratings. On the other hand, the same precluded stocks tended to have negative Robeco SDG scores. We therefore concluded that the latter metric is more useful to investors who are focused on aligning their portfolios with positive.

We have since extended our investigation to popular third-party thematic impact strategies. These are typically designed to offer investors diversified exposure to companies that are associated with positive contributions to a specific theme, such as clean energy, sustainable water or health. As such, we believe they offer us another avenue to test whether readily available ESG ratings can capture the societal impact of their underlying investments.

In our evaluation, we observed a weak relationship between the investee companies in these thematic impact strategies and their respective ESG ratings, in line with the findings outlined in our first article. And similar to the outcome in our previous assessment, we saw that there was a much stronger alignment when we used a measure based on the SDGs.

訂閱 – 指數洞察

時刻把握荷寶最新可持續性、因子及市場觀點文章。

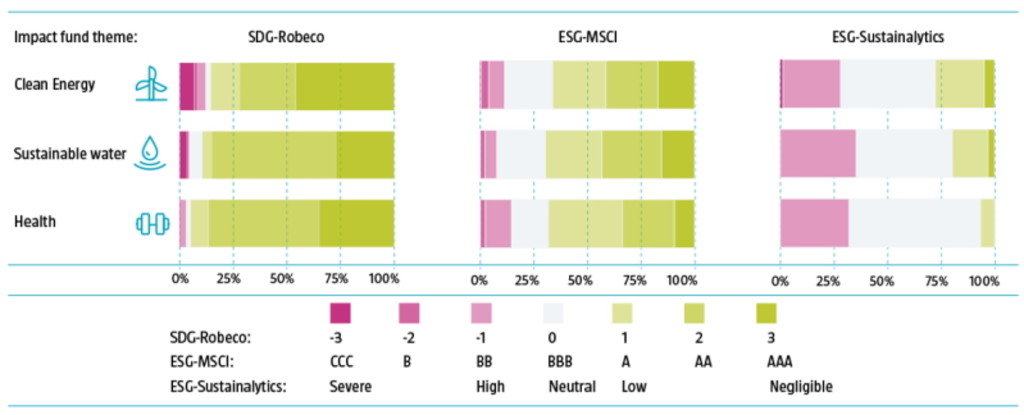

Figure 1 | Thematic impact strategies are better aligned with SDG scores than ESG ratings

Source: Robeco, MSCI, Sustainalytics, Morningstar.

For example, Figure 1 shows that about 25% of the investee companies in our sample of popular third-party thematic impact strategies with a focus on clean energy are considered to have high ESG risk, according to Sustainalytics, while an additional 50% of the holdings receive only a neutral ESG risk rating. While the picture improves when using MSCI ESG ratings, most stocks still only have an average ESG score (BB, BBB or A) or are considered to be ESG laggards (CCC and B).

By contrast, the majority of the underlying investments (more than 80%) exhibit a positive Robeco SDG score, in line with their positive impact on clean energy. A similar trend is also visible across the other themes when we look at our sample of popular third-party thematic impact strategies with a focus on sustainable water and health.

Data and methodology

For our analysis, we took into account the holdings in some of the largest and most popular thematic impact strategies. We focused on three well-established themes – clean energy, sustainable water and health – in the sustainable investing space that consist of strategies or ETFs with considerable track records and asset bases.

More specifically, we selected thematic impact strategies with good or excellent Morningstar sustainability ratings, i.e., ones with a score of 3, 4 or 5 using their 5-point rating scale. We then added strategies with similar investment focus areas that did not have a Morningstar sustainability rating. From this group, we only chose those that had significant assets under management (USD 350 million or higher) and a minimum four-year track record.

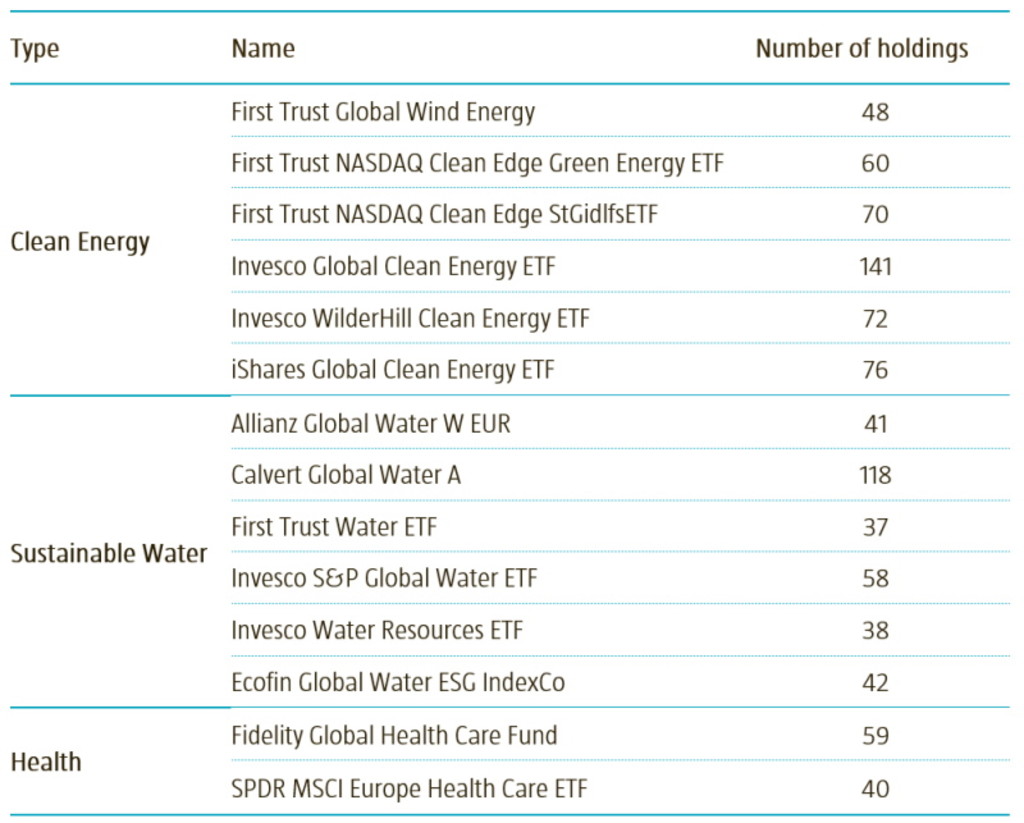

In total, we analyzed the holdings of 14 different strategies/ETFs, amounting to 598 unique companies. Table 1 provides an overview of these strategies/ETFs.

Table 1 | List of thematic impact strategies

Source: Morningstar. Holdings as at 31 October 2021.

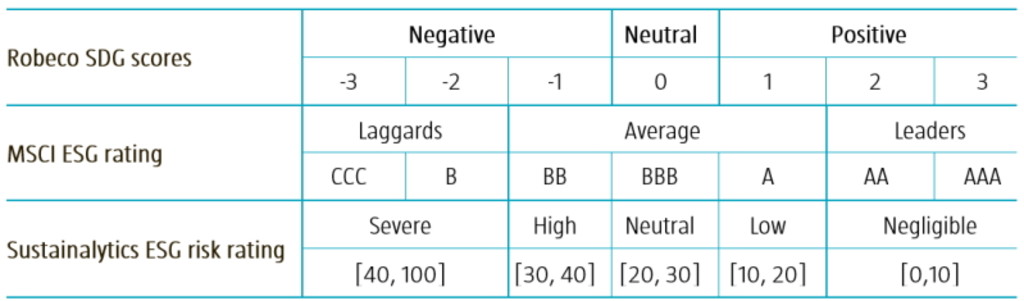

For each of the stocks held in these impact strategies, we analyzed their sustainability scores by referring to three data providers, namely the Robeco SDG scores based on our proprietary SDG framework, MSCI ESG ratings, and Sustainalytics ESG risk ratings. Note that these three data providers use different approaches for their scoring methodologies and that their sustainability scores are not directly comparable.

That said, the sustainability scores clearly differentiate between firms that have a negative, neutral or positive impact on society (Robeco SDG scores); companies that are deemed to be ESG laggards, average in terms of ESG, or ESG leaders (MSCI ESG rating); or businesses that have high, neutral or low ESG risks (Sustainalytics ESG risk rating).

For instance, the Robeco SDG scores and MSCI ESG ratings apply a categorical scale, ranging from -3 to +3, and from CCC to AAA respectively. The Sustainalytics ESG risk ratings assign a quantitative risk score that is used to place a company in one of five risk categories, ranging from severe to negligible. This is summarized in Table 2.

Table 2 | Scoring methodologies

Source: Robeco, MSCI, Sustainalytics.

Conclusion

This analysis further reinforces our view that ESG ratings may not effectively capture the impact companies have on society. In our opinion, an SDG-based approach can enable investors to align their portfolios with positive impact by investing in firms that contribute positively to the SDGs and avoiding those that contribute negatively.

In the next ‘Indices insights’ article, we will look at how incorporating sustainability within the investment process of a passive strategy potentially affects its risk-return dynamics. In our investigation, we will focus specifically on carbon footprint reduction and SDG integration.

Background to sustainability metrics

In defining sustainability, investors have a multitude of dimensions and metrics they could consider. For example:

Values-based exclusions

ESG integration

Impact investing

ESG scores typically put more focus on the operations of a business, whereas SDG scores also incorporate the impact that the business’ products and/or services have on society.

We see client sustainability objectives increasingly moving towards avoiding controversial businesses (values-based exclusions) and including those that provide sustainable solutions (impact investing). In the first few articles of our Indices Insights series, we will empirically show how the different sustainability metrics (negative screening/exclusions, ESG, SDG) relate to these increasingly impact-oriented client sustainability objectives.

Footnote

1Huij, J., Lansdorp, S., and Van Zanten, J., February 2022, “Indices insights: Do ESG ratings align with the values of large investors?”, Robeco article.

指數洞察

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.