Finding the downside risks in credit with ESG

Using financially material ESG information leads to better-informed investment decisions and benefits society. This is how we approach the analysis.

概要

- ESG is one of five factors in our structural issuer analysis

- This assessment is critical in managing downside credit risk

- In 24% of cases, ESG risks have material impact on our fundamental views

ESG considerations have been integral to our investment process since 2010, and are an essential part of our sustainable investing methodology in fundamental credits. Consistently integrating ESG information in our bottom-up credit analysis, and thus avoiding defaults or distressed situations, has helped us reduce downside risks in our credit portfolios. We strongly believe that using financially material ESG information leads to better-informed investment decisions and benefits society.

The key focus of our credit analysis is the cash-generating capacity of the issuer, the quality of cash flows, and the ability to repay debt. We assess five factors to reach a conclusion on this. This conclusion is expressed in the form of a fundamental score, referred to as an F score. The issuer’s ESG profile is one of these five factors.

For this factor, we analyze each issuer to determine how it is positioned in terms of the key ESG factors defined by our team for each industry, including climate change considerations, and how this could affect fundamental credit quality.

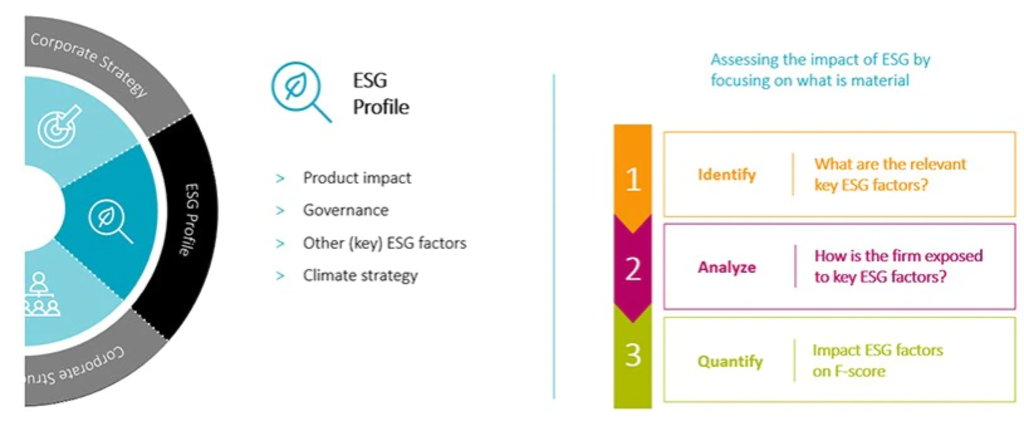

A four-fold evaluation of ESG risks

Our assessment of ESG factors and their implications for an issuer’s fundamental credit quality considers four elements. These are the impact of the product or service produced, to the company’s governance system, how the company is positioned in terms of the key ESG criteria that our analysts have identified for each sector and sub-sector, and its decarbonization strategy. (As a case study, see: European utilities on the cusp of a decade-long investment opportunity”).

Figure 1 | The role of ESG integration in fundamental credit analysis

Source: Robeco

Product impact: our view is that companies offering unsustainable products and services (e.g., oil, tobacco, refinery services, oil field services, manufacturers of internal combustion engine cars, coal miners) face additional risks. Demand for these products may shrink, while stricter environmental regulations may further constrain a firm’s business model and result in higher capex and R&D expenses. The issuer’s SDG score, determined by our proprietary SDG framework which draws from the UN Sustainable Development Goals, helps to inform our assessment of the product impact.

Governance: we rely on a variety of inputs to assess the quality of the governance framework. These are the S&P Corporate Sustainability Assessment scores, Glass Lewis and the Sustainalytics risk scores.

Key ESG factors: this step is aimed at determining how a firm is positioned in terms of our list of key ESG factors for each sector and sub-sector. The process starts with an analyst assessment that incorporates a range of inputs, including our research and meetings with management, the company profile reports created by our SI research team, the S&P Corporate Sustainability Assessment, Sustainalytics risk scores, and the company’s track record in conduct.

Depending on the company, other factors may be relevant, too. If a firm has been involved in a bribery scandal, for example, it would be important to examine this issue – even if bribery is not considered a key risk factor for the industry in which the issuer operates.

Climate strategy: climate change has a prominent role in our credit research process. Our analysts follow a formal process which takes into consideration the philosophy of the Taskforce for Climate-related Financial Disclosures (TCFD) on climate risks and opportunities. The below section provides further detail on how this criterion is analyzed.

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Assessing whether an issuer is climate-proof

The central question for this last criterion is to assess the extent to which a firm’s decarbonization strategy – or failure to have an appropriate one in place – may have an impact on its fundamental credit quality. This assessment comprises three steps.

Step 1: Identify: determine the exposure to climate risk and opportunities. The average Scope 3 CO2 intensity per sector is used as a starting point to assess a firm’s climate-risk exposure. A high CO2 intensity, as is the case in the automotive, metals & mining and building materials industries, would indicate that the sector is vulnerable to climate risk. Among other reasons, this could be due to the high capex commitments needed for companies to improve their emissions profile. For lower-emission sectors, such as supermarkets, for example, the climate risk is significantly lower. Our overall approach is to evaluate the exposure to climate-related transition and physical risks, as well as the opportunities.

Step 2: Analyze: what is the company’s response? We consider aspects such as a firm’s climate strategy, GHG reduction targets, capex, R&D, and how all of this is embedded in its governance framework. Important inputs can also be derived from company rankings in the various Paris-aligned pathway assessments. These assessments include those from the Science Based Target Initiatives (SBTI) and the Transition Pathway Initiative (TPI).

Step 3: Quantify: draw a conclusion about the impact on the company fundamentals, including capex, margins, asset valuations, and cash flow. Critical questions are whether the issuer’s plans are sufficient and whether it can afford the transition and related investment plans.

A similar three-step approach is used for the other ESG factors.

ESG risks have a material impact on our fundamental views in 24% of cases

In analyzing and investing in corporate bonds, the focus is tilted towards detecting downside credit risk. This makes sense as risk is asymmetrical for credit investors. A good risk management system at a bank, for instance, does not lead to a strong improvement in credit quality; a weak one, though, could lead to its total collapse. In a limited number of cases, we do find companies where ESG factors contribute positively to the fundamental view. This is often owing to the product impact criterion, such as in cases where the product is a solution for a better environment.

We scan all the company profiles created by our credit analysts and keep track of the extent to which ESG factors have a financially material impact on these profiles. Our latest data shows that ESG information has a financially material impact in about 24% of company profiles. In most of these cases, the impact is negative, in the sense that it weighs negatively on our fundamental assessment of the company.

Conclusion

ESG screening has been a fundamental aspect of our credit analysis for more than a decade, and is fully integrated in our bottom-up security analysis. We apply it to each company in which we invest – and across all our fundamental strategies, regardless of whether they have a specific sustainability focus.

Our proven methodology considers four distinct elements – product impact, governance, key ESG factors and climate – and helps shape our overall fundamental assessment of an issuer. In fact, our data shows that ESG information has a financially material impact in about a quarter of our company profiles.

The integration of ESG considerations in our fundamental analysis is critical in our management of downside risk in credit portfolios, and is important in enabling us to identify those issuers that will be part of a more sustainable future.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.