Digital twins and machine vision: exciting themes of ‘smart’ production

Manufacturing as we know it is coming to an end. It is en route to become more flexible, increasingly digital and often closer to its end markets. Cyber systems and physical systems will connect, driving a trend towards ‘smart’ and more sustainable production. Within this trend, machine vision and ‘digital twins’ are becoming ever more important themes, says Robeco Industrial Innovation Equities portfolio manager Marco van Lent.

概要

- Industry 4.0 is about increasing digitization of products, value chains and business models

- Drivers of ‘smart’ production are big data, algorithms and stronger computing power

- ‘Digital twins’ and machine vision are two of this trend’s hottest themes

The main drivers of Industry 4.0 are big data, the emergence of algorithms to analyze this data, and advancements in software and hardware capabilities. Among demographic drivers, a strong push is coming from an aging workforce in countries such as China, but also in many developed countries.

Robeco Global Industrial Innovation Equities strategy, like every other Trends strategies, selects long-term growth trends driven by demographic, technological or regulatory changes. This strategy has benefited strongly from the ‘digitalizing production’ trend via investments in players that combine advanced manufacturing techniques with the Industrial Internet of Things (IIoT).

Digital manufacturing turns production into self-adapting systems with a shorter R&D cycle, raising quality and reducing costs. For example, Maserati has achieved a 50% reduction of time to market by implementing IIoT. Adidas is trialing two ‘speed factories’ that bring local production closer to local consumption through smart manufacturing and 3D printing; it has dramatically reduced time to market for a pair of sneakers from 12-18 months to only 30 days.

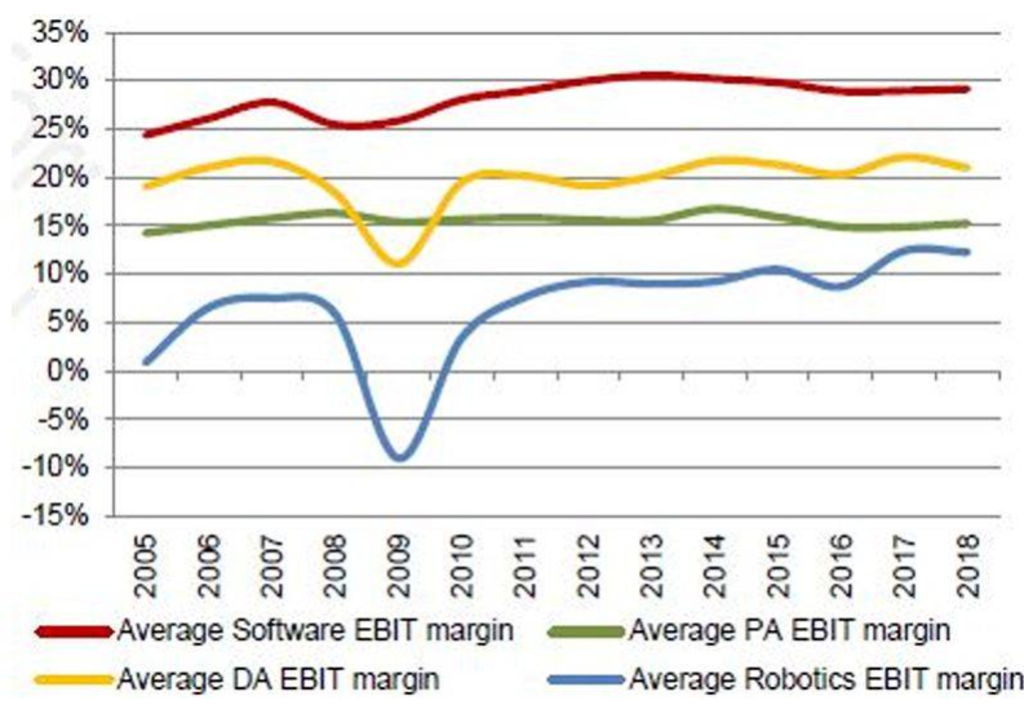

The global digital production trend is growing fast, and within it, the Industrial IoT – a network of platforms, connected devices and software – is growing the fastest. The Industrial IoT software market also has margins that are among the highest in the automated production universe.

EBIT margin by automation application

Source: Credit Suisse

Machine Vision

Being able to capture and process visual information in real time is absolutely critical for ‘smart’ manufacturing. This is called machine vision – it transfers images to a computer and enables almost instant feedback into the process. “I personally like machine vision a lot. It adds vision to machines to perform online testing and checking. This means you can have this done at all stages along the production line much earlier in the process and not just at the end, when the product is already finished,” says Van Lent.

Machine vision relies on lighting instruments, lenses, image sensors and vision processing. Used in the automotive, pharmaceutical, printing, food, and other sectors, machine vision is now able to not only work as a replacement for human vision, but also to handle information invisible to the human eye. According to Credence Research, the machine vision market is expected to reach USD 15 bln by 2022 from the current level of USD 9 bln.

Digital Twins

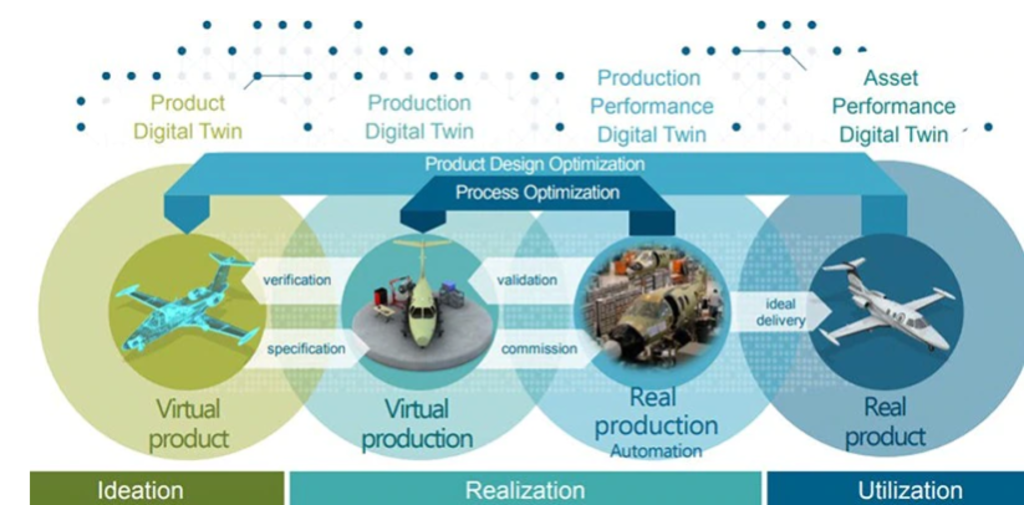

Digital twins are virtual representations of physical products or processes that can be used to understand, predict and optimize their performance. It is yet another hot application of IIoT that research firm Gartner has put on its list of top 10 strategic technology trends for 2019.

Source: Siemens eAircraft

“Digital twins map the physical production process online; for example, for jet engines,” said Van Lent. “You don’t have to build test models directly, you can design and test them on the screen. Rolls Royce, for instance, stated that before ‘digital twins’, it would typically have damaged or destroyed several test engines. Now, it produces one core engine which has been operational in tests, with none destroyed.”

But you can also use digital twins in operation. “You can collect information from the jet engine when flying and feed it into the computer on the ground. This can run tests to see how the engine will react to, for example, an energy-saving solution. Then you send the data back to the airplane, and the pilot can adjust the engine’s settings,” explains Van Lent. The global digital twin market is expected to reach USD 36 bln by 2025 from the current level of USD 4 bln according to MarketsAndMarkets data.

Stages of the Gartner hype cycle

“Within the Trends Investing team we try to capture new trends early on. This has obvious risks attached to it, as, after the initial hype, technologies frequently fail to live up to people’s unrealistically high expectations,” says Van Lent. This is captured well by the so-called Gartner hype cycle. Expectations about a new technology will often lead to a ‘peak of inflated expectations’, after which a wave of ‘disillusionment’ sets in and the number of players drops. But once these technologies have overcome their teething troubles, some of them will take root and continue growing through the ‘slope-of-enlightenment’ phase on to the more stable ‘plateau of productivity’.

Various building blocks of Industry 4.0 are located at different stages of this hype cycle. Machine-learning technology is currently at the peak of expectations, while self-driving cars have entered the phase of ‘disillusionment’ already. At the same time, industrial robots have reached their plateau phase, with four manufacturers in the lead globally.

As for IIoT platforms, currently offered by around 500 companies, they are now just past the peak of the hype cycle. “The number of companies offering them will certainly drop, and it is difficult to pick the ultimate winner,” says Van Lent. “For this reason, at this stage of the hype cycle, you have to invest in a basket of names.”

It is important to note that there are no real pure-play companies offering these technologies. All companies in this market are developing and offering IIoT and other platforms on top of their existing businesses. “If they chose to stop their supply, their bread-and-butter business will continue. So the companies themselves will not disappear,” says Van Lent.

Cyclical nature of industrial automation

Digital manufacturing offers multiple opportunities for investors and this trend is currently still at an early stage. Only a handful of industries have meaningfully progressed along the digitization curve, with some, such as buildings, industrials or food and beverages, being the least digitized.

The incorporation of IIoT into factories is a growth market, yet it is cyclical in nature, cautions Van Lent. “This means that capex can drop abruptly, depending on macro developments, as the current trade dispute between the US and China demonstrates,” he said. “This makes the industrials sector very different from, say, the food industry, for which it is impossible to imagine demand dropping 10% overnight.”

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.