Consumer trends in 2026: Safety, security and the wearables comeback

Through these turbulent times, consumer spending is remaining solid even as consumers pivot to mandatory categories like healthcare, and an important emerging segment, Safety & Security.

Samenvatting

- US consumer spending to be supported by fiscal boost

- Safety & Security emerges as a fast-growing theme

- Wearables regaining momentum with vastly improved functionality

Despite cost-of-living concerns and uncertainty over tariffs, it’s estimated that US real consumption rose 2.6% in 2025 versus 2024.1 Can 2026 sustain the trend?

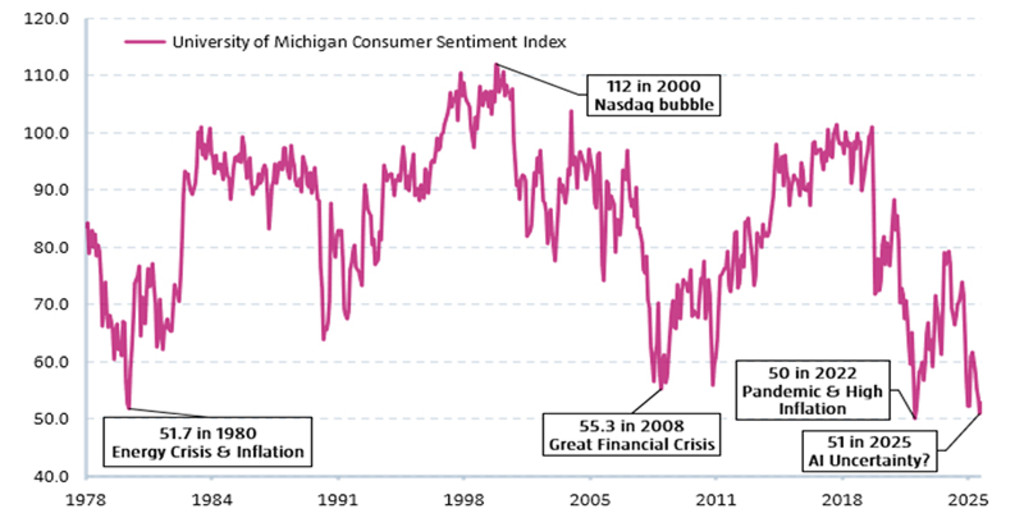

The University of Michigan Consumer Sentiment Index rose to 56.4 in January 2026, up from the final reading of 52.9 in December 2025, and the highest since September 2025, but well below January 2025's 71.7.2 Despite strong economic growth – the Bureau of Economic Analysis reported US GDP rose at a 4.3% annual rate last quarter – consumer sentiment remains subdued because people focus on immediate financial pressures like high prices (inflation), increased interest rates, and housing costs, which erode purchasing power and income and make consumers feel poorer.

This also reflects the ‘K-shaped’ economy with higher income cohorts feeling much better than lower income cohorts. Higher income cohorts are benefiting from wealth effects from rising equity markets, increasing their ability and willingness to spend and this is reflected in recent credit card data with December 2025 card spending rising 2.4% YoY for higher income households and 0.4% for lower income households.3

This results in the ’kitchen table experience’ feel worse than macro data suggests. On top of that, continued advances in artificial intelligence make job security feel less certain. This has created a disconnect where robust spending occurs despite a pessimistic medium-term outlook, as consumers prioritize value and struggle with daily affordability despite overall economic strength. Consumers perceive softening job creation, slower hiring, and uncertainty about job security, and all this combines to reduce their confidence, as Figure 1 illustrates.

Figure 1 | Despite strong economic growth, consumer sentiment is hovering around the lowest levels since 1980

Source: University of Michigan, January 2026.

Help is on the way for middle and lower income cohorts with 2025’s One Big Beautiful Bill Act set to deliver a bumper tax refund season worth USD 370 billion for US taxpayers, with most of this to be paid by the end of March.4 This is likely to support consumption through Q1 and Q2 while monetary easing will help underpin asset prices, keeping the wealth effect intact. In Europe, the outlook is also cautiously positive for consumption with stable house prices and mortgage costs for most consumers, moderate wage growth, and a buffer from high levels of savings. While this backdrop appears constructive, we are seeing consumer spending growth mainly visible in mandatory categories like Housing and Healthcare. Our new theme, Safety & Security, is also growing fast and that’s where we will start our discussion of consumer trends in 2026. We’ll also analyze the opportunities offered by innovation in wearable technology and how it can impact preventative healthcare.

Global Consumer Trends D EUR

- performance ytd (31-1)

- -1,66%

- Performance 3y (31-1)

- 9,93%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividenduitkerend (31-1)

- No

Updating the Global Consumer Trends strategic themes

In the fourth quarter, we updated the most relevant themes for our strategy. We not only revisited existing themes, but we also determined whether new themes needed to be added. We decided to add a new theme to the universe (below), which we call Safety & Security.

Figure 2 | Investment Universe* (update for 2026)

* The companies shown above are for illustrative purposes only. No inference can be made on the future development of the company. This is not a buy, sell, or hold recommendation.

Source: Robeco, January 2026.

1. Safety & Security: A rising priority for consumers and investors

In today’s increasingly uncertain world, geopolitical tensions have become a central force shaping both economic dynamics and consumer behavior. Conflicts, trade frictions, and disrupted supply chains have underscored how interconnected, and vulnerable, the global economy has become. Consumers are feeling these effects directly, whether through higher living costs, concerns about recession, or heightened sensitivity to personal financial stability. As a result, resilience and reliability are becoming more important than efficiency alone, creating a lasting shift in how households and businesses make decisions.

Events such as the conflicts in Ukraine and the Middle East, mounting tensions between the United States, Europe and China, and the growing push toward national self‑sufficiency are reshaping how societies function. For consumers, these developments translate into higher day‑to‑day uncertainty – whether through elevated energy bills, higher food prices, or a more cautious financial outlook overall. Surveys across Europe show that even as real incomes have recovered, concerns about recession and personal financial deterioration remain unusually elevated. Consumers are increasingly aware that global shocks can have rapid and tangible local consequences. This shift is reinforcing a preference for stability, transparency, and trust across products, services, and brands.

From an investment perspective, these geopolitical shifts support long‑term demand for companies that enhance resilience, whether through secure supply chains, critical infrastructure, or enabling technologies. As globalization slows and supply chains re‑regionalize, a premium is emerging on businesses that can operate reliably in a more fragmented world.

Cybersecurity: A consumer‑critical imperative

Within our Safety & Security theme, cybersecurity has become one of the most visible and pressing dimensions of personal safety. Instances of credit‑card theft, identity fraud, ransomware incidents, and data‑privacy breaches continue to rise in both frequency and sophistication. With attackers now leveraging AI‑enhanced tools to automate social‑engineering attacks and penetrate digital ecosystems at scale, consumers face growing exposure in their everyday transactions – from online shopping to mobile banking to digital identity verification.

Governments and regulators worldwide are responding with tighter data‑protection rules and more stringent reporting requirements, prompting companies to invest heavily in securing their digital infrastructure. For consumers, this creates growing demand for solutions that help safeguard personal information, such as secure payment technologies, identity‑protection services, and end‑to‑end encrypted communication. For investors, cybersecurity stands out as a structural growth theme supported by both regulatory momentum and a rising societal need. As digital life expands, the expectation that companies protect consumer data is becoming non‑negotiable.

Food safety & energy security

Food systems are increasingly exposed to contamination risks, weak traceability, and climate‑related disruptions. Consumers may not always see the complexity behind global food networks, but they do feel the consequences when prices rise or recalls occur. These challenges are prompting greater investment in real‑time monitoring, traceability, and preventative technologies.

Energy security, once viewed mainly through the climate lens, is now also about affordability and independence. While the shift to renewables continues, grid bottlenecks, volatile fuel markets, and geopolitical shocks have underscored the need for robust, modernized energy infrastructure. For consumers, this boils down to steady, predictable energy costs and reliable access.

2. Smart glasses comeback with a vengeance

After a false start in 2013 when Google Glasses launched but found little uptake, smart glasses are back with a vengeance. Worldwide sales are now exceeding 1 million units per quarter, more than doubling compared to a year ago. Since the ambitious but failed Google Glasses venture, technological progress and societal changes have made modern smart glasses an appealing product for many consumers. For instance, the Ray-Ban Meta smart glasses, currently the most popular ones globally, look like glasses instead of sci-fi props because hardware has shrunk enough to fit batteries, processors and cameras in a normal looking frame. Also, ten years ago, ‘smart’ meant displaying a calendar notification or showing a low-resolution map while today’s glasses can ‘see’ what you see and can answer questions such as “What building is this” or do live translation, supported by AI technology.

In terms of societal changes, wearing smart glasses has become more socially acceptable after a decade of wearing Apple Watches and AirPods. With the majority of the world now watching TikToks, Reels and YouTube videos, sharing videos captured with smart glasses is much more relevant than when Google Glasses launched. Lastly, smart glasses have gone from expensive, about USD 1,500, to more accessible with entry-level models selling for USD 299.

Figure 3 - Smart glasses 2013 vs. 2026

Source: Google, Meta, EssilorLuxottica, January 2026.

Consumers are getting more to choose from in terms of smart glasses and that is good for future adoption. Ray-Ban Meta launched four new models right before the 2025 holiday season including the Ray-Ban Meta Display which includes a small projected screen enabling more features such as video calls. How well the application and AI work day-to-day on the Meta Ray-Ban Display will likely be an important determinant for usage and sales. Meta CEO Mark Zuckerberg’s live demos went poorly. Still, there is probably a sizeable group of early adopters that are going to buy the Meta Ray-Ban Display as they tolerate imperfect products in exchange for the newest hot thing.

But it remains to be seen what the consumer verdict is on the product, although early signs are good with Meta delaying the international launch of Ray-Ban Meta Display due to high demand in the US. Google and Samsung are joining the smart glasses arena as they will start to sell their product in partnership in 2026. This is on top of various Chinese firms offering smart glasses, including tech heavyweight Alibaba. At some point, Apple could enter the market as well, which would be another extension of its already powerful ecosystem.

On an ordinary metro ride one sees most people staring down at their phones, but that could change and some smart glasses makers dream of replacing smartphones entirely. There is a lot to go after with annual smartphone sales hovering around 1.3 billion units. Still, that is unlikely to happen in the next few years as most smart glasses today still rely on a connected smartphone’s processors to do the hard work as they offload data processing and battery-draining tasks (like cellular 5G connection). Significant technological improvements in battery life, heat dissipation and miniaturization (making things smaller) have to be made before smartphones are replaced as our closest companions without a heartbeat. In practice, smart glasses are winning early adoption not through constant use, but through micro-use cases: navigation while walking, real-time translation, quick visual queries and hands-free video capture. These moments favor eyewear over smartphones.

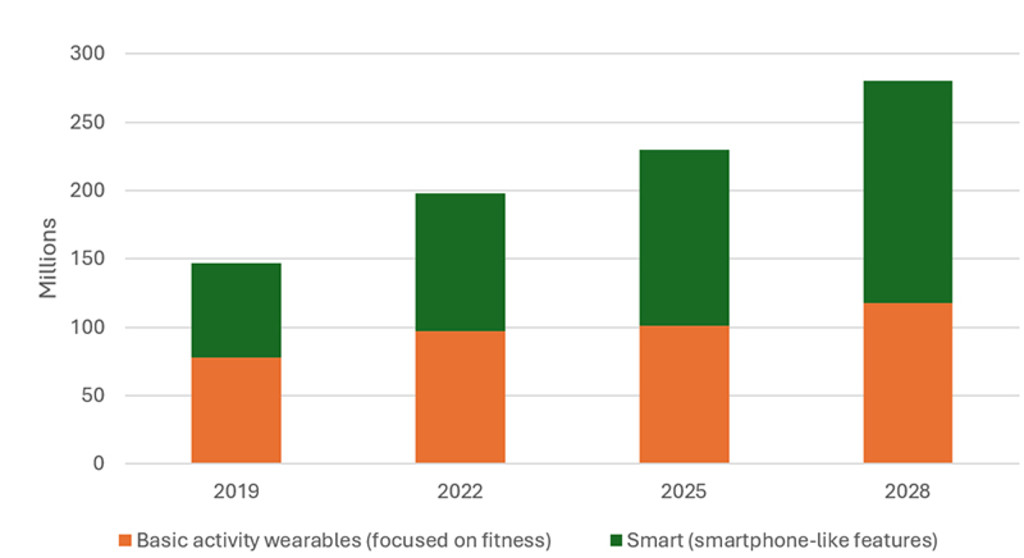

Growing sales of smart glasses neatly fits into the broader rise of the wearables market. The wearables market is growing at a steady pace – units sold are projected to rise from about 150 million in 2019 to 280 million by 2028. While sales of basic fitness wearables increase, the real growth comes from smart wearables. This shift reflects a broader trend: consumers want more than step counts – they want connectivity, AI, and convenience. Smart glasses, led by Ray-Ban and Meta, are redefining the wearables market now and others are entering the stage, broadening choice for consumers and spurring innovation which is expected to lead to continued high growth of smart glasses sales.

Figure 4 - Wearables market by number of units sold

Source: Euromonitor, November 2025.

3. Preventative healthcare: Better safe than sorry

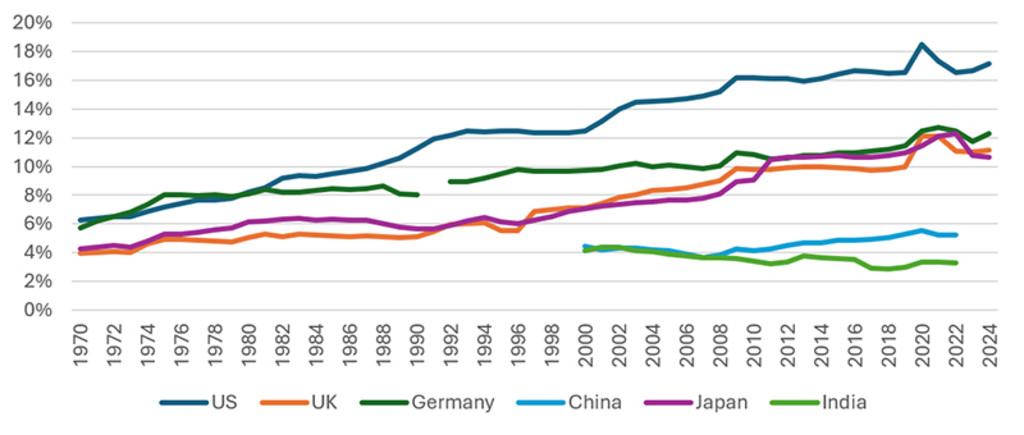

As healthcare costs rise globally, prevention is increasingly recognized as an effective way to improve outcomes and control expenditures. Healthcare expenditures as a percentage of GDP are trending higher in developed countries reaching levels necessitating serious action. In 2024, developed countries allocated 9.3% of their GDP to healthcare on average, a jump from 8.8% in 2019. The most obvious remedy against soaring healthcare costs is avoiding becoming ill. Although this may sound obvious, there is in fact a lot that can be done to prevent people from getting ill beyond vaccines, the most cost-effective preventive measure ever created.

Many illnesses can be traced back to either unhealthy or risky behavior or a genetic predisposition to certain diseases. We believe an important way to get more ‘bang for our buck’ in healthcare is through preventive care i.e., more spending and focus on preventing diseases instead of reacting to diseases with expensive drugs, hospital stays or long-term care. The World Health Organization (WHO) and major economic consultancies estimate a return of 1:5 to 1:19 for every euro spent on preventative health.

Figure 5 - Healthcare spending as % of GDP

Source: OECD, 2025.

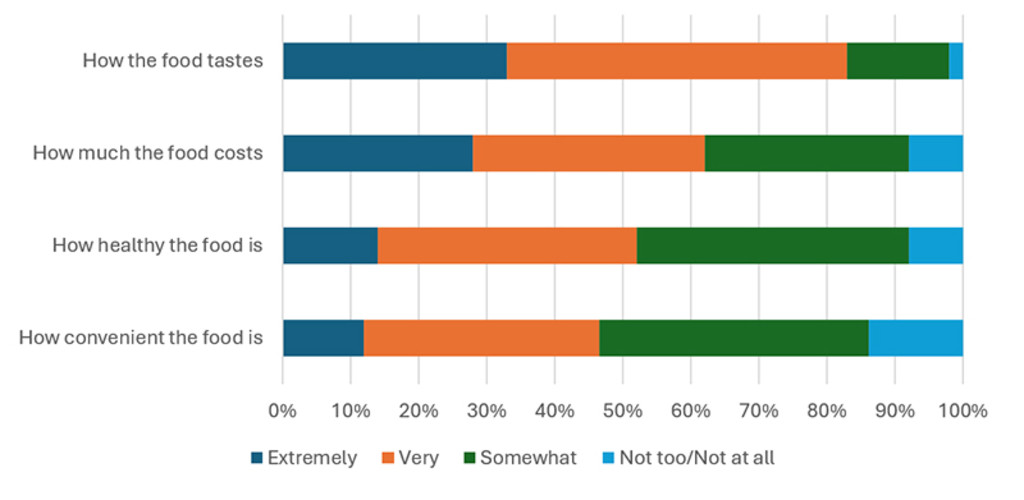

Lifestyle interventions are the most effective tool for reducing the burden of diseases that are not passed from person to person such as heart disease, various cancers, diabetes and lung disease. Evidence shows that a significant portion of those are preventable through diet and physical activity. Although consumers say taste (83%) and cost (62%) matter more than healthiness (52%) when deciding what to eat in a recent survey, we do observe consumer trends in demand for protein-rich nutrition and emerging demand for fiber-rich products. For instance, Danone’s sales growth has been positively impacted by high consumer demand for protein drinks and yoghurts. Grocery retailers are also saying that protein-rich products are one of the few food and drinks categories that is growing at a decent rate.

Figure 6 - Importance of US adults' food choices

Source: Pew Research Center, May 2025.

At the core of modern prevention is the ability to identify health risks long before symptoms appear. Diagnostics have evolved beyond standard blood work to include high-sensitivity screening that can detect anomalies in advance. For instance, Natera’s personalized tests based on tumor DNA can detect returning cancer up to two years before imaging scans like CT or MRI. In another example, Danaher5 is involved in the preventive potential of gene editing aiming to use gene editing to permanently address genetic disorders, effectively ‘preventing’ the lifelong progression of hereditary disease by fixing the genetic root cause early in life.

The firm’s diagnostics tools are also used to identify biomarkers – biological ‘warning signs’ – allowing for early intervention when survival rates are highest. Regular health screenings including diagnostics are not common in most countries. However, Japan’s ‘Ningen Dock’ – an annual subsidized checkup – demonstrates the potential for widespread adoption. Japan boasts a 85-year life expectancy (one of the highest in the world) while dealing with one of the most aged populations and spending only about one percentage point more on healthcare as a percentage of GDP than the developed country average.

Continuous monitoring through wearables further enhances preventive care. Unlike traditional check-ups that capture a single ‘snapshot’ of someone’s health, smartwatches and now AirPods and someday perhaps smart glasses provide a ‘movie’ of continuous data. Apple integrated heart rate monitoring into AirPods Pro 3, released in late 2025, using new in-ear sensors. These wearables can track heart rate variability, sleep patterns and potentially glucose levels in real-time. By analyzing this data, apps can flag ‘silent’ indicators – such as irregular heartbeat – before they escalate into emergency room visits. This constant feedback loop also empowers consumers to take ownership of their health while providing doctors with the data for early, low-cost interventions.

Conclusion

Geopolitical tensions, re regionalization, and technological disruption are reshaping consumer behavior and investment priorities, pushing safety, security, and resilience to the forefront. Despite solid macroeconomic growth, consumers remain pessimistic due to persistent inflation, high interest rates, housing costs, and rising job insecurity, exacerbated by rapid advances in AI. This has created a disconnect between spending and sentiment as households focus on daily affordability and value. This environment is driving a shift toward trusted, transparent brands and companies that enhance resilience through secure supply chains, critical infrastructure, and enabling technologies.

Footnotes

1 United States Economic Forecast – Deloitte – 19 December 2025

2 https://www.sca.isr.umich.edu/ - Preliminary data – 9 January 2026

3 Consumer Checkpoint: Choppy start, solid finish – Bank of America – 9 January 2026

4 https://waysandmeans.house.gov/2026/01/12/biggest-tax-refund-season-starts-january-26-thanks-to-working-families-tax-cuts/

5 The company referenced above is for illustrative purposes only. No inference can be made on the future development of the company. This is not a buy, sell, or hold recommendation.