How will carmakers survive the shift to electrification?

Regulation, changing consumer preferences and new entrants are cranking up the pressure.

まとめ

- The transition to electric will require large investments from carmakers

- Emission regulation and consumer tastes are strong incentives for change

- We look for credit issuers who will reap the benefits of their investments

The automotive industry is transitioning towards an electrified future.1 It is laser-focused on reducing the carbon emissions of its product offering, through more efficient internal combustion engines (ICE) and, most importantly, hybrid and fully electric vehicles (EVs). In addition, automotive manufacturers have become increasingly active in vocalizing their climate strategy, which generally entails targets for electric vehicle sales, zero tailpipe emissions, and carbon reduction or even neutrality.

The transition towards electric vehicles requires substantial investments from automotive manufacturers (OEMs) to fund research and development and the build-out of manufacturing capabilities based on new technologies. These investments are critical to OEMs’ ability to meet their ambitious targets that, in turn, require a significant increase in electric vehicle sales.

The multi-decade transition has begun, as illustrated by the number of successful battery electric vehicles (BEV) that have already hit the tarmac. We believe that the ability of an OEM to make the transition towards an electrified future is significant for two reasons: at a global scale, it will contribute to the goal of reducing carbon emissions. From an industry perspective, it will be a key determinant of the company’s ability to survive and for industry leaders to maintain their position in the next automotive era. As credit investors, we actively search for these qualities in issuers, seeking to invest in companies that will survive and thrive in this transition.

Strong incentives for innovative change

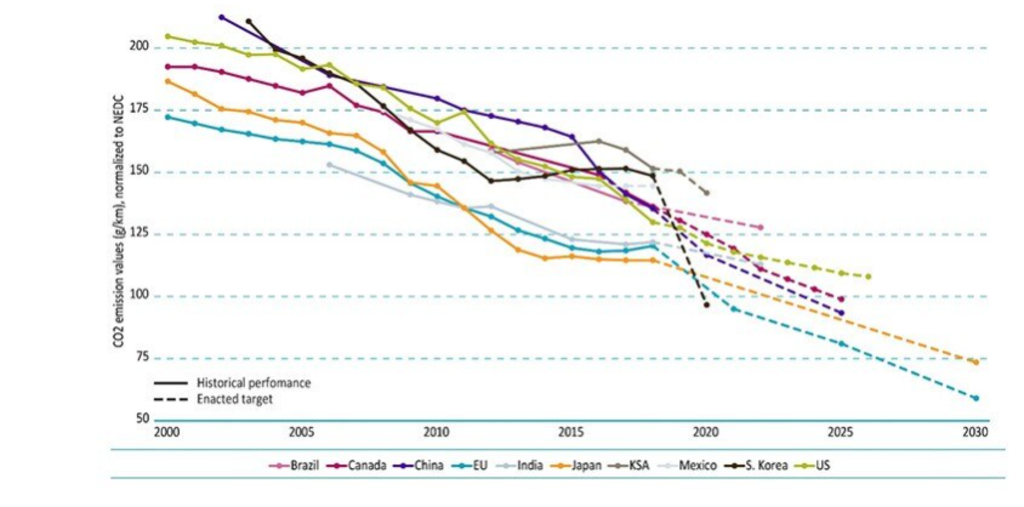

We believe the increasingly stringent regulatory limits for CO2 and NOx emissions are a key catalyst for the technological transition. Regulators around the globe have set clear and strict emission limits for new vehicles.

European regulators are setting the global example, with regulation including not only strict emission targets, but also non-compliance penalties if an automotive manufacturer breaches these limits. Such penalties provide a meaningful incentive for manufacturers to allocate resources to R&D and capital expenditures.

Manufacturers’ ability to maintain profit margins varies considerably by company. In general, the switch to electric vehicle sales will initially have a negative impact on margins, as electric vehicles do not yet have sufficient economies of scale and hence generate lower margins than ICE vehicles. It is therefore vital for automotive companies to reach significant scale in electric vehicle production as soon as possible, in order to retain overall profitability.

Figure 1 | Passenger car CO₂ emissions - normalized to the New European Driving Cycle (NEDC)

Source: The International Council on Clean Transportation; data to May 2020

The good news is that consumers are increasingly adopting electric vehicles. Many of the typical arguments against buying an electric vehicle, such as the higher acquisition cost, limited range and lack of charging infrastructure, are becoming less compelling. Manufacturing costs for ICE and electric vehicles are expected to reach parity in the next few years, the ranges of electric vehicles are increasing as the products are further developed, and the rollout of charging infrastructure continues. We are even seeing a decent number of electric vehicle launches in the US pick-up truck segment, which many had labeled as one of the last segments to make the transition.

Covid-19 accelerated electrification pathways

Certain developments triggered by the emergence of the Covid-19 pandemic in early 2020 have been very beneficial for the electrification of the automotive industry. Governments and other national regulatory bodies introduced attractive incentive schemes for consumers and subsidies for manufacturers to ease the financial impact of the pandemic on the automotive industry. These incentives and subsidies focused mainly on the entry and mid-market electrified models, for both fully electric as well as plug-in hybrids. In addition, governments offered scrap bonuses to eliminate high-polluting vehicles that are near the end of the product life cycle.

As the pandemic progressed, automotive sales were boosted by the trend to avoid public transport and instead rely on private transportation, as well as by the faster-than-expected recovery in the global economy. As a consequence, vehicle production volumes recovered faster than anticipated, with the added benefit that consumers are buying a higher share of low-emission vehicles than previously foreseen. We do note that the current semiconductor shortage is temporarily limiting car production.

サステナビリティに関する最新のインサイトを把握

ロベコのニュースレター(英文)に登録し、サステナブル投資の最新動向を探求しましょう。

Implications for legacy OEMs

It is inevitable that the market for ICE vehicles will shrink as electric vehicle penetration increases. Depending on the pace of electric vehicle adoption, the ICE market may end up having significant excess manufacturing capacity, which in turn will squeeze profit margins and may result in asset write-downs and expensive plant closures. Being too slow in moving away from ICE vehicles may also mean unnecessarily allocating resources to a declining business, whereas the return on those resources could be far better if spent on electrification.

Investment implications: the race is on

As the shift towards electrification could have a notable impact on the development of a company’s credit quality, it has become a key component of our fundamental analysis of automotive companies.

One important element of this analysis is our assessment of the EV product strategy. Here we have a preference for purely electric vehicles over hybrid vehicles, as they are better able to reduce emissions and benefit from the relative simplicity of their product; hybrids, by contrast, still require two powertrains, i.e., both a combustion and an electric engine. Furthermore, we favor automotive manufacturers that apply a universal ‘modular’ platform that can be utilized for a multitude of different models, as this allows for higher economies of scale and consequently higher margins.

Another aspect we look at is the OEM’s expected market share development in electric vehicles. Ideally, the OEM is an early adaptor and has already incurred most of the R&D costs and capital expenditures. If not, we look at the magnitude of the capex and R&D plans. For example, we would assess if the expenditures are sufficient to realize the targets, and how the company would be able to fund these expenditures.

Footnote

1This article is based on a slightly longer paper with the same title.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会