Scopri il valore del quant investing

Iscriviti per ricevere approfondimenti sulle strategie quantitative più avanzate.

In the first half of 2023, stock markets experienced a substantial rebound. The MSCI World Index surged by 15% in USD, regaining more than two-thirds of the losses from the previous year. Interestingly, this comeback is largely driven by a handful of prominent US tech stocks, including Alphabet (Google), Amazon, Apple, Microsoft, Meta (Facebook), Nvidia, and Tesla. Some have dubbed these stocks the ‘Magnificent Seven’, while others have coined terms inspired by quant investing, such as MAMANTAm (momentum), or superheroes, such as FATMAAN and MANTAMAN, all replacing the previously used term, FANG. 1

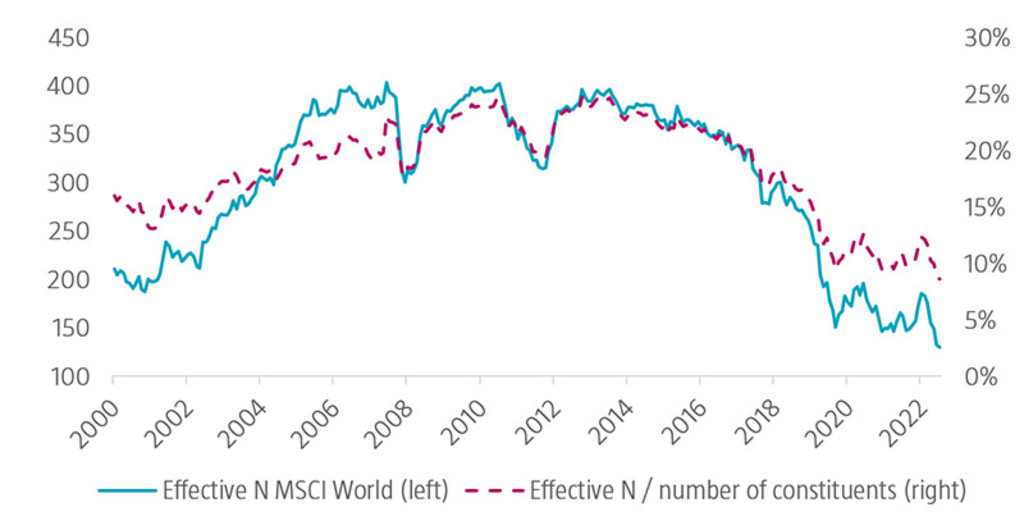

This narrow market raises crucial questions about market diversification. While the MSCI World Index comprises more than 1,500 stocks, the top 10 make up just more than 20% of the total index. One way to assess market concentration is through ‘effective N,’ a metric that compares the balance between portfolios with diverse weights versus those that are highly skewed. For instance, in a portfolio of 100 stocks with equal weights, the effective N would be 100. In contrast, if a single stock dominated 99.9% of a 100-stock portfolio, the effective N would be closer to 1.

Source: Robeco, Refinitiv. The figure shows the effective N (left axis) and the ratio of the effective N relative to the total number of constituents (right axis) for the MSCI World Index over time. Effective N is calculated as the inverse of the Herfindahl-Hirschman Index (HHI) for portfolio weights, where HHI is the sum of the squared stock weights.

The sample period is December 2000 to June 2023.

Figure 1 visualizes the effective N as well as the effective N relative to the number of all constituents for the MSCI World over time. For many years the effective N hovered between 300 and 400, but since 2018 has steadily declined, reaching a low of 130 at the end of June 2023. Consequently, the effective N is now less than a tenth of the total number of index constituents, indicating a significant concentration.

This trend suggests that investing in the MSCI World Index may not offer the diversification one might assume based on the sheer number of constituents. Given that the dominant stocks are all US based, tech-focused, and carry high valuations, they inherently share similar risks. Therefore, investors may want to consider diversifying their investments by exploring opportunities in international markets, small-cap stocks, and alternative investment strategies not solely based on capitalization weight.

1 Mackintosh, J., June 2023, “FATMAAN and MANTAMAN: Superhero Acronyms for Super Stocks”, Wall Street Journal.

Iscriviti per ricevere approfondimenti sulle strategie quantitative più avanzate.