New research into the stock-bond correlation shows when they correlate – and when they don’t

Recent research investigates the impact of macroeconomic variables like inflation, real interest rates and government creditworthiness on the correlation between stocks and bonds.

Robeco’s Laurens Swinkels and his co-authors, Roderick Molenaar, Edouard Sénéchal,1 and Zhenping Wang,2 conducted a comprehensive study on the correlation between stock and bond returns, crucial for asset allocation decisions. The findings, which indicate significant shifts in correlation across different periods, offer valuable insights for managing multi-asset portfolios and understanding bond risk premiums in various macroeconomic contexts. We sat down with Laurens to discuss the findings.

“As a multi-asset investor, understanding the total risk of your portfolio requires knowledge of how the asset classes you invest in correlate with each other. The primary asset classes for multi-asset investors are bonds and equities, so understanding the correlation between these two is crucial. We’ve observed periods where this correlation is negative, which is beneficial because one asset class can act as a hedge against the other, but there are also periods where the correlation is positive, meaning both asset classes move in the same direction simultaneously. These situations increase the risk of a multi-asset portfolio.”

“Because we manage multi-asset strategies, we need to manage risks effectively. This includes both the total benchmark risk and the risks associated with taking active positions for tactical asset allocation. It's important to know whether being long in equities and short in bonds is partially hedging or reinforcing the position – understanding the factors influencing the stock-bond correlation was a key driver for our research.”

“Another question we explored was related to the expected return of bonds. If bonds are an effective hedge against equity risk, then owning bonds should be favorable, as they protect your portfolio from the primary risk faced by many investors. Consequently, the demand for bonds would increase, potentially raising their price, but conversely this could imply lower forward returns for bonds. In scenarios where the stock-bond correlation is negative, theory suggests that one shouldn’t expect too high excess returns from investing in bonds, as they become an attractive asset class for mitigating risk.”

Active Quant: finding alpha with confidence

Blending data-driven insights, risk control and quant expertise to pursue reliable returns.

What were your key findings?

“We had data going back to 1875 for the US and even further for the UK, with our findings showing different regimes in stock-bond correlation over time. Before 1952, we found limited explanatory power but post-1952, inflation and real interest rates emerged as significantly determining the correlation between the two asset classes. This is likely driven by more counter-cyclical central bank monetary policies. High real interest rates or inflation levels tend to coincide with positive stock-bond correlation, which is not favorable for multi-asset investors looking to reduce risk by investing in both asset classes.”

“During our actual research, which began before the inflation spike in 2020-2023, we saw prolonged periods where stock and bond markets declined simultaneously, making bonds ineffective as a hedge. This real-time observation backed up our findings from historical data, showing how important these factors are. While our research was initially historical, our research took on a practical dimension through experiencing these inflationary periods, which really underlines the relevance of these discoveries.”

“Importantly, instead of trying to directly predict the stock-bond correlation, our approach focuses more on understanding the macroeconomic situation, where inflation and interest rates play significant roles. If our predictions about the macroeconomic environment are incorrect, then our assumptions about the stock-bond correlation will likely be incorrect as well. However, in scenarios where we anticipate inflation to be under 3% and real interest rates to be normal, we expect the stock-bond correlation to be negative.”

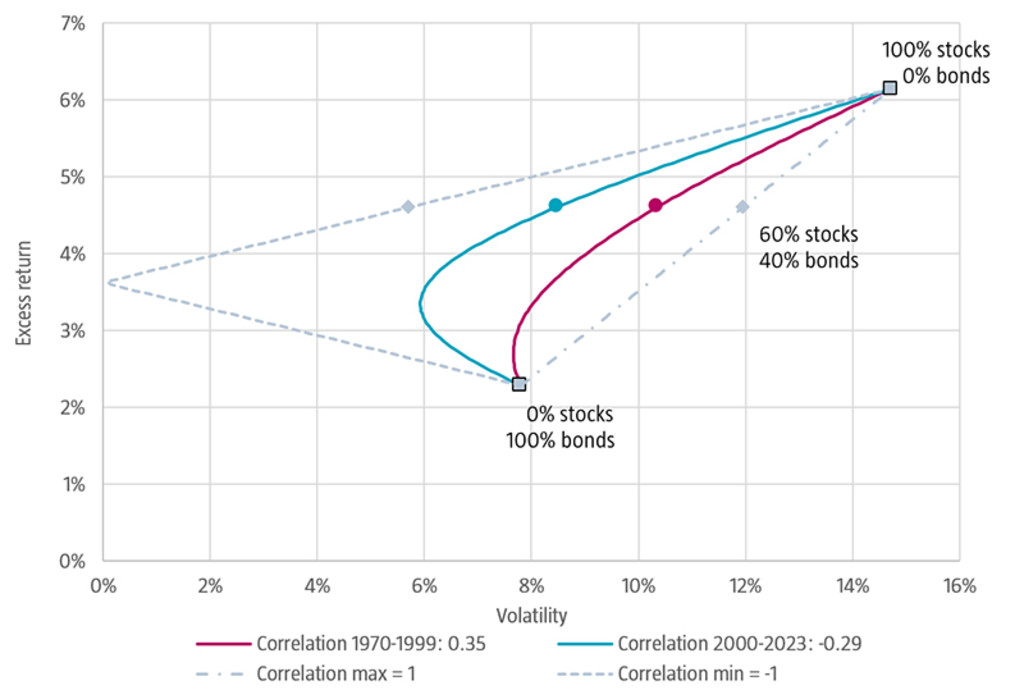

“We explored the implications of the correlations on multi-asset portfolio risks (see Figure 1 below) and found that the 60/40 stock/bond portfolio's volatility fluctuates significantly with these correlations—showing a decrease from about 10.5% to 8.4% as correlations shifted from positive (+0.35) in the period 1970–1999 to negative (-0.29) in 2000–2023. This change suggests that investors might need to adjust their equity holdings downwards during periods of positive correlations to maintain a consistent risk level.”

Figure 1: Multi-asset portfolio risk and return for different stock-bond correlations

Source: Authors. Note: Authors’ average standard deviation and excess returns from January 1970 to June 2023. Pearson correlation coefficient of monthly returns computed between January 1970 and December 1999 and between January 2000 and June 2023.

“Our findings also reinforce the importance of macroeconomic variables in forecasting stock-bond correlations, crucial for managing cross-asset risks. For example, our empirical model indicates that a 1% increase in both inflation and real rates results in a 0.17 increase in the correlation between stocks and bonds. In turn, this can lead to an increase of 0.8% to 1.7% in the risk of a 60/40 portfolio, depending on the starting stock–bond correlation (see Figure 2).”

Figure 2: Relation between stock-bond correlation and portfolio risk

Source: Authors. Note: Average of standard deviation and Pearson correlation coefficient of monthly returns computer over 36-month rolling windows ending January 19070 to June 2023.

“In addition, we discuss how a higher stock-bond correlation could necessitate increased bond risk premiums, as demonstrated by historical data and regression analyses linking higher premiums to periods of stronger stock-bond co-movements. This may be an indication that the CAPM has a stronger empirical basis across than within asset classes.”

“Based on this understanding, you can then estimate your portfolio risk. We also take these findings into account when we construct our macro scenarios in our Five-year Expected Returns.”

Did your findings differ across markets?

“We wanted to explore how the stock-bond correlation behaves across different countries, particularly in relation to the concept of 'safe havens'. And we found that in countries considered safe havens, stock and bond correlations can fluctuate between positive and negative regimes. However, in countries not regarded as safe havens, the correlation tends to be more consistently positive. This comes from the fact that the 'flight to safety' effect, often observed in bonds during periods of market stress, is not as pronounced. Much of the existing research is US-based and highlights this effect, but our study shows that this phenomenon doesn't automatically apply to all countries.”

“For instance, during the Eurozone crisis, Italian stocks and government bonds showed a positive correlation, and in emerging markets, we often observed a positive correlation, suggesting the absence of a significant flight to safety effect from government bonds. This international dimension to our research challenges the assumption that findings based on US markets are universally applicable.”

Can you share how your collaboration with the analysts at State of Wisconsin Investment Board (SWIB) came about and evolved into the project it is today?

“Through serendipity and mutual interest in financial research! It's important to note that our primary aim wasn’t the publication of a paper: the project team, comprising Roderick Molenaar, myself, and Edouard and Zhenping, two analysts from SWIB, happened to want to answer the same question. This led to an ongoing exchange of ideas, data collection and analyses, and critical questions from each side of the ocean to the other.”

“As the project progressed, we recognized the broader value of our findings and decided to distill those insights into a comprehensive paper. In the end our manuscript was accepted for publication in the Financial Analysts Journal, underscoring for me the pleasure and importance of collaboration.”

“It was fascinating that, despite potential differences in perspectives between asset managers and other investors like pension funds, we shared the same research question in this instance. The partnership encouraged us to question whether our standard methods were indeed the only way, or if there could be alternative, perhaps more effective approaches.”

“While we focused more on the risk aspect of our total portfolio and SWIB on expected bond returns—the underlying question remained constant: What drives the stock-bond correlation?”

Footnotes

1From the State of Wisconsin Investment Board

2From the State of Wisconsin Investment Board

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.