Wie wij zijn

Fijn om kennis te maken

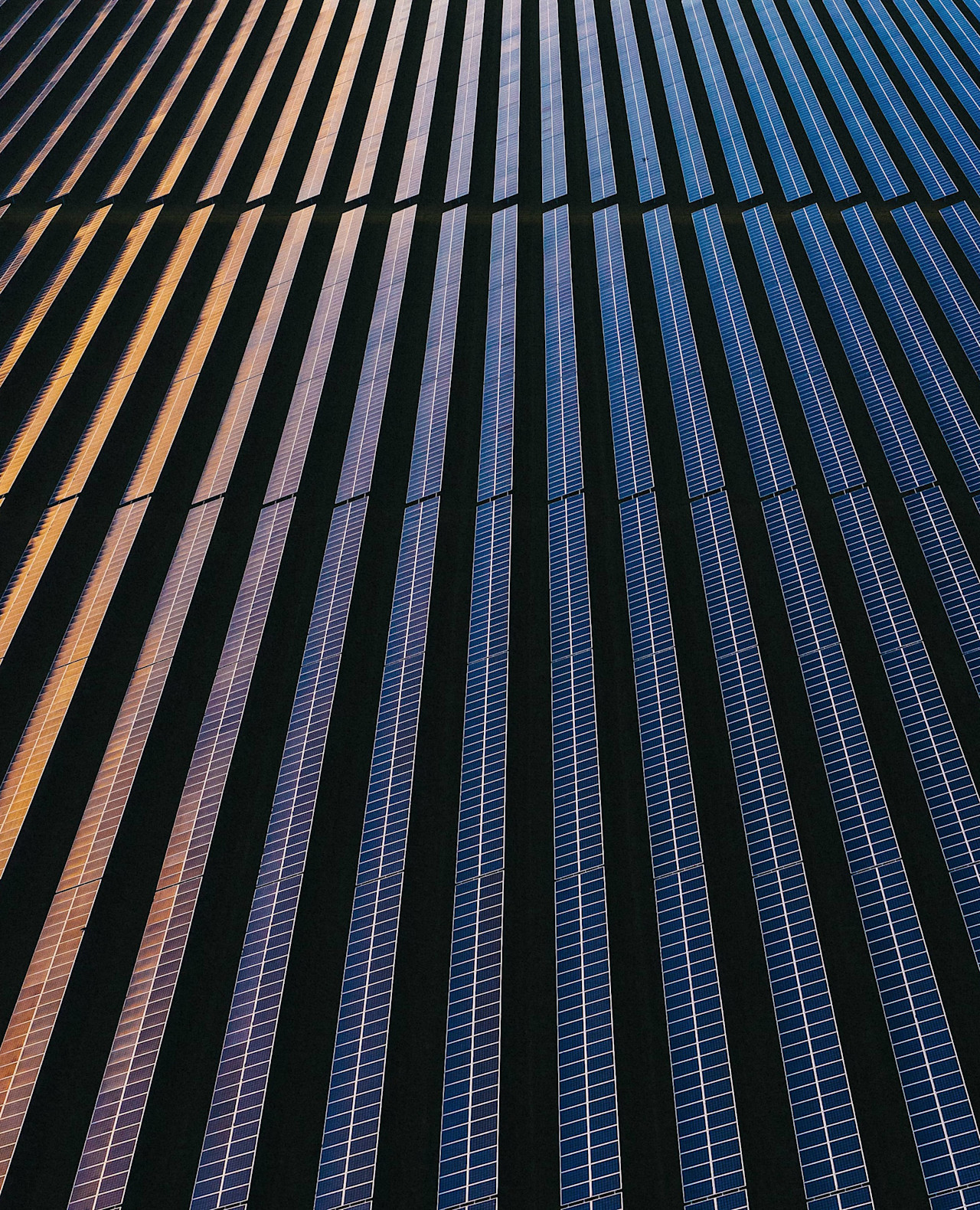

Als wereldwijd vermogensbeheerder staat in onze zoektocht naar oplossingen uw vraag centraal bij ons. Dankzij onze tomeloze nieuwsgierigheid, grondig onderzoek en een bewezen passie voor duurzaamheid zijn wij in staat u baanbrekende actieve beleggingsstrategieën aan te bieden.

U wilt beleggen in de wereld van vandaag én morgen? Dan hebben we een gezamenlijk doel, want onze beleggingen dragen bij aan een gezonde planeet en maatschappij. Wilt u hier meer over weten? Een van onze collega's gaat graag met u in gesprek.

Jaarlijks vooruitzicht

Jaarlijks vooruitzicht Robeco Active ETF's

Robeco Active ETF'sActieve ETF's voor beleggers van nu

Nieuwste artikelen

Beleggingskansen

We belichten graag een aantal kansen die onze experts hebben geselecteerd.

Een greep uit onze producten

QI Global Developed 3D Enhanced Index Equities

Systematische en duurzame factorbenadering als alternatief voor passief beleggen

Emerging Stars Equities

High conviction-beleggen in de aantrekkelijkste bedrijven in Azië

Credit Income

Streven naar consistente inkomsten door te beleggen in bedrijven die bijdragen aan de SDG's

Climate Euro Government Bond UCITS ETF

Een nieuwe beleggingsoplossing die een portefeuille van staatsobligaties afstemt op klimaatactie