Japan value starting to be unlocked

We remain overweight Japan within our Asia-Pacific Equities strategy and are leveraging our engagement expertise to find the best opportunities in a relatively unexplored listed universe.

Samenvatting

- Japan equity inflows have significant room to grow

- Buybacks and dividends will reward investors in undervalued names

- Engagement and policy proving effective in influencing corporate behavior

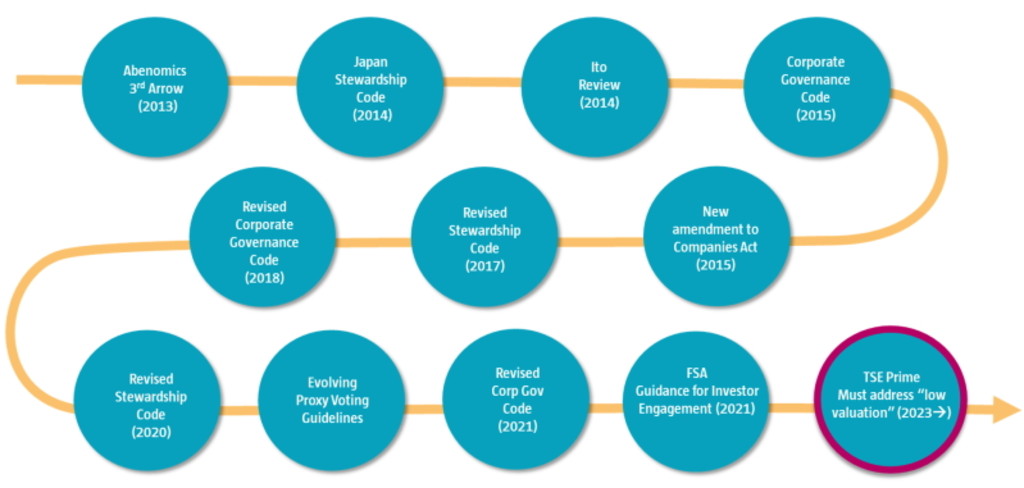

We positioned early for Japan’s policy pivot from zero-interest rates and it’s ongoing reflation. This is a high-profile and well-known story now, but we don’t think global investors are yet fully committed, with several false dawns in the previous three decades fresh in the memory. Foreign investors were net buyers of Japanese equities for nine straight weeks through 26 May 2023, the longest run of purchases since 2019.1 Nevertheless as Figure 1 shows, equity market trading activity by foreign investors has recovered recently but is not yet approaching levels seen a decade ago in the first flush of Abenomics. The current market rally has been well-supported by earnings growth and changes in corporate governance carried out by Japanese companies. This is just the beginning of Japan’s emergence from deflation, and the majority of Japan's hidden value remains to be unlocked.

Figure 1: Net purchases of accumulated foreign investment in Japanese equities since 2010 (JPY trillions)

Source: Robeco, Nikkei Quick, Citi Research, 25 May 2023

For us this isn’t time to hesitate. Corporate behavior in Japan has already changed with significant value unlocked in several high-profile multinational companies, but the wider Japan universe is still to be explored. Our sustainable investment research and engagement teams are active in Japan identifying companies where we can influence governance in a positive way, and get a better deal for long-term shareholders. This stock-picking focus is the real opportunity in our view, in contrast to some investors purely investing in a ‘rising tide will lift all boats’ approach, which essentially depends on broader macroeconomic factors to succeed.

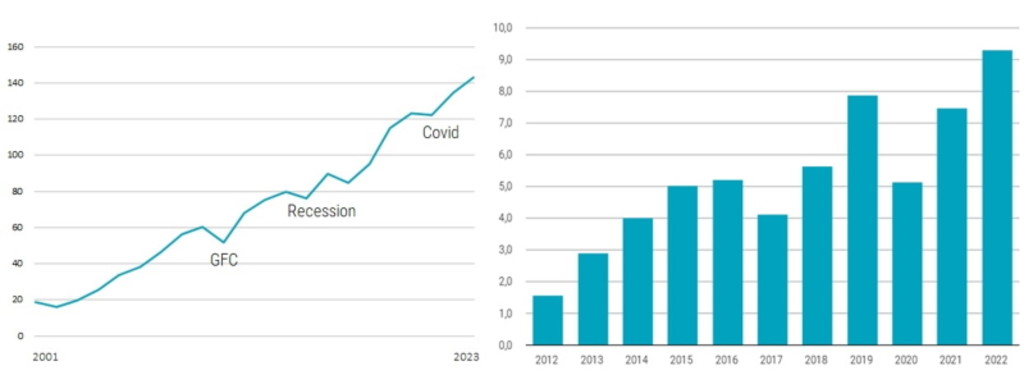

Japan’s progress towards corporate governance reform has been slow but steady (see Figure 2) since it became an economic policy pillar in 2013. This opportunity can be best captured by engagement-linked active managers. We have long argued that many foreign investors are macro ‘tourists’ to Japan and frequently disappointed, but the historic shift in corporate culture and the social contract is now impacting the whole corporate sector. It is now a fertile hunting ground for alpha generation for patient fundamental-driven investors, exemplified recently by Warren Buffett.2

Figure 2: Staging posts in Japan’s corporate governance evolution

Source: Morgan Stanley Research, Japan’s ROE and Productivity Journey, April 2023

With nearly 50% of companies trading below book value in 2022 the Tokyo Stock Exchange (TSE) imposed stricter requirements for listing, based on liquidity and financial reporting standards. Continuing their efforts, in 2023 the TSE published a working paper discussing the need to enhance financial management of companies, targeted at companies trading at book values below 1.0x, while also encouraging constructive dialogue with investors.

The TSE said: “In Japan, there are many cases where management is unaware of the cost of capital and stock price. TSE could encourage management to properly identify the company's cost of capital and capital efficiency, evaluate those statuses and its stock price and market capitalization, and disclose policies and specific initiatives for improvement as necessary. In particular, companies with a PBR consistently below 1.0x should be required to disclose their policies and specific initiatives for improvement. In addition, the Code of Corporate Conduct introduced by TSE in 2007 should be reviewed and revised as necessary to clarify the responsibilities of listed companies, such as awareness of the cost of capital and respect for shareholders’ rights/protection of minority shareholders’ rights.”3

We are actively researching and engaging with companies with legacy cross-shareholdings, excess net cash, and bloated real estate holdings unrelated to their current business operations. These companies are likely to realize the value of fallow assets and return excess cash to shareholders over time. This has already been happening, with both dividends and buybacks (Figure 3) on a long-term uptrend in Japan.

Figure 3: TOPIX Aggregate Total Dividend Amount (USD billions ) TOPIX Buybacks Announced (JPY trillions)

Source: Bloomberg, March 2023

Why Japanese equities now?

As we anticipated in 2022, the necessary conditions for a revitalization of Japan’s economy are being put in place. While the Bank of Japan has only taken measured steps so far, we believe it will continue to normalize monetary policy given economic data is now supportive of the thesis that reflation is underway. We anticipate Bank of Japan governor Kazuo Ueda will continue to slowly dismantle yield curve control by allowing wider trading bands for JGB yields and tapering off purchases of JGBs and other financial assets.

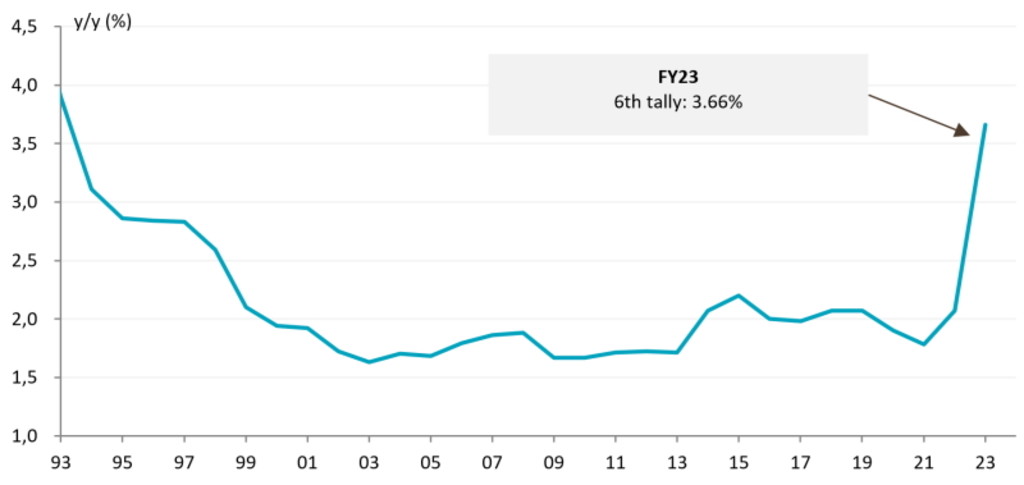

Japan’s inflation is real. Inflation in Japan is clearly much higher than it's been since any time since 1991, with CPI inflation reaching 4% in late 2022, and has actually risen a lot quicker than forecasted, including by the BoJ itself. Most recently Japan’s CPI was 3.4% year on year in April 2023, the 20th straight month of price gains. As illustrated in Figure 4, core wage growth in Japan is likely to accelerate from April with a jump in spring wage negotiations. For the first time in decades, wage growth is sustaining the momentum of inflation in Japan.

Figure 4: Japan wage increase surveyed by Japanese Trade Union Confederation (RENGO)

Source: Bloomberg, UBS Research, RENGO, 31 May 2023

Unlike previous CPI breakouts which were related to sales tax hikes and collapsed quickly, this current rise is likely to be more persistent and mark a break from the post-1989 trend. One reason for this is that companies have long tried to absorb cost inflation through internal efforts, but are now finally passing on those costs to customers. The mindset is shifting from top-line growth to margin protection. Major employers are now raising wages, especially for entry-level and junior roles to attract workers.4 In our view this is inevitable, and indicates the normalization process will continue. Even more encouraging is Japan’s stronger than expected GDP growth in the first quarter, coming in up 0.4% quarter on quarter on the back of strong domestic consumption and inbound tourism. The question still to be answered longer term though is whether an aging demographic is ultimately inflationary or deflationary.

Japan’s exit from deflation is unambiguously positive for Japan equities and means there is real value in positioning for the long term. That said, this is a structural background factor – we believe it’s at the microeconomic level where outperformance can be achieved.

Ontvang de nieuwste inzichten

Meld je aan voor onze nieuwsbrief voor beleggingsupdates en deskundige analyses.

Bottom up focus

Our strategy has a value bias and we focus on those names benefiting from corporate restructuring and governance reform. This cuts across sectors but we are particularly interested in owners of dominant Japanese consumer brands with pricing power that are benefiting from rising domestic appetite to consume from delayed re-opening (Covid was only downgraded in Japan to be in line with flu as recently as 8 May 2023), and the tourist boom which is an increasingly important long-term contributor to growth. We also like Japanese tech names which in many cases are undervalued versus peers and will benefit from the US attempts to diversify supply chains in the region, especially in some subsectors like robotics, EV inputs and semiconductors.

In addition, an immediate winner from the exit from deflation will be Japan’s financial sector. Valuations had been beaten down to a huge discount to global peers since outgoing BoJ Governor Kuroda was appointed in 2013. Previous to that banks traded at an average P/B of 1.0x and we believe with a yield curve control exit they can trend back towards that level. Meanwhile, total return yields of both Japan life insurance companies and banks are high and attractive.

For the companies we own in Japan, Robeco voted 225 times in 2022. This kind of engagement gives us leverage to impact corporate decision making and thus protect the interests of our clients.

We remain very overweight

Global fund managers in aggregate remain underweight Japan, despite the strong equity market performance this year. In contrast, within our Asia-Pacific equities strategy, Japan is a significant overweight at 40% versus 32% for the MSCI Asia-Pacific benchmark. We believe that over the next decade an active approach to investing in Japan equities can deliver outperformance.

Footnotes

1 Japan Stocks Trading Value Hits Record on Foreign Buying, MSCI – Bloomberg, 1 June 2023

2 Buffett’s intriguing bet on Japan – Financial Times, 27 May 2023

3 Source: Tokyo Stock Exchange (Summary of Discussions on Measures to Improve the Effectiveness of the Market Restructuring as at 30 Jan 23, and TSE’s Future Actions in Response to the Summary of Discussions of the Follow-up Council (Draft) as at 25 Jan 23)

4 NTT graduate – NHK: NTT raises the starting salary of new university graduates by about 30,000 yen to 250,000 yen next year – 11 November 2022

Uniqlo owner gives Japan Inc a jolt with 40% wage hike – Reuters, January 11, 2023