Climate

Limit global temperature increase to well-below 2°C degrees aligned with the goals of the Paris Agreement

Transition is the journey in the investment process and sustainability is the destination. In other words, sustainability is the goal, and transition investing is the path taken to get there. With sustainable investing we emphasize investing in companies and sectors that are already sustainable. Through transition investing, capital is directed towards helping companies and sectors adjust their processes to more environmentally sustainable.

A sustainable transition involves shifting economic and social systems to operate in ways that ensure long-term environmental health and societal wellbeing. This transformation is guided by three interrelated pillars: climate, nature & biodiversity, and social development. Each pillar represents a crucial area of focus, with specific goals that collectively support the transition towards a more sustainable future.

Limit global temperature increase to well-below 2°C degrees aligned with the goals of the Paris Agreement

Halt and reversing biodiversity loss to restore nature for the benefit of people and planet e.g. enhancing sustainable use of oceans and marine resources

Seeking relevant targets for social development, e.g. access to safe and affordable drinking water

A vital reason for a sustainable transition is the pressing issue of resource scarcity. Our current economic model is heavily dependent on the rapid consumption of finite natural resources, which is not only unsustainable but also poses a significant threat to future economic growth. As critical resources – such as water, minerals, and fertile land – become increasingly scarce, their rising costs and limited availability will act as a brake on economic expansion.

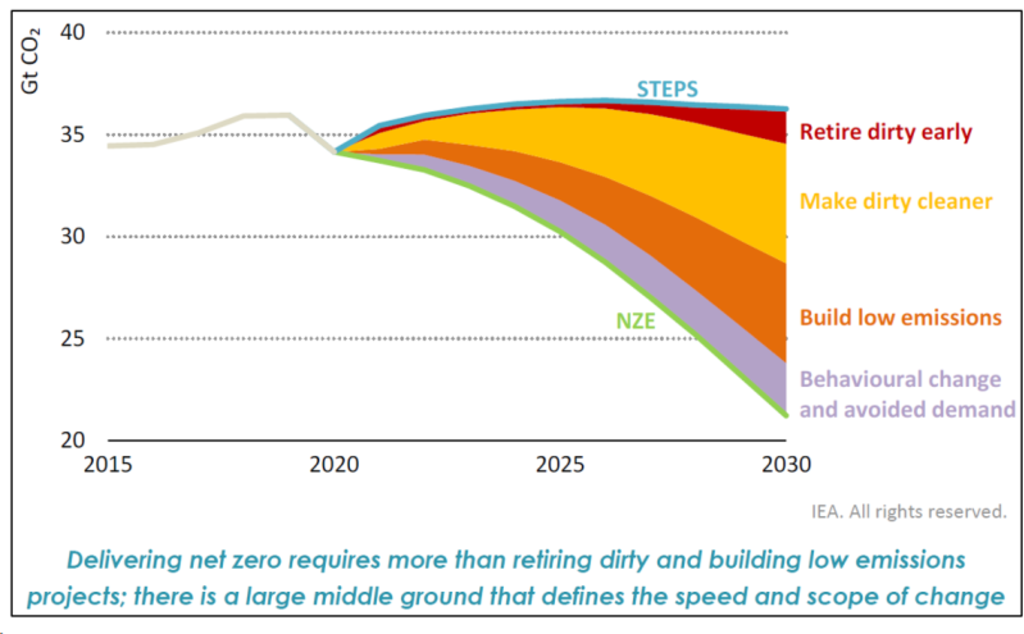

And we are not moving fast enough to mitigate the impending climate changes that scientists are warning us about. If we look at the International Energy Agency’s (IEA) policy pathway, building low-emission structures only represents 15-20% of the reduction needed. The majority of the effort is required in the section: ‘making dirty cleaner.’ This involves transition investments that support companies in transforming their operations and business models to drive meaningful change.

Investors can support the shift to a sustainable economy while generating attractive returns by tapping into a broad set of opportunities. This includes equity, corporate bonds, and green, social, and sustainability bonds (GSS bonds) that fund projects aligned with climate, biodiversity, and social goals. By investing in companies successfully navigating regulatory shifts and adopting sustainable practices, capital will flow to those well-positioned for long-term growth. Identifying the winners in this evolving landscape, across both equity and fixed-income markets, is essential to capturing alpha while driving environmental and social progress.

Our investment process recognizes the multiple dimensions of transition to create robust and resilient investment solutions that understand both the complexity and the longevity of this transition – all with a focus on generating alpha. The transition investment opportunity is a fast-moving topic that is set to last several decades, and it does not fit traditional investment approaches.

We crafted transition solutions based on three essential criteria we believe every great solution should meet:

We developed a framework to identify transition opportunities using forward-looking metrics.

We recognize the complex nature of the transition, accounting for regional differences in taxonomies, regulations, and opportunities, particularly in emerging markets.

We understand that transition is an integral part of the investment journey, with sustainability as the goal. Our solutions are designed to be flexible, adaptive, and continuously evolving.

Sustainable transition presents a global opportunity, with a focus on emerging markets due to their high growth and population. These regions account for 93% of the rise in carbon emissions. Latin America, with rich natural resources, is well-positioned for climate transition, while Asia, home to 60% of the global population, produces half of the world’s greenhouse gas emissions. Regulators are working to mobilize financing for Asia’s net-zero transition. With offices in Hong Kong, Shanghai, and Singapore, Robeco leverages local expertise to tailor solutions for our clients.

The Industrials sector is at the forefront as it consumes high amounts of energy and makes many unsustainable products, followed by Energy itself, and then Materials. The Information Technology, Financials and Health Care industries are already fairly sustainable, not including their energy consumption. But others are rather complex, such as changing the global agricultural system and ultimately moving to a more circular economy.

If you have any questions, or would like to arrange a meeting, please reach out to us.

分析用およびマーケティング・クッキーの利用に同意していない場合、この動画はご利用いただけません。クッキーの利用に同意することにより、すべてのコンテンツの視聴が可能になります。

重要なお知らせ 当社や当社役職員を装ったSNSアカウントやウェブサイト等を使った投資勧誘にご注意ください さらに表示