Why Greenland is less Golden Dome and more gold rush for rare earths

The Trump administration continues to tout control over Greenland as a matter of national and global security, but Greenland is less about strategic defense than about securing new kinds of ‘precious’ metals – the rare earths and minerals that underpin future technologies and economic growth.

Sommario

- Greenland has a treasure trove of rare resources buried under the ice

- Rare minerals and metals are needed to drive high-tech economy

- US move part of a long-term plan to counter China’s rule on rare resources

When US officials talk about taking control of Greenland, they frame it in terms of national security. Trump and members of his administration have repeatedly stated that the US acquisition of Greenland is vital for his ‘Golden Dome’ project, a global anti-missile system which will house ground-based missile interceptors to complement those launched from space. However, policy and funding initiatives so far reveal a much more plausible motive – procuring metals and minerals to protect US strategic autonomy and future economic growth.

Greenland sits on sizeable endowments of rare earth elements, critical minerals and specialty metals – some with sci-fi names such as dysprosium, yttrium and terbium in addition to the more recognizable transition metals of graphite, copper, zinc, and nickel.

Together, they serve as key inputs for the magnets, lasers, sensors and semiconductors needed for a long list of technologies driving a future, high-performance economy – from AI data centers, EVs and autonomous driving, to robotics, drones, and factory automation. That list also includes the wind turbines, solar cells, and battery storage that undergird smart, resilient energy grids.

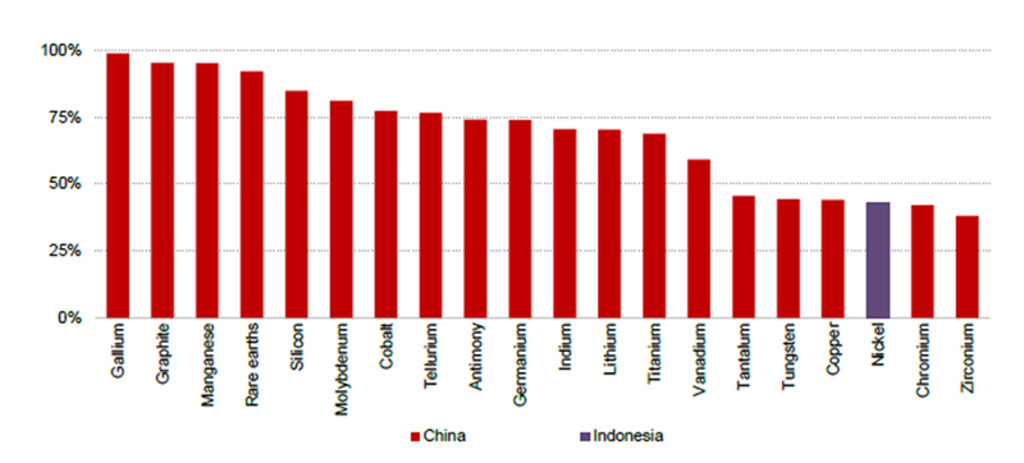

China has spent two decades building its dominance over critical mineral supplies. It now commands 60-90% of mining and over 90% of refining capacity. This dominance has been repeatedly weaponized over the past two decades, most recently in 2024 and 2025, where export bans triggered global price spikes and exposed the vulnerability of high tech supply chains. It also sharpened Washington’s focus on securing critical mineral independence.

Figure 1 – China dominates critical mineral production

Source: IEA, Global Critical Minerals Outlook 2025.

Greenland – a long-term prize

Although largely self-governing in terms of domestic affairs, Greenland is still a territory of Denmark, which retains control over foreign policy and defense. Moreover, the two economies are deeply integrated. Legal, economic, and strategic ties to Denmark, an EU member mean that any of Greenland’s resources could be claimed by the EU. A 2023 survey found that 25 of 34 minerals classified as ‘critical raw materials’ by the European Commission are found in Greenland.

Moreover, the EU Critical Raw Materials Act sets 2030 targets to mine 10%, process 40% and recycle 25% of the EU’s needs for ‘strategic raw materials’, while capping single‑country dependence at 65%. That puts it in direct competition with the US which also seeks to secure raw materials to keep its economy globally competitive and reduce foreign dependence. Like the EU, the US is also taking legislative action to shore up mineral supplies.

The US Inflation Reduction Act (2022) includes FEOC (Foreign Entities of Concern) restrictions which disqualify electric vehicles from federal tax credits if their batteries contain FEOC components (2024) or FEOC‑sourced critical minerals (2025). The IRA has helped jumpstart domestic mining and refining capacity as well as secure reliable supplies from mineral-rich allies like Australia, and now perhaps, Greenland.

China too is interested in Greenland, having expressed interest in Greenland as part of its ‘Polar Silk Road’ which aims for access to Arctic Sea trade lanes and footholds in Arctic resources. Chinese companies have also attempted to buy Greenland mining assets, but so far these efforts have drawn pushback from Denmark, the US, and Greenland itself.

Quali sono i temi caldi del momento?

Iscriviti per ricevere in un’unica newsletter tutte le ultime tendenze dell’investimento tematico.

Securing the future

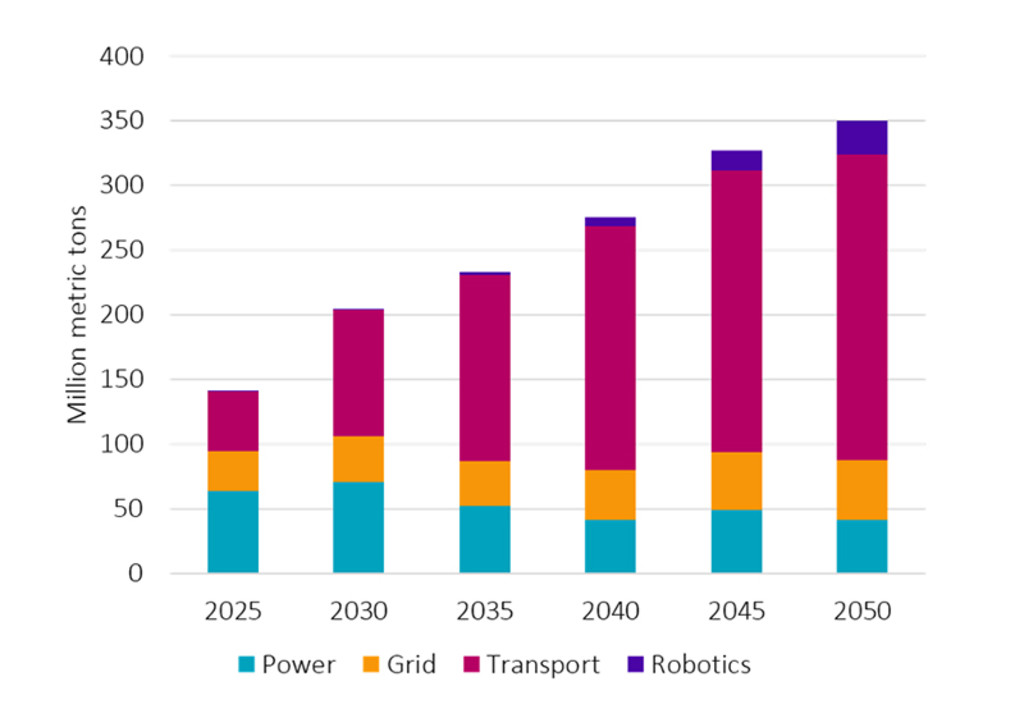

Control over rare earths, critical metals and other specialized materials effectively determines the pace at which electrification, intelligent power grids, factory automation and other AI-powered technologies can advance. So regardless of how the Greenland geo-politicking plays out, there is a rush for rare earths that won’t end any time soon.

Figure 2 - Global demand for transition metals, by sector

Source: Robeco, Bloomberg, Robeco 2026.

Production constraints mean higher prices

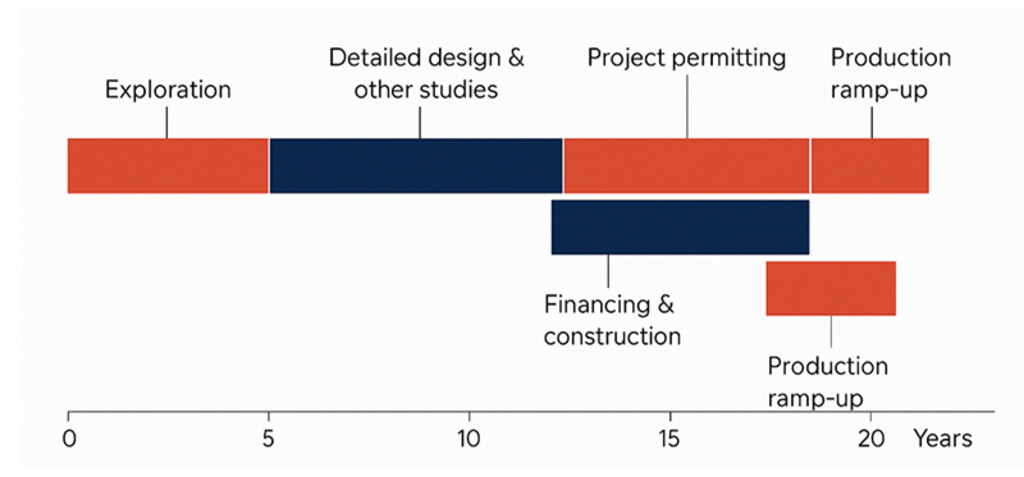

While demand-side factors are increasing, future supplies are uncertain, creating pricing power for dominant upstream players. The process of building a mine, let alone making it operational, is notoriously long and fraught with complications. Several structural factors shape this reality; new mines take between 15 and 25 years to reach full production; China continues to dominate downstream refining for many critical materials.

Although the US and Europe are reshoring key parts of their industrial base, these efforts are costly and progress is slow. That’s why Greenland is of long-term strategic importance rather than a quick fix. The result is a persistent imbalance between rising demand and constrained supply, leading to widening copper deficits, lithium prices stabilizing at higher levels, improving margins for rare-earth producers, and sustained premiums for domestic suppliers. Investors are naturally drawn to this backdrop, as scarcity itself becomes an investable theme.

Figure 3 – Mineral mines are decades in the making

Source: IEA, The Role of Critical Minerals in Clean Energy Transitions, 2021 and updated analysis from the Global Critical Minerals Outlook 2025.

Investment implications

Demand for materials is now accelerating driven by powerful forces such as electrification, the expansion of AI, rapid advances in robotics and rising industrial automation. Persistent supply constraints, amplified by geopolitical tensions, continue to strengthen pricing power across the sector. Despite these pressures, valuations in the minerals-materials ecosystem are appealing, offering the opportunity for significant and long-lasting upside potential as earnings from companies in the space continue to grow.

Looking ahead, the case for acting now is compelling. Just as oil defined the last century, materials will shape the next. The geopolitical focus on Greenland is merely a visible symptom of a broader reality – economies cannot decarbonize, digitize, automate, or maintain security without reliable access to strategic materials and the technologies required to process them.

Robeco Smart Materials

The Smart Materials strategy provides smart exposure to these powerful drivers of future economic growth. Its investments cover the full spectrum of materials and manufacturing technologies – from upstream providers of transition metals and strategic minerals all the way to downstream applications such as batteries and energy storage, building efficiency solutions, electrification systems, and advanced manufacturing components.

This broad positioning sets the portfolio apart from pure mining plays, traditional cyclical chemicals, or narrow AI focused equity strategies. Instead, it targets the critical bottlenecks and enablers within these value chains – areas where scarcity and pricing power tend to persist. It also recognizes the strategic value of recycling, investing in companies that recover and re process scrap to procure for precious minerals.

Smart Materials D EUR

- performance ytd (31-1)

- 10,26%

- Performance 3y (31-1)

- 6,21%

- morningstar (31-1)

- SFDR (31-1)

- Article 9

- Pagamento del dividendo (31-1)

- No