Quiénes somos

Encantados de conocerle

Como gestora de activos global, nuestras soluciones de inversión están enfocadas a sus necesidades. Nos inspira una inagotable curiosidad, un análisis riguroso y una demostrada pasión por la sostenibilidad, y queremos guiarle hacia estrategias innovadoras de gestión activa.

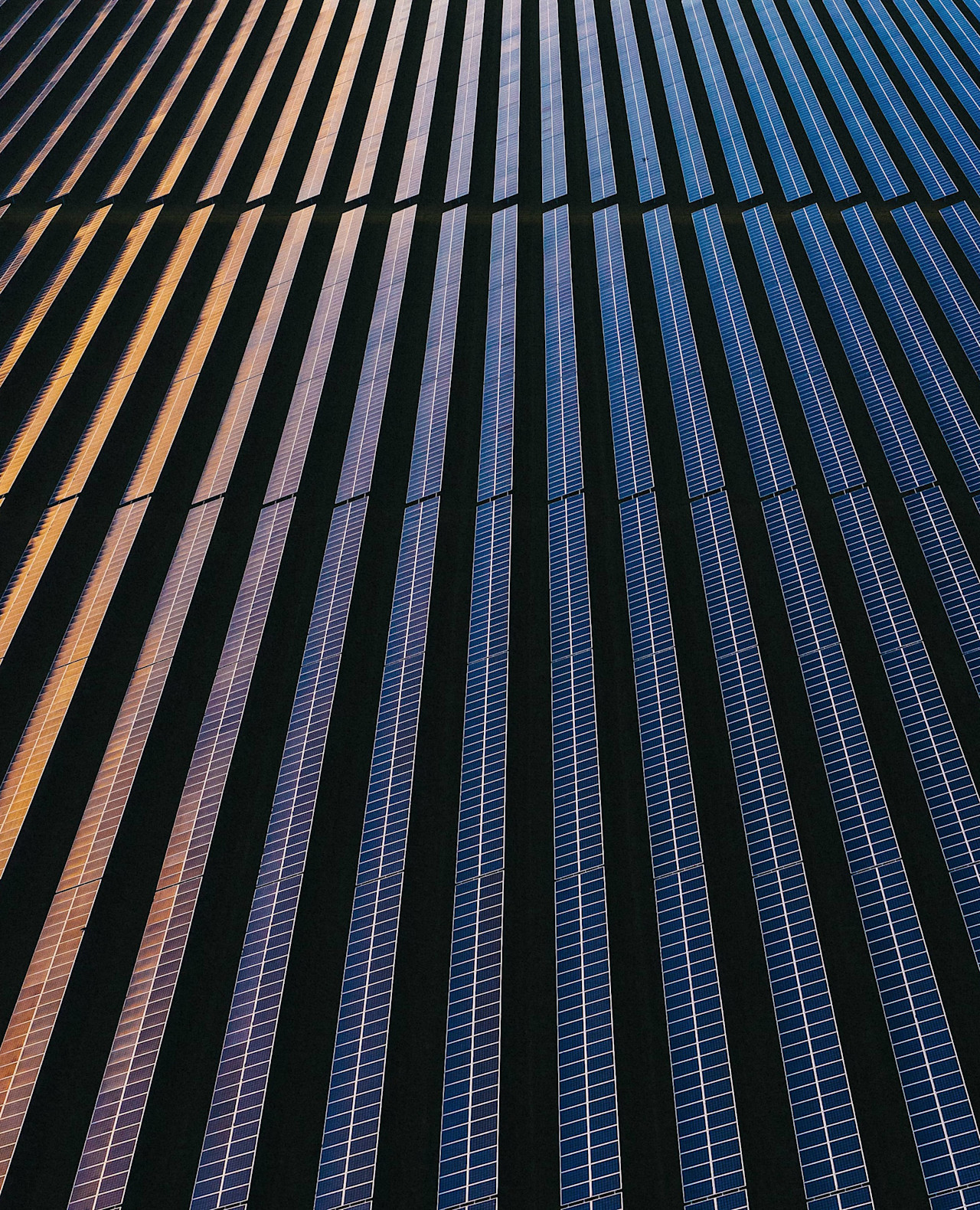

¿Está interesado en invertir en las tendencias del presente y del futuro? Con nuestras inversiones contribuimos a un planeta saludable; la sociedad es el objetivo que compartimos. Únase a la conversación: hable con uno de nuestros expertos.

Perspectiva anual

Perspectiva anual ETFs activos de Robeco

ETFs activos de RobecoETFs activos para el inversor de hoy en día

Encuentro trimestral

Encuentro trimestralFinding Alpha: nuestras mejores ideas de inversión. ¡Regístrate!

Últimas reflexiones

Oportunidades de inversión

Nos complace destacar algunas de las oportunidades seleccionadas por nuestros expertos.

Una muestra de nuestros productos

QI Global Developed 3D Enhanced Index Equities

Enfoque sistemático y sostenible como alternativa a la inversión pasiva

Emerging Stars Equities

Inversión concentrada y sin restricciones en las estrellas más brillantes de Asia

Credit Income

Búsqueda de un nivel de ingresos homogéneo invirtiendo en empresas que contribuyen a la consecución de los ODS

Climate Euro Government Bond UCITS ETF

Una novedosa solución de inversión que alinea la cartera de deuda soberana con actuaciones sobre el clima