Sustainable Asia is rich with alpha opportunities

After a strong 2025, we are seeing attractive opportunities in Asia-Pacific in sectors including AI, energy storage, distributed solar, and smart grids. With its blend of emerging and developed markets, as well as opportunities for growth in key sustainability and technology-driven sectors, we believe Asia will attract increasing investor flows.

Resumen

- Asia equities and corporate bonds are firmly on the investor radar in 2026

- For sustainable investors, Asia is the center of transition technology supply chains

- Government policies and market incentives are aligning to create alpha** opportunities

For the first time in nearly a decade, Asia equities easily eclipsed US equities in 2025 with the MSCI AC Asia ex Japan up 33% versus the S&P 500 at 16.4%.* However, after ten years of underperformance this secular trend of rotation into Asia is in its early stages. The significant valuation difference and relative under-ownership of Asian markets are likely to be key topics of discussion in asset allocation meetings worldwide.

Asia credit outperforms US

Asia credit also outperformed US peers, returning 8.22% compared to 7.08% in 2025 for the global credit benchmark.*1 This outperformance is underpinned by stronger fundamentals and lower leverage in Asia relative to the US. Furthermore, the AI capex boom has led to a surge in bond issuance by US hyperscaler companies. In contrast, Asian issuers in tech sectors, such as semiconductor suppliers, have not needed additional funding due to their position in the supply chain. As a result of these strong fundamentals and lower leverage, Asian corporates are likely to see stable or even declining funding costs as rate cuts continue, which should further support positive technical trends in the asset class. We do expect a data center rollout in Asia, but it is likely to be funded by a mixture of public and private debt in both local and hard currency, and rolled out over a longer time horizon, so the impact on the market is, so far, limited.

Action not words

Sustainable investing targets assets already aligned with ESG standards, while transition investing finances the credible decarbonization pathways of higher-emitting sectors toward those standards. For both investment approaches Asia is emerging as an attractive region for alpha opportunities with the supply chains of the most important transition technologies centered in the region. These sectors are being supported across Asia-Pacific as governments and regulators take action to encourage more sustainable economic development and enable transition finance.

The COP29 and COP30 presidencies established a USD 1.3 trillion climate-finance roadmap, setting the stage for accelerated funding of green projects and Asia will benefit from an outsize share of that total. Recent actions include South Korea confirming its 2035 emissions target as well as a bold target to cut plastic waste by 30% by 2030, reinforcing policy pressure on heavy industry and governance reforms. Singapore’s Tuas Power announced plans to convert a coal plant to 100% biomass by 2028, marking a significant transition in Southeast Asia’s energy mix. India’s Solex Energy committed USD 1.5 billion to solar manufacturing, strengthening domestic photovoltaic supply chains, while China pledged faster progress on green initiatives in its upcoming Five-Year Plan. By 2035, China aims to reduce economy-wide net greenhouse gas emissions by 7 to 10% from peak levels and increase the share of non-fossil fuels in total energy consumption to over 30%, signaling sustained support for renewables and storage technologies.

Sustainable Asian Stars Equities S EUR

- performance ytd (31-1)

- 7,18%

- Performance 3y (31-1)

- 11,93%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Pago de dividendos (31-1)

- No

Cross-border capital allocation

More structurally, Asian countries and regional intergovernmental organizations like ASEAN are following a broadly comparable process to the EU, with the EU Taxonomy acting as a reference point to categorize sustainable activities. China is engaging with the EU through the Common Ground Taxonomy (CGT) to support interoperability, while gradually expanding corporate ESG reporting requirements. Singapore and Japan are building frameworks to support transition finance, while ASEAN Taxonomy Version 3 took effect in December 2024, expanding detailed criteria for activities like transport, construction and real estate. Greater taxonomy and disclosure convergence should ease cross-border capital flows and enhance comparability, supporting differentiated alpha opportunities as transition finance scales across regions.

Within Asia credit, established issuers in the renewable space have structured their debt profiles to match their capital expenditure and reduce refinancing risk. The issuance of green and social bonds, although having fallen from its peak, continues to be relatively robust as regulators in the region continue to support an energy transition that promotes growth and avoids being overly disruptive to existing industries. As a result, a policy reversal is now less likely, which should give investors more confidence.

Drivers in place for a positive 2026

As we look ahead, the sustained integration of sustainable finance initiatives and evolving regulatory frameworks across the Asia-Pacific region should further enhance the attractiveness of local markets for forward-thinking investors. The dynamic interplay between government policy support, corporate innovation in renewables and smart technologies, and the growing emphasis on robust ESG standards is expected to underpin resilience and unlock new growth opportunities. This convergence of factors, combined with the region’s pivotal role in global supply chains, positions Asia-Pacific not only as a beneficiary of the transition but also as a key driver shaping the trajectory of sustainable investment worldwide.

There are three clear reasons why Asian assets can build on their recent advance in 2026. First, we expect more monetary easing with rate cuts likely to benefit emerging Asian markets including the ASEAN nations and India. Emerging Asia has lagged the northern tech industrial powerhouses (China, Korea, Taiwan) but we expect a relative recovery in 2026 based on upward earnings revisions. Second, the proliferation of AI capex is ongoing and remains a positive for North Asian countries and their vital hardware supply chains. Third, if geopolitical noise levels ease, investors can refocus on fundamentals – which would be a positive backdrop for Asian equities and credits.

Manténgase al día de las novedades en inversión sostenible

Suscríbase a nuestro newsletter para descubrir las tendencias de IS.

Sustainable themes can be an extra alpha generator

In equities, the Robeco Sustainable Asian Stars Equities strategy has an embedded focus on defined sustainability goals, including a 20% lower carbon footprint and stronger ESG characteristics than its benchmark index. Our fundamental stockpicking with ESG integration aims to enhance alpha generation through selecting stocks that will benefit from sustainability-related growth trends. We expect continued momentum in sectors like energy storage, renewable energy, and smart grids.

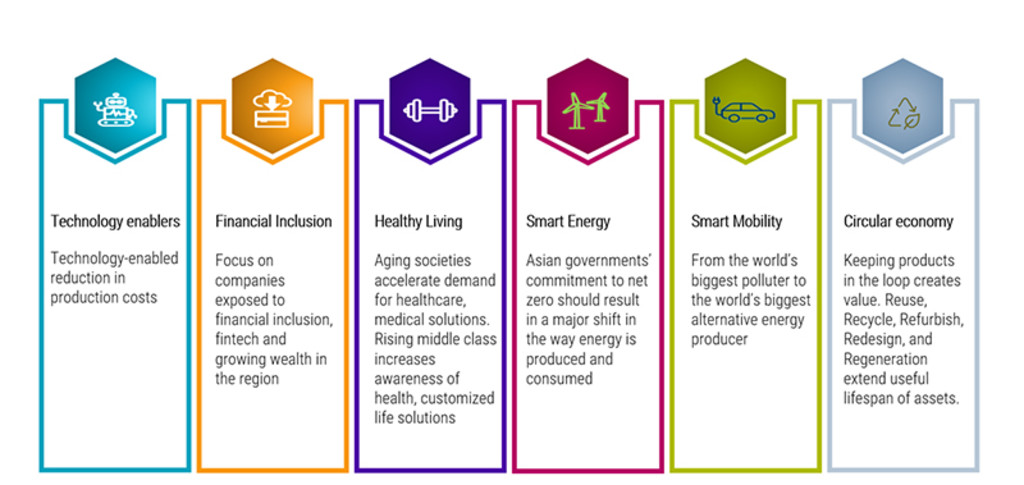

Figure 1: The future of Asia is wealthy, healthy, electric and green

Source: Robeco

In addition, from a governance perspective we expect initiatives like Value-up in Korea to increase in intensity and deliver improved shareholder returns in select stocks. We are being selective with our AI exposure, and we like memory makers which are well positioned in an industry shortage. Smartphones and edge devices also remain under the radar, offering potential upside as AI moves closer to the consumer. We consider Chinese cyclicals to be trading at attractive valuations and we are positioned in insurance and brokers, as well as select industrials and materials.

In credits, we believe our deep understanding of the energy transition and its impact across cycles and sectors makes it possible to identify emerging alpha opportunities. The Robeco Transition Asian Bonds strategy targets lower emissions than the benchmark and a higher allocation to issuers making and enabling the energy transition.

Robeco is uniquely placed to provide solutions for investors that are tailored to their specific investment return, risk and sustainability goals – in line with the principles of sustainable or transition investing. For large institutional investors, we can support the development of customized solutions to meet specific exposure to asset classes. Speak to your local Robeco representative to find out more.

** Alpha refers to the excess return of an investment relative to a benchmark index and is a measure of performance.

* Past performance is no guarantee of future results. The value of your investments may fluctuate.

Footnote

1Total Return for JPM Asia Credit index ("JACI"); vs 2025 Total Return for Bloomberg Global Aggregate Corporate (Hedged to USD).