Warsh's wishful thinking

Kevin Warsh has been portrayed as an inflation hawk, but the picture is much more nuanced. His views actually suggest room for lower (not higher) rates, and his goal of shrinking the Fed’s balance sheet may turn out to be more wishful thinking than reality.

Resumen

- Warsh looks less like a hawk and more like a pragmatic rate-cutter

- Shrinking the Fed’s balance sheet may prove harder than the rhetoric suggests

- The Treasury curve still has steepening potential

During his time as Federal Reserve Governor, Fed Chair-pick Kevin Warsh fretted about the inflationary risks emanating from Quantitative Easing (QE) and emerged as one of its most vocal internal critics. We now know QE primarily as a policy that has boosted the Fed’s balance sheet. Hence, it is of little surprise that in a Wall Street Journal op-ed in November 2025, he argued that “the Fed's bloated balance sheet… can be reduced significantly”. This view has cemented his recent portrayal as an inflation hawk.

However, he has also clarified that “if we would run the printing press a little quieter, we could then have lower interest rates”. Not a pure hawk then. What is more, back in July, he criticized the Fed’s “hesitancy” to cut rates during an interview with CNBC – which hardly sounds hawkish. As for Warsh’s view that the Fed’s balance sheet should decline, this could be perceived by investors as detrimental to the support of the longer-dated segments of the US Treasury market – something the current Treasury Secretary Scott Bessent would surely not cheer.

Euro Government Bonds D EUR

- performance ytd (31-1)

- 0,77%

- Performance 3y (31-1)

- 2,78%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Pago de dividendos (31-1)

- No

There’s also another practical difficulty to consider: aggressively shrinking the Fed’s balance sheet could re-ignite tensions in US money markets. A rapid decline in reserves risks pushing the system back toward scarcity, increasing volatility in overnight funding rates and repo markets. Indeed, to prevent this, the Fed has recently decided – after several years of Quantitative Tightening (QT) – to expand its balance sheet again mainly through increased Treasury bill purchases.

In short: we believe that the portrayal of Kevin Warsh as a hawk is overstated and expect that he will support a further reduction in policy rates by June, which would likely be his first meeting as Chair. Regarding his view that the Fed’s balance sheet may be excessively large, we believe it will be difficult in practice to shrink it meaningfully without regulatory adjustments to the ample-reserves regime in the banking system.

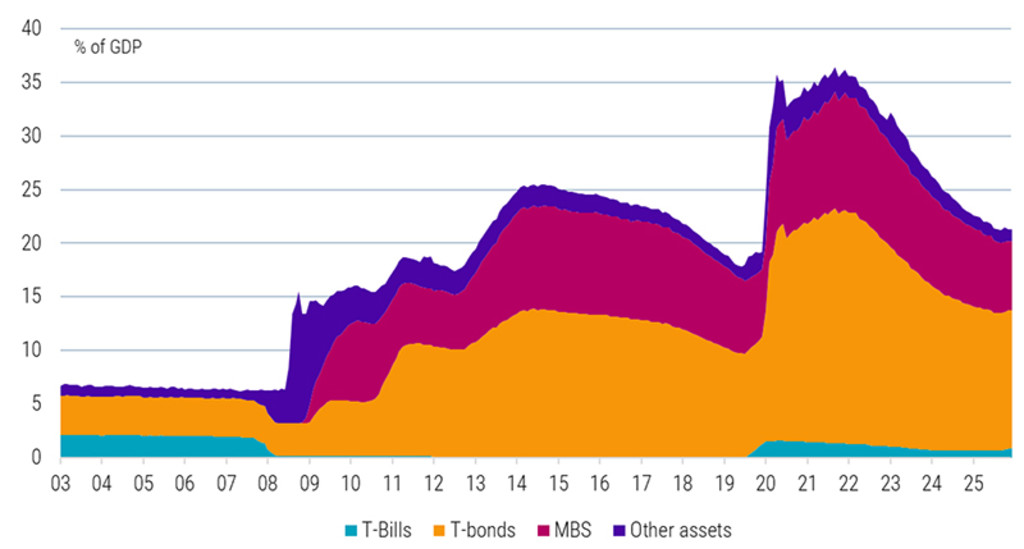

A plausible outcome is that the balance sheet – currently around 20% of GDP (see chart below) – expands more slowly than the US economy in the coming years, and/or that Warsh advocates for a faster shortening of the average maturity of the Fed’s bond portfolio. This should make our preference for the 2 to 5 year segment of the Treasury curve relative to 10 year maturities far from wishful thinking, and instead a logical outcome of a Fed that, under Warsh, is likely to favor pragmatism over ideology.

Federal Reserve assets, as % of GDP

Source: Bloomberg, Robeco, 6 February 2025

Acceda a las perspectivas más recientes

Suscríbase a nuestro newsletter para recibir información actualizada sobre inversiones y análisis de expertos.