Denmark is the new world leader in sustainability performance

Denmark tops Robeco’s latest country ranking thanks to consistent environmental performance. Hungary’s declining ESG scores creates a cautionary tale for rising populist movements. Analysis finds educational investments are not enough to stave off country ‘brain drain.’ Indonesia wants to join the OECD, but is it ready?

Summary

- Consistency is key in Denmark’s rise in the ranks

- The US improves but gains most likely short-lived

- Hungary shows populism can be toxic for investments and growth

Denmark is now the world leader in sustainability performance, according to Robeco’s latest country ranking, which measures 150 countries on material environmental, social, and governance indicators that materially impact economic growth and development.

Though it shot past Finland, Sweden and Norway, its rise is by no means meteoric. For more than a decade, it has consistently ranked in the top five, even besting No. 2 Sweden on environmental scores just last year and receiving the world’s best social score in 2021. But it has never managed to surpass its northern neighbors in performance overall. This year nicely illustrates that though intensity of effort is rewarded by short-term gains, consistency of effort pays off nicely in the long run.

Source: Robeco, October 2024.

Both Finland and Sweden struggled on environmental and social dimensions. In Finland, a right-wing coalition government proposed reforms that would seriously undermine workers’ and civil rights. In Sweden, Tesla’s refusal to collectively bargain with IF Metall – a prominent trade union representing a large portion of the country’s manufacturing sector – threatens workers’ rights and creates a stormy precedent for future labor negotiations. Moreover, decarbonization has slowed in both countries, which has weighed on environmental scores.

Though not in the top ten, the UK rejoined an elite group scoring above 8.00 overall, thanks to stronger environmental and governance scores. The US and Japan, the two largest sovereign debt issuers, slightly improved overall scores, with Japan noteworthy for maintaining its decarbonization trajectory.

Country data is calculated as of end of October, the Trump victory are not reflected in the US’s current ESG score. As with most international observers, a dial back of climate and environmental policies, social protections such as affordable health insurance, reproductive services, and minority rights is expected. This will undoubtedly weigh on US performance across all ESG dimensions in the coming years.

ESG’s biggest movers

Kazakhstan, Côte d’Ivoire and Guatemala registered some of the largest gains. Kazakhstan noticeably improved GHG intensities and political stability while the Côte d’Ivoire made advances in environmental and labor rights.

Figure 2 – Countries with the largest performance improvements

Source: Robeco, October 2024.

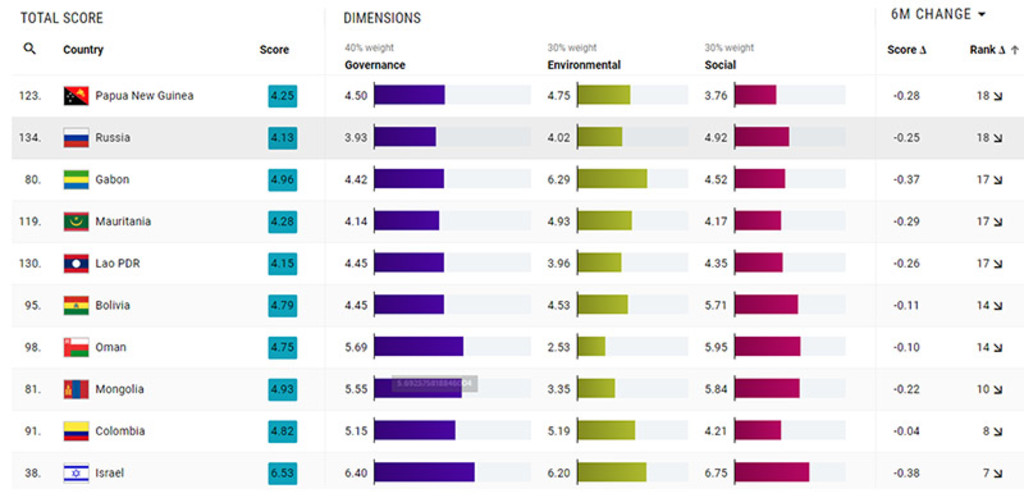

Conversely, weaker labor and higher carbon emissions drove large declines for Russia, Papua New Guinea, Gabon, Mauritania, and Laos.

Figure 3 – Countries with the largest performance declines

Source: Robeco, October 2024.

Populism in Hungary – a cautionary tale

Populist themes of anti-immigrant, anti-climate, and anti-establishment sentiments marked national elections across Eastern and Western Europe this year. Hungary is a striking example of how unchecked populism not only stifles dissent but also economic growth and foreign investment.

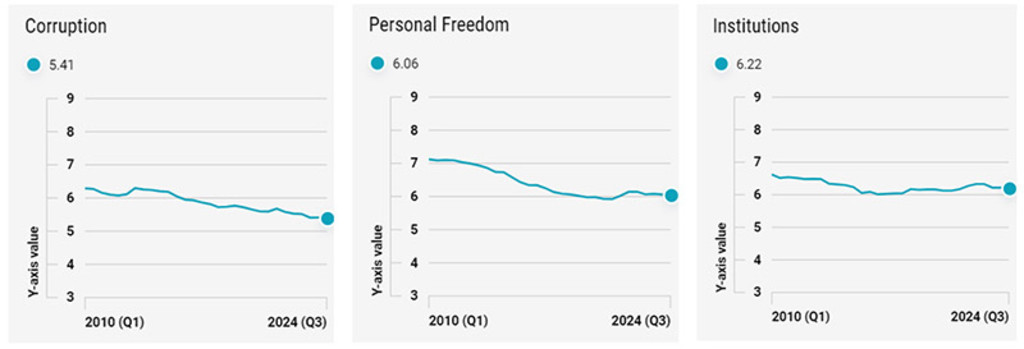

Since taking power in 2010, Viktor Orbán has undermined judicial independence, suppressed the media, and restricted the rights and voice of civil organizations – all reflected in Hungary’s deteriorating performance on key governance indicators (Figure 4). Consequently, investor confidence in its sovereign bonds suffered, indicated by high credit default spreads (CDS) between Hungary and EU peers.

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

Figure 4 – More corruption, less freedom and weakened institutions under Orbán

Source: Robeco, October 2024.

To regain credibility and fight inflation, its central bank has aggressively hiked interest rates. Consequently, its bond yields have risen but this has also strained public finances and borrowing costs for businesses and citizens and impeding growth. Despite hikes, CDS spreads remain high. Over time, this can trigger a vicious cycle of economic stress, social unrest and political instability. It’s a cautionary tale for EU countries and would be members should closely heed.

For sovereign debt investors, this political trend demands a more nuanced approach to risk assessment, taking into account the complex interplay between politics, governance, and economic stability. As Europe continues to navigate this shifting political landscape, the importance of robust governance as a foundation for economic stability cannot be overstated.

Indonesia’s OECD bid

Indonesia wants to be the first Southeast Asian country to join the OECD. Its bid signals a strong desire to be an economic engine in the region and escape the middle income trap that has restrained the region’s economic growth.

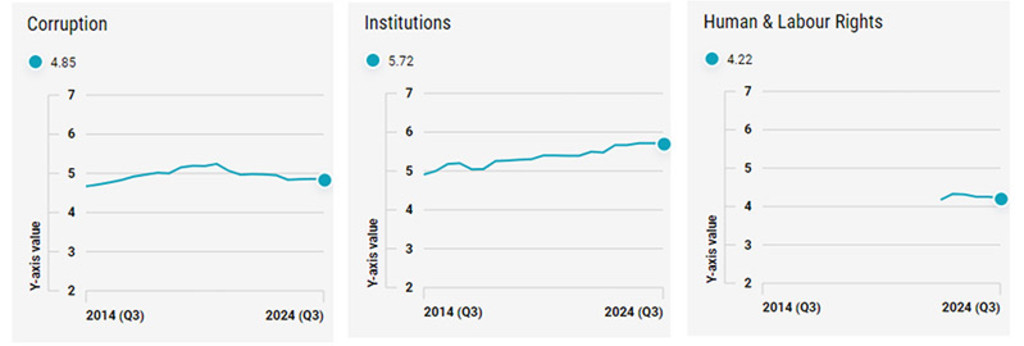

OECD membership has its privileges including access to foreign investment and improved trade conditions. In return, countries must commit to defending human rights, the rule of law, transparency, and free-market principles – the same factors measured in Robeco’s Country ESG Framework. Based on our assessment, Indonesia’s chances appear slim. It scores poorly on corruption (115 out of 180 countries) and faces allegations of serious human rights abuses according to international activists.

Figure 5 – Indonesia’s ESG report card shows mixed progress on key ‘S’ and ‘G’ factors

Source: Robeco, October 2024. Note: The scoring methodology for the Human and Labor Rights criterion changed in 2022, complicating historic score comparisons.

Moreover, it will need to significantly strengthen its climate policies, digital infrastructure for local enterprises, and institutional capacity. We see Indonesia’s interest as a good signal that it’s ready to take positive action, which should still boost investor confidence and kickstart investments into critical areas that support future growth.

Spotlight on education

A strong education system is essential for economic growth and prosperity, but it’s not enough. But as Albania and Taiwan can attest, without strong employment prospects or living conditions, even countries with high educational attainment will experience brain drain. According to the Human Flight and Brain Drain Index, currently, Jamaica, Ukraine and Samoa are most vulnerable to human flight while Australia, Sweden and Norway are the least.

And once started, the cycle is hard to escape. A poor employment outlook begets more emigration, further depleting the country’s human capital and hindering its economic development and job creation. While it’s easier for high-income countries, other income cohorts are making strides through policy reforms. For example, Qatar, Belize and India created tax incentives for companies hiring local talent, prioritized R&D to stimulate demand for high-skilled jobs, and invested in healthcare, housing, and public services to boost residents’ quality of life.

Robeco measures this complex interplay between health, education and prosperity via several data sources. When combined these determine a country’s performance on human development, which is reflected in the overall social score.

Conclusion

The latest rankings highlight the pivotal role of political leadership in shaping ESG performance and investment risks. That’s one reason why governance is so heavily weighted in Robeco’s country framework – even slight changes can alter a country’s trajectory. Moreover, academic research finds that country’s ESG scores are linked with higher investor confidence. That makes continually assessing ESG performance essential — not just to gauge current conditions, but to anticipate future trends, potential risks, and emerging opportunities.