China aims to re-ignite domestic economy

China’s 15th five-year plan reiterated the familiar theme of building a modern, high productivity industrial system which is logical given its ongoing technology race with the US. Investors will be heartened by an increased emphasis on invigorating the domestic economy, with policy detail to be revealed by the year-end.

Summary

- Five-year plan focuses on tech, self-reliance, and domestic consumption

- Implementation plan details could be catalysts into the year-end

- We remain constructive on Chinese equities

China’s fourth plenum and its introduction of the next five-year plan concluded in Beijing on 24 October 2025 to a muted reception by markets, with top policymakers signaling broad continuity. The strategic objective remains industrial and technological self-reliance. The positive outcome for investors was the increased emphasis on stimulating domestic consumption although specific policy details are to come. A resolution to the current trade impasse with the US before 1 November, when penurious US tariffs are scheduled to kick-in, will be required before equities start to reflect any positive sentiment over the five-year plan.

Chinese Equities I EUR

- performance ytd (31-1)

- 1.81%

- Performance 3y (31-1)

- 0.53%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

The five-year plan communique reiterated that raising per capita GDP to the level of a “moderately advanced economy level” by doubling the economy’s size between 2020 and 2035 is the ultimate performance target, which implies sustained average growth of around 4-5% over the coming decade. With this in mind the communique said that “economic work as the center” and a tilt to “high quality” growth was the mantra, which should reassure investors that any other political or geopolitical goals will be subordinate to that. Economic reforms are clear and necessary, given continued property market weakness, overinvestment resulting in intense competition and potential misallocation of resources, with a very high domestic savings rate imposing deflationary pressure.

Innovation acceleration

Rapid innovation in emerging competitive sectors like AI, Quantum computing, hydrogen energy, nuclear fusion and biomanufacturing was also emphasized. These sectors represent a primary arena of competition with the US, a key undercurrent of the current trade negotiations. From our perspective, this means a fertile future for China’s technology sector. It’s also an opportunity long-term investors should not ignore, especially given valuations remain at a discount to peers in the US and Europe.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Spend don’t save

China’s household savings rate is estimated at around 35 to 40% in 2025, far higher than 15.4% in Europe1 and 4.6% in the US.2 This reflects property market weakness and the perceived inadequacy of social welfare provision. Reform of the transmission mechanism between central and local government expenditure leading to more balanced and efficient public investment is now accepted to be necessary. Policy detail on this will be required to tip this large pool of savings into consumption and asset markets. The fourth plenum communique did mention economic rebalancing and consumption as a policy priority but we will have to wait for specific action and reforms with 2025 GDP growth expected to be in line with the 5% target. As a long-term driver for the economy and Chinese equities, this will be key, especially if trade tensions with the US and the rest of the world cap further export growth.

Conclusion

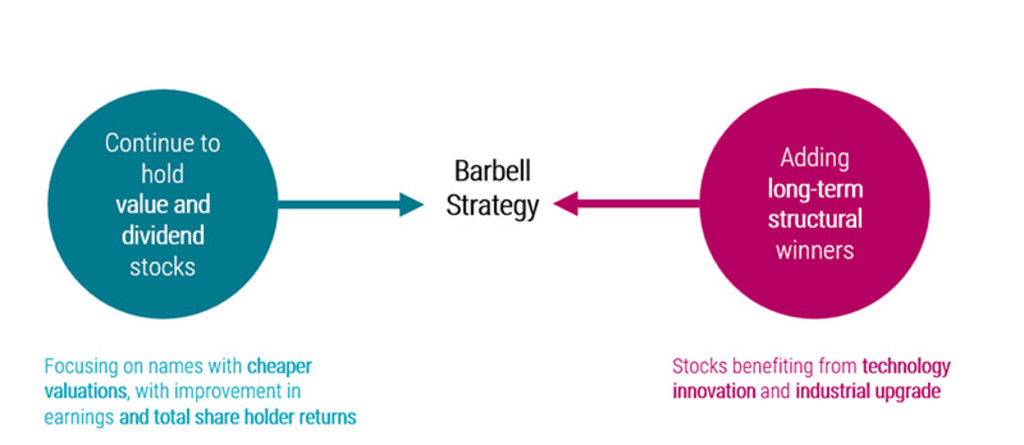

We continue to position our portfolio toward structural winners in technology and innovation, aligning with long-term strategic priorities. Notwithstanding any final resolution to the trade negotiations with the US, earnings revisions are critical to sustaining the current positive market sentiment. Given the persistence of deflationary risks, we will continue to hold value stocks with potential for earnings upgrades and improve total shareholder returns as the other side of our barbell strategy during this period.

Footnotes

1 Eurostat, 2024.

2 St Louis Federal Reserve, August 2025 data.