Who needs the Mag 7: A long tail of opportunity

Over the past five years, equity markets have become increasingly concentrated, with overall returns driven by a small group of mega-cap stocks. While investors cannot easily reduce the impact these companies have on market beta, they can prevent this concentration from dominating alpha.

Summary

- The Magnificent Seven may shape the benchmark, but not necessarily outperformance

- Systematic, benchmark-aware investing keeps single stocks in check

- Our Global Developed Active Equities strategy uncovers alpha across the entire market

Our new article explains how Robeco’s benchmark-aware Active Equities approach is designed to keep alpha generation broad, ensuring performance is not overly influenced by just a handful of names.

As of 30 October 2025, the so-called Magnificent Seven stocks have ballooned to more than a quarter of the entire MSCI World index.1 The rise in concentration has been steady, but the narrative surrounding it has not, starting with the name.

Over the past decade, this small, evolving cohort of dominant companies has been rebranded repeatedly – from FANG, to FAANG, FAANG+, MAMAA, Magnificent Seven, and even BATMMAAN – each acronym attempting to capture the prevailing market story of the moment.2 And those stories have shifted just as often, from the platform-economy boom to the impact of quantitative easing, and from the Covid-driven digital acceleration to most recently the surge in AI enthusiasm. Yet despite the changing names and narratives, one constant has remained: the sheer scale of these firms and the outsized influence they continue to exert on global equity markets.

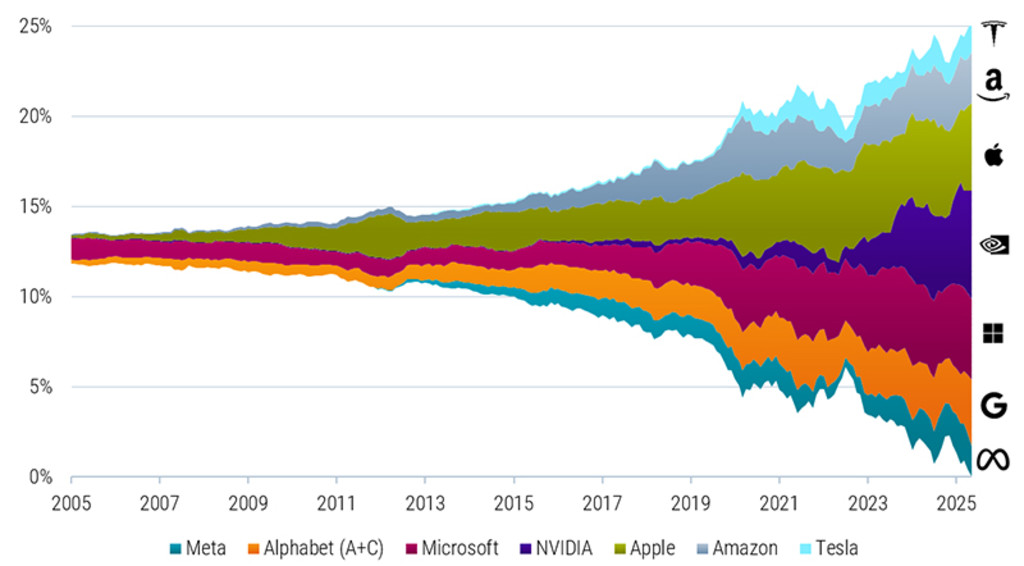

Such an acceleration is rarely seen outside of periods of high euphoria. In practical terms, fewer stocks now drive a greater share of total market absolute performance, with the effective N 3 decreasing from more than 300 in 2005 to just 84 in October 2025. Expressed differently: the market may contain thousands of listed companies, but the experience of owning the index has increasingly resembled owning just a few. The composition of major developed market indices, such as the MSCI World Index, is a stark reflection of the prevailing narrative, as depicted in Figure 1.

Figure 1 – Weight of Magnificent Seven stocks in the MSCI World Index

Source: Robeco, LSEG. The figure shows the cumulative weight of the Magnificent Seven stocks in global developed markets. The Magnificent Seven comprise Alphabet (A & C shares), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. Global developed markets are represented by the MSCI World Index. The sample period covers October 2005 to October 2025. For illustrative purposes only.

The challenge

It cannot be denied that these companies have reached a size where they are key drivers of market beta and will remain so, at least for the foreseeable future. The real question is whether your alpha must also be dictated by this same small group. When such a small group of stocks contributes so meaningfully to index returns, large relative positions in aggregate – either overweight or underweight – can become the primary drivers of whether a strategy outperforms or underperforms. For many active strategies it has concentrated both opportunity and risk in a way that challenges the foundations of diversification, with significant implications.

For investors positioning against current leaders in anticipation of mean reversion, the risk is that the momentum extends and persists longer than valuation models might suggest, leading to a persistent relative performance drag. Yet leaning heavily into the winners is equally problematic. Concentrated overweight positions can amplify portfolio risk and create uncomfortable exposure to a narrative that could shift quickly, especially if earnings momentum slows, policy environments change, or business models are disrupted. History shows that reversals often occur not gradually, but abruptly – and after prolonged periods where it was claimed, “This time is different”.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

A benchmark-aware quant solution

Robeco offers a third path: a systematic, benchmark-aware approach that spreads risk across the full equity universe. Rather than making big calls on the Magnificent Seven – or missing out on them entirely – the strategy takes many small under- and overweight positions, guided by diversified return signals and disciplined risk controls at the stock, sector, and country levels. This keeps any single exposure from overpowering the portfolio.

The result is a portfolio of hundreds of positions, each contributing modestly to active risk and return. Alpha is built through breadth, not concentrated bets; aiming to capture opportunities across the entire market rather than relying on the dominant index constituents of the moment.

Footnotes

1The Magnificent Seven refers to Alphabet (A and C shares), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

2FANG initially comprised Facebook (now Meta), Amazon, Netflix, and Google (A and C shares, now Alphabet). FAANG added Apple, while FAANG+ referred to FAANG plus additional large-cap technology stocks such as Microsoft or Tesla (with definitions varying across sources). MAMAA consists of Meta, Apple, Microsoft, Amazon, and Alphabet. BATMMAAN extends the Magnificent Seven by adding Broadcom to this cohort.

3Effective N is calculated as the inverse of the Herfindahl-Hirschman Index (HHI) for portfolio weights, where HHI is the sum of the squared stock weights. For instance, in a portfolio of 100 stocks with equal weights, the effective N would be 100. In contrast, if a single stock dominated 99.9% of a 100-stock portfolio, the effective N would be closer to 1.