Greenhouse gas emissions are the levels of carbon dioxide, carbon monoxide, sulfur dioxide and other gaseous byproducts of the industrial processes of a company in its business operations.

They are cited as being the principle cause of global warming, since they become trapped in the Earth’s atmosphere, creating a blanketing effect.

The need to decarbonize companies – and thereby portfolios – becomes more urgent as evidence of global warming mounts with every passing year. In order to combat it, it is important to be able to measure it. The Greenhouse Gas Protocol was set up to establish comprehensive global standardized frameworks to measure and manage emissions from private and public sector operations, value chains and mitigation actions. It is based on a 20-year partnership between the World Resources Institute and the World Business Council for Sustainable Development. Its calculation tools are used by companies, municipalities and governments to measure greenhouse gas emissions and carbon footprints.

Some carbon footprints are more obvious than others; power generators that burn coal to make electricity obviously emit more CO2 in the resulting emissions than a bank on the high street. The bank’s footprint would essentially be any emission produced as a result of heating, cooling and ventilating the building. But they can be deceptive – many people think going online to send an email or download a movie is non-polluting. Yet, the infrastructure surrounding the internet, including the energy-intensive data centers needed to make it all work, has a carbon footprint that is almost as high as the airline industry.

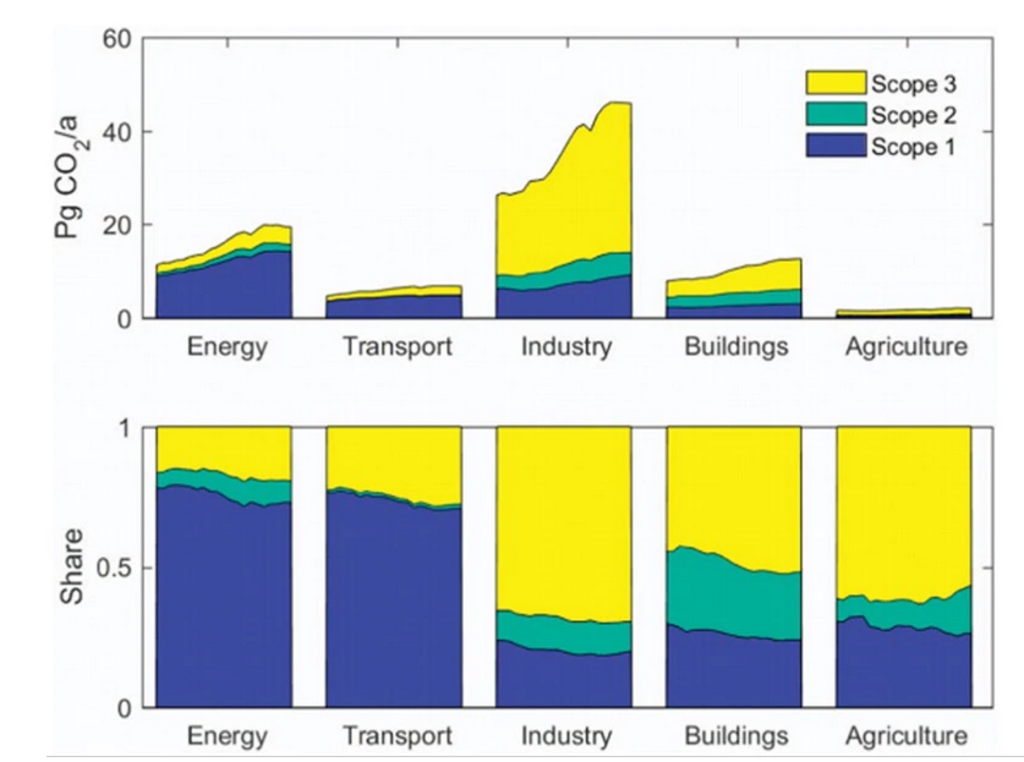

Greenhouse gas emissions that cause the footprints are measured in three ways: Scope 1, 2 and 3. Scope 1 emissions are those that are directly generated by the company, such as an airline emitting exhaust fumes. Scope 2 emissions are those that are created by the generation of the electricity or heat needed by the company to sell its main products. An electricity utility would therefore have relatively low Scope 1 emissions caused by its infrastructure or grid, but high Scope 2 emissions if it’s power came from the burning of fossil fuels rather than from renewable sources. Scope 3 emissions are those caused by the entire value chain, including the end-user of the product over its life cycle, and are much more difficult to measure. A carmaker would have relatively low Scope 1 and 2 emissions for making the car, but the user of the vehicle would burn petrol to run the car over many years, causing very high Scope 3 emissions.

Scopes 1-3 emissions of the five IPCC sections over the period 1995-2015, calculated using EXIOBASE 3

Source: IOPscience

One solution to lowering carbon footprints is seen as the introduction of a carbon tax that makes companies pay for emissions above a certain threshold. They would therefore have a choice of a large increase in costs, harming their profitability and long-term viability, or cutting carbon to avoid the tax.