The Paris Agreement is an international accord that aims to limit the rise in global average temperatures to below 2 degrees Celsius above pre-industrial levels by the end of this century, and to pursue efforts to limit it to 1.5 degrees.

It was formulated at the 21st Conference of the Parties (COP 21) of the United Nations Framework Convention on Climate Change (UNFCCC) and signed on 12 December 2015. The agreement was ratified on 22 April 2016, which the UN designated as Earth Day, and has was signed by all 196 nation members of the UNFCCC. The United States under President Donald Trump pulled out of the Paris Agreement in June 2017, saying it was not in the US’s interests to be party to it.

In order to meet the goals of the agreement, scientific consensus has concurred that cuts are needed in global emissions of greenhouses gases, which were cited as the main cause of global warming. This led to what became known as the 20/20/20 targets – to reduce carbon dioxide (CO2) emissions by 20%, to raise the market share of renewable energy to 20%, and a to improve energy efficiency through existing technologies such as insulation by 20%. The Paris Agreement requires all signatories to put forward their best efforts through nationally determined contributions (NDCs) and to strengthen these efforts in the years ahead. This includes a requirement to report regularly on national emissions and on decarbonization efforts.

Scientific consensus has concurred that to limit global warming to a maximum of 2 degrees by 2100, the world would effectively need to become carbon neutral by around 2050. A report issued in October 2018 by the International Panel on Climate Change (IPCC) warned that in order to achieve the lower 1.5 degree target, emissions need to be cut by 40%-60% from 2010 levels by 2030, reaching net zero around 2050. To reach the higher 2 degree target, emissions need to be cut by 25%. To fail to do either would lead to irreversible climate change starting from about 2030, the report said. The IPCC warned that at current levels of (in)activity, the 2-degree target would probably be reached by 2030, and that global warming of 3 degrees by the end of the century was more likely. In September 2019, the IPCC further warned that sea levels would rise by at least 1.1 meters by 2100 unless the world takes action now.

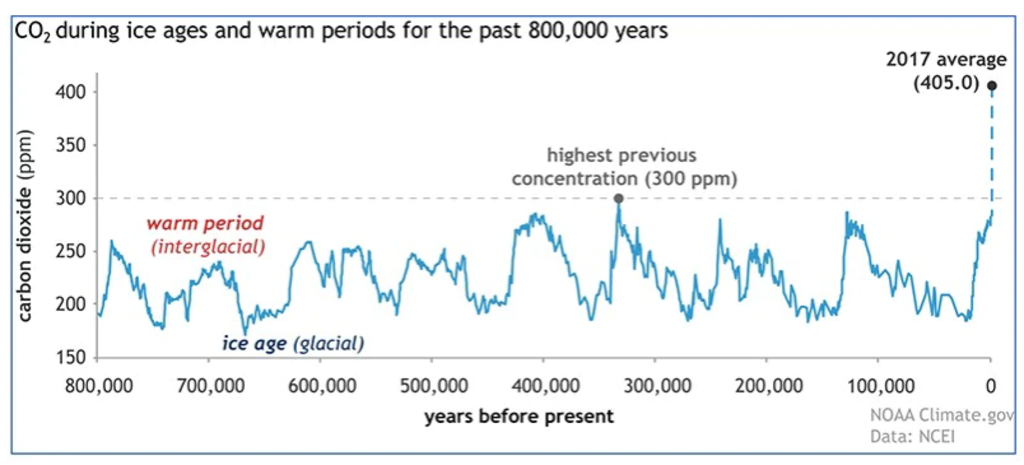

The principal cause of global warming remains CO2 produced by burning fossil fuels for electricity, heating, cooling, and transportation, studies show. Research by the Potsdam Institute for Climate Impact shows that the level of 405 parts per million (ppm) of carbon dioxide recorded in the atmosphere in 2017 was last seen on Earth three million years ago. At that time in the Pliocene Era, before humans had evolved, the average surface temperature was 2-3 degrees Celsius higher than pre-industrial levels, and the average sea level was up to 25 meters above what it is today.