Green climate funds are investment portfolios that seek to buy the equities or bonds of companies that are aligned with the goals of the Paris Agreement. They can also target the sovereign bonds of governments that are cutting greenhouse gas emissions, thereby reducing their contribution to global warming.

The core aim of the Paris Agreement is to limit global warming to a maximum of 2 degrees Celsius above pre-industrial levels, and ideally to limit it to 1.5 degrees or less. This means making the world carbon neutral by 2050 at the latest. Subsequently, climate funds are targeting those companies (and governments) that are decarbonizing at a rate sufficient to meet these targets.

Robeco climate funds and benchmark

In December 2020, Robeco was one of the first asset managers in fixed income to launch climate funds. The Climate Global Credits fund invests in credits, while the Climate Global Bonds fund invests in both credits and government bonds.

As there was no global benchmark for climate bonds, Robeco created a Paris Aligned Benchmark (PAB), as defined in EU regulation, in conjunction with Solactive, a German provider of financial indices. Performance will be measured against this index, rather than the usual benchmarks used for credit funds, such as the Bloomberg Barclays Global Aggregate (corporate) Index.

Finding companies that are committed to decarbonizing their business operations and that are either already aligned with the Paris Agreement – or are on a trajectory to be able to do so – is an essential part of portfolio construction for a climate fund. This is done by using both negative and positive screening.

Negative screening means excluding high-carbon emitters who do not qualify for the fund, such as large users of thermal coal. It also means excluding those who are simply not making enough effort to decarbonize their business models. Positive screening means using analytical models to measure companies’ greenhouse gas emissions, among other metrics, to assess their rate of decarbonization. This data can then be used in the investment process to decide which credits to buy.

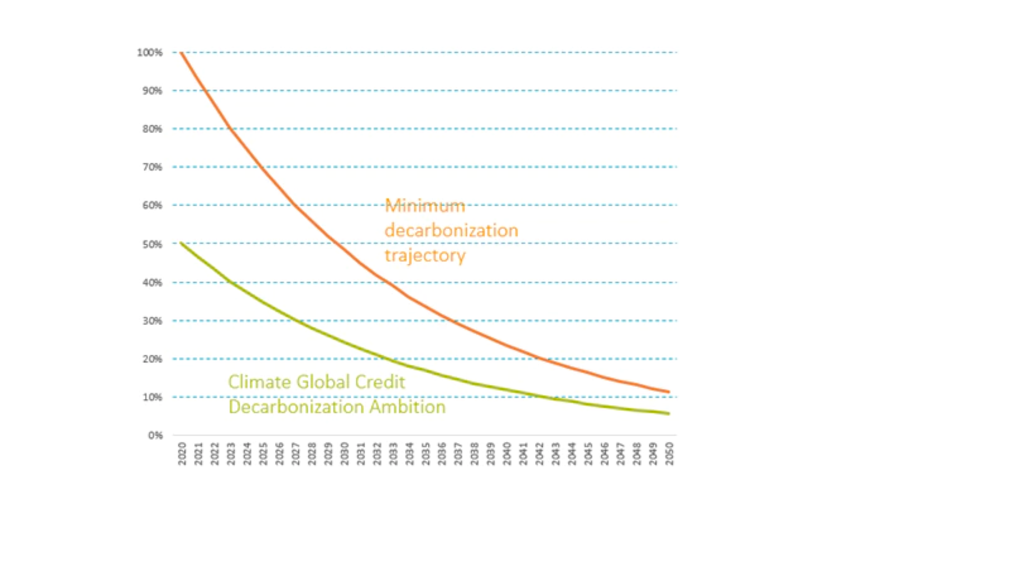

The chart below shows how Robeco’s credit selection process will be used to target companies doing better than the global norm. This will enable the future fund to pick the winners and outperform the global average. The impetus behind this fund is that the world needs to decarbonize from its current levels (100%) to zero by 2050. Companies that are already half-way there (50%) will have an easier ride and a less steep trajectory. However, companies with a steeper trajectory could still be considered if their climate ambition is in place.

Emission intensity relative to global economy in 2020

Picking the credits of companies on a minimum decarbonization trajectory.

Source: Robeco