Reduce, recycle, reshore: localization is revving up the circular revolution

While reshoring doesn’t feature among the circular economy’s traditional refrain of ‘reduce, reuse, recycle’, it does act as a catalyst to promote a host of circular solutions. With a strong focus on IT, AI and industrials as well as domestic suppliers, the circular economy strategy is well positioned to capture the short and long-term growth of reshoring waves.

Summary

- Reshoring is gaining momentum amid high tensions and tariffs

- Reshoring promotes circularity, circularity facilitates reshoring

- Reshoring tailwinds strongest for Industrials, IT and local manufacturers

The Covid pandemic, escalating conflicts, and rising trade tensions have all exposed the vulnerabilities of offshore production and supply chains. Already in 2021, business executives cited cyberattacks, commodity price fluctuations, diverging regulations, and China’s slowdown behind the Covid pandemic as significantly disruptive supply chain events. Threats once thought to be temporary have materialized into structurally persistent costs of globalization. Spring forward to 2023 and mentions of “reshoring” in earnings calls of S&P 500 companies were up 128% compared to a year earlier. More impressively, US manufacturing construction is booming (see Figure 1). Likewise, 78% of EU business executives from diverse sectors planned on moving parts of their supply chains back home, according to a UBS survey. 1

Figure 1 – A boom in spending in US manufacturing construction

Source: US Census Bureau, Bloomberg, March 2024. US Manufacturing Boom is about more than EVs and chips.

Reshoring promotes circular solutions

Reshoring reduces supply chain length and complexity. This not only improves resilience and reliability, it also reduce emissions and waste associated with long-haul transport. Furthermore, reshoring adds visibility and control enable companies to invest in circular solutions, especially those enhanced with AI technologies.

Industrial engineers and project developers are adopting AI powered circular solutions to avoid bottlenecks, minimize material use, reduce waste. This reduces costs and accelerates reshoring construction efforts. Once operational, companies can deploy more AI-enhanced solutions that conserve resources and improve margins while reducing waste and pollution. Using AI models, companies are better able to predict domestic demand, adjust inventories, and accelerate material sourcing while at the same time reducing operational inefficiencies, product waste and short-haul emissions.

Reshoring also comes with downsides, especially for EU and US markets. Robust regulatory systems, skilled labor shortages and limited access to critical raw materials all make reshoring more costly for EU and US companies. The upside to these challenges is that they are also forcing companies to embrace circular economy principles that reduce wasteful inefficiencies, improve material recovery and enhance labor productivity.

Circular solutions reduce costs of reshoring

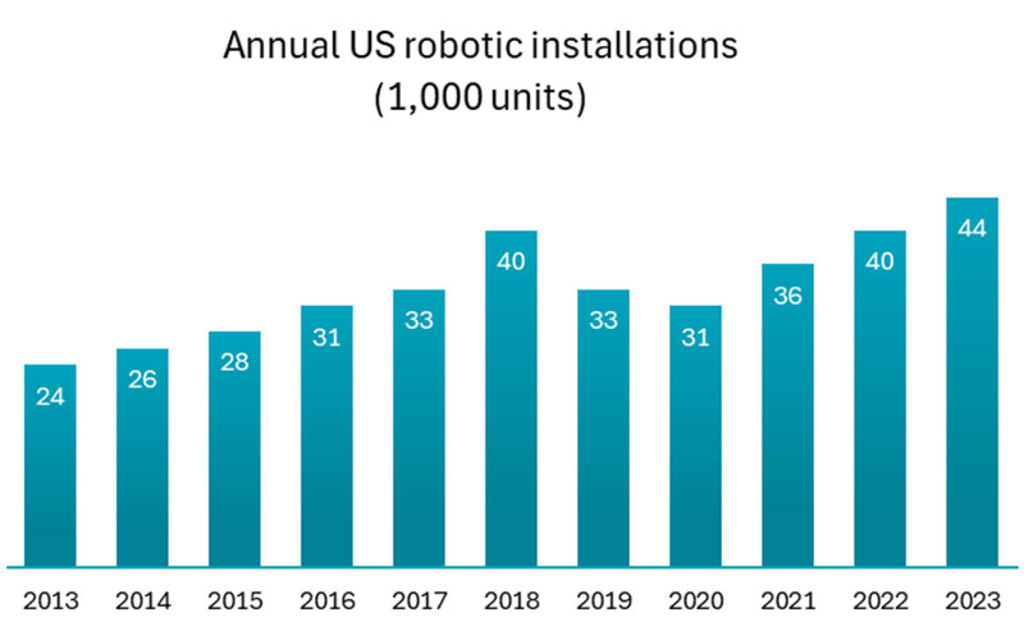

Domestically based predictive maintenance and repair operation (MRO) networks are also driving down inflationary costs. Not only do MROs reduce costly equipment breakdowns and short-term operational expenses, they also keep machinery optimally running over longer lifetimes, reducing companies’ long-term capital expenses. Moreover, AI is significantly mitigating wage inflation and labor shortages. By leveraging automation and robotics, companies can streamline processes and reduce reliance on manual labor.

Figure 2 – Robotics is growing alongside reshoring

In the US, industrial robotic installations are growing. Source: U.S. Companies Invest Heavily in Robots - IFR Preliminary Results - International Federation of Robotics. April 2024.

Closer proximity to local markets means companies can adapt more quickly and efficiently to local regulations, such as the US IRA’s domestic procurement requirements or the EU’s recycled content mandates. AI-powered robotics are also aiding and abetting these efforts. Computer vision and machine learning are enabling the efficient recovery and recycling of valuable materials in product waste streams. Predictive analytics is also being used to evaluate suppliers based on important factors such as costs, location, quality, customization, emissions, and other sustainability.

Celebrating five years of investing for healthy returns and a healthy planet

The Circular Economy strategy is coming full circle

Reshoring good for domestic growth

Reshoring encourages manufacturers to procure materials from domestic sources rather than imports. Moreover, reshoring contributes to increased investment in infrastructure. As companies build new factories and expand existing ones, there is a corresponding multiplier effect across a wide range of industries, from steel and cement to logistics and transportation.2 Bank of America research estimates that for every USD 10 billion of manufacturing revenue that is moved back to the U.S., there is around USD 3.8 billion of capex spending.3 In addition, according to one study, 7.4 new jobs are created in other industries for every durable manufacturing job generated by a reshoring project.4

Riding the waves to reshore

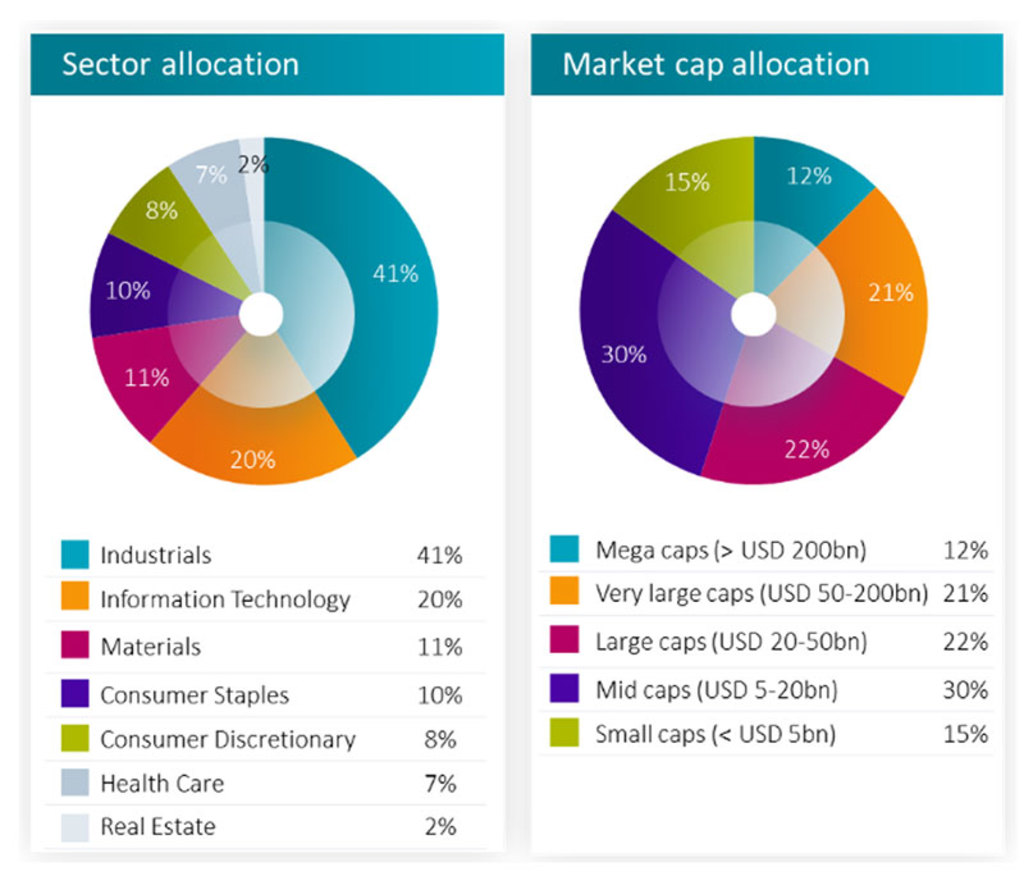

Circular solutions are well positioned to benefit from tailwinds created by the reshoring renaissance. The strategy has a mid-cap tilt, which benefit disproportionately from robust local demand and strong domestic growth relative to international conglomerates.

Industrials and technology companies that provide robotics and automation are set to be the biggest beneficiaries from government efforts to reshore manufacturing in strategic technologies such as chips, EVs and electric grid infrastructure.5 But growth is also spreading beyond artificial arms and neural networks to higher-value products that require more sophisticated manufacturing including high-end appliances, chemicals, medical supplies, logistics and transportation.6 Not only is the strategy rife with to these diversified areas, but it is also diversified by size, given many of its holdings in there companies are smaller large caps as well as mid- and small caps.

Regardless of size, lower interest rates will enable manufacturers to finance large investments into tech and automation to further boost productivity, growth and expansion.

Figure 3 – Strong sector and market cap diversification

Source: Robeco. This is the current overview as of 31.12.2024 and not a guarantee of future developments. It should not be assumed that any investments in sector or market cap identified were or will be profitable.

Conclusion

Reshoring is set to flourish driven by supply chain disruptions, tightening tariffs, and incentive-heavy industrial policies. However, labor, regulatory and resource constraints raise the cost of doing business in the EU and US. That makes circular solutions an increasingly valuable commercial proposition for local businesses and global companies that reshore or invest in these markets.

The circular economy strategy is well-positioned to capture short and long-term growth from these important structural trends. Strong exposure to AI, automation, and smart manufacturing means the strategy will benefit from their positive impact on resource efficiency, productivity, and profitability. Moreover, exposure is balanced across large, small and midcap stocks. These companies can invest more intensively in circular innovation as well as benefit disproportionately from domestic incentives compared to international firms.

Longer term, by forcing companies to confront resource efficiency alongside productivity and profitability, reshoring trends are helping unlock sustainable production models and revving up the circular revolution.

Footnotes

1 CNBC, June 2023. Reshoring more domestic manufacturing due to supply chain disruption. June 2023.

2 https://manufacturing-today.com/news/why-the-reshoring-renaissance-is-the-future-of-u-s-manufacturing/

3 Bank of America. October 2024. “Regional Morsel: Reshoring grows roots in the South and Midwest.”

4 American Century Investments, 2024. Economic Policy Institute, 2019. “Reshoring reaches mid-America.”

5 Wall Street Journal. January 2024. Midcap stocks are often ignored. They shouldn’t be.

6 MIT, Sloan Management Review. November 2023. A Reshoring Renaissance Is Underway.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.