Finding diamonds in the rough

Marilyn Monroe once famously sang that “diamonds are a girl’s best friend” – but do they hold the same allure as a metaphor for stocks? Looking for hidden gems among small caps rather than fixating on the crown jewels in mega caps may well allow investors to beat the market next year, says strategist Peter van der Welle.

Summary

- Markets still follow the ‘soft landing’ narrative even though they’re usually wrong

- Small caps may have already discounted the mild recession we predict for 2024

- Looking for hidden gems likely to uncover more value than the ‘Magnificent Seven’

Stock markets are still expecting a soft landing for the global economy in 2024, but they have never been a good indicator for the likelihood of recessions. Still, equity investors can only invest in companies and not trend lines, whether their predictive power is good or not. Finding the stocks that can outperform the others during rough times remains the art of active management.

But it may well be time to reconsider the Magnificent Seven of mega-cap tech stocks that have dominated returns in the S&P 500 for several years, and look instead for the diamonds that lay somewhere in the smaller-cap Russell 2000, says Van der Welle, strategist with Robeco Sustainable Multi-Asset Solutions.

“The imperfect predictive powers of the stock market with regard to economic downturns tend to generate more false positives than false negatives,” he says. “Nobel laureate Paul Samuelson quipped in 1966 that ‘Wall Street indices predicted nine out of the last five recessions’. Risk aversion still rules the cycle.”

“Yet, could the market this time err on the side of negligence? While soft landings for the global economy are the exception rather than the rule, the latest Bank of America Merril Lynch survey shows 75% of asset managers expects a soft landing to materialize in 2024.”

“Stock markets have embraced this soft landing narrative, and all the more so in November after the October (core) US inflation numbers seemingly confirmed the Fed is on the path to achieve its 2% inflation target without tanking the economy.”

This optimism has been reflected by a stock market rally in 2023, though much has been led by the bullish sentiment embodied by the large-cap tech stocks, rather than the smaller-cap companies that may be giving a better reading of the underlying economy.

“The S&P 500 index is up 21% for the year, and short-term momentum is exceptionally strong,” Van der Welle says. “The typical equity market sell-off in the three to six months prior to the onset of a recession is nowhere to be seen.”

“Still, while the broad equity indices are all trending up in the year to date, the relative performance of small versus large caps reveals significant bearish undertones. This suggests that parts of the equity market may have already been anticipating an economic downturn after all.”

“In contrast to large caps, we think that small caps – more specifically the Russell 2000 – have by and large already discounted the mild recession that we in the multi-asset team do anticipate in 2024.”

“Sure, not all of its constituents are exactly diamonds, since around 40% of Russell 2000 companies are loss-making. Investors willing to weed through the rough could pick up some gems nonetheless.”

Peak-to-trough performances

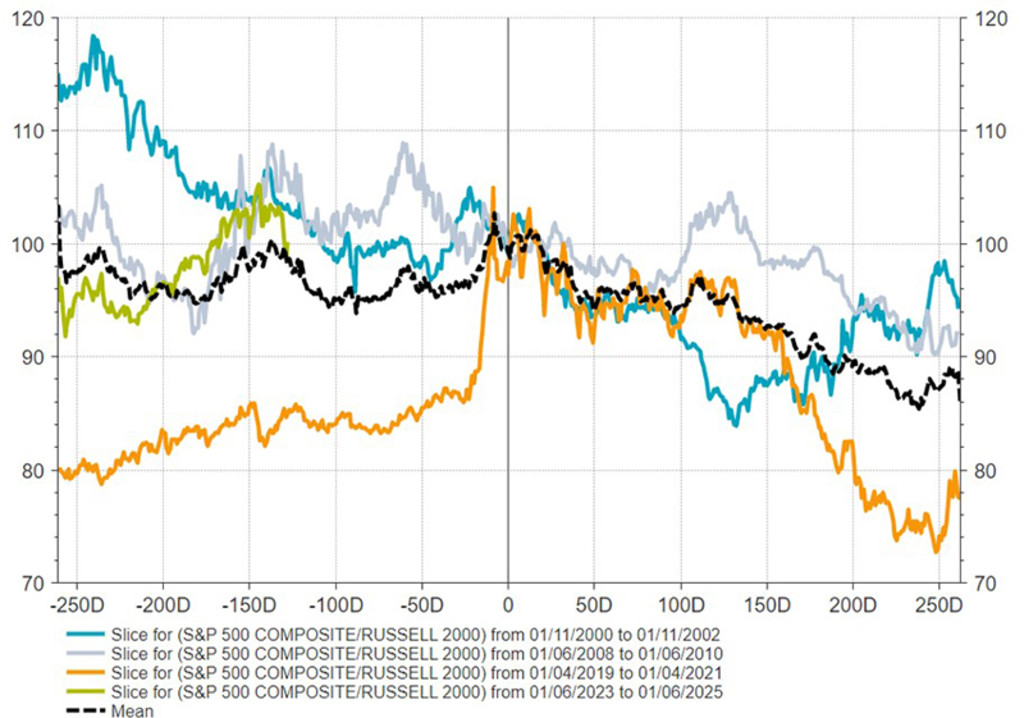

The technicals in the stock market bear this out. The historical relative performance of the Russell 2000 currently almost matches the average peak-to-trough relative performance of the S&P 500 prior to the onset of a recession as defined by the National Bureau of Economic Research (NBER).

The Russell 2000 has lagged the S&P 500 by 29% since its cyclical peak in March 2021, when the typical recessionary peak-to-trough lag is 31%. This implies that the Russell 2000 has discounted 93% of the recession risk.

“Of course, history may not rhyme, as index ratios are not a stationary time series, since fundamental shifts in the economic structure may have caused structural breaks,” Van der Welle says. “For instance, small caps could face additional downside relative to large caps in a persistent above-target central bank inflation regime, where large-cap firms with the highest pricing power continue to take it all.”

A major inflection point

Another observation is that the Russell 2000 tends to outperform the S&P 500 after the trough of an NBER recession. “If our mild recession call in 2024 proves to be correct, next year could see a major inflection point, as the Russell 2000 has seen an average outperformance of 10% in the 200 trading days following a US recession trough,” Van der Welle says.

The S&P500 versus Russell 2000 performance around NBER recession troughs. Source: LSEG Datastream, Robeco

“This is corroborated by looking at data from the four phases of the business cycle: recovery, expansion, slowdown and recession. Data since 1988 confirms that during the recession and recovery signals, the S&P 500 typically lost ground to the Russell 2000.”

“The S&P 500 lost on average 0.2% on a monthly basis against the Russell 2000 when our business cycle monitor signaled recession. Applying the same analysis to the MSCI small caps 1750 index versus the MSCI large cap 300 index yields similar results.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Not so Magnificent Seven?

So, should investors stick with the ’Magnificent Seven’ – Alphabet (Google), Amazon, Apple, Meta Platforms (Facebook), Microsoft, Nvidia and Tesla – for another year? Or look for opportunities in more unloved territory?

“We believe that small caps are well into the apathy phase of the investment sentiment cycle in the US and elsewhere,” Van der Welle says.

“Investors have flocked to the Magnificent Seven, though investors that have fundamental and active strategies will uncover some gems in small caps. While there could be additional relative downside for the Russell 2000 in the near term, we believe a mild US recession in 2024 could deliver an inflection point.”

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.