Fixing fashion’s faux pas

Fashion is a powerful force in society and the global economy. But the industry faces serious social and environmental challenges. Through focused investments and tailored engagement, Robeco’s Fashion Engagement Equities Strategy (“the Strategy”) aims to drive sustainability in fashion while capturing its growth potential.

Summary

- Fashion is fundamental for society and the global economy

- Fashion’s broad reach creates compelling growth opportunities across the value chain

- Engagement is key to addressing environmental and social challenges

Fashion is a source of joy and a means of self-expression and cultural identity for billions of people. But for all its positive effects, the industry is also grappling with negative impacts. Sourcing, production and processing of materials are resource-intensive and polluting. Fashion generates up to 10% of global greenhouse gas emissions.1 It also creates a lot of waste. Of the 100 billion articles of clothing produced each year, 20% go unsold2 and less than 1% are recycled for new garments.3

Social risks also abound. Manufacturing is concentrated in regions where wages are unfair, labor rights are inequitable or non-existent, and working conditions unsafe. On average, factory workers receive just 55% of the pay needed to maintain a decent standard of living.4

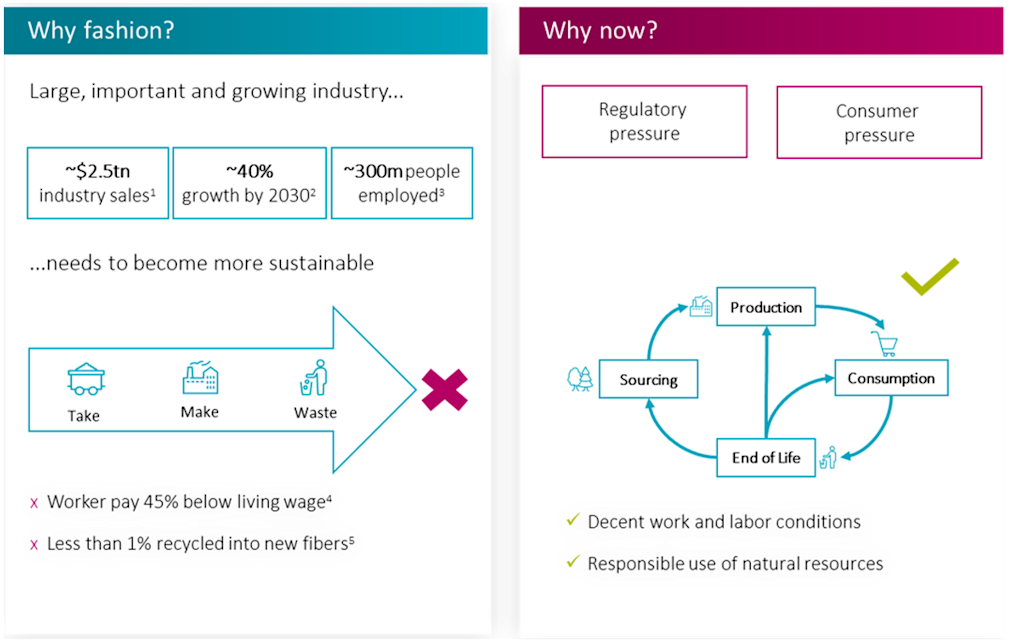

Fashion is already a USD 2.5 trillion industry.5 Increasing population growth and disposable incomes globally ensure robust demand for decades to come and intensify an already urgent need for the industry to become more sustainable. The Strategy aims to help reshape the face of fashion from its wasteful take-make-waste production model toward a circular one that is fair to workers and the environment.

Figure 1 – The Strategy aims to re-fashion production toward circular models

Source: Robeco, 2022. Euromonitor, Tecnon Orbichem, UN Fashion Alliance, The Industry We Want, Ellen MacArthur Foundation

Investment opportunities across the fashion value chain

The Strategy invests in and engages with publicly listed companies across the entire fashion value chain and product life cycle. This provides a rich and multi-layered universe that stretches from the fiber makers, fabric treaters and textile manufacturers that create woven fabrics and finished goods from raw materials, as well as (e-)retailers that market them to end consumers. And textiles are not the only target. Accessories and cosmetics serve to accentuate our apparel and appeal, so in addition to clothing, the Strategy also invests in footwear, jewelry, watches, eyewear, make-up and perfumes.

Technology companies are also in the investment mix. Design software and factory automation tools promise to make production less costly and more resource-efficient. Meanwhile, ‘smart’ chip-bearing tags and digital marketplaces are enabling the shift to circular business models that allow goods to be rented, resold, traced, certified and recycled.

Problems in the supply chain

Just as fashion’s sprawling reach offers a vast array of investment opportunities, it also presents a wide variety of sustainability challenges at each stage of the supply chain.

Sourcing raw materials

The extraction and processing of raw materials – particularly textile fibers – are among the most energy intensive processes in textile manufacturing. The industry’s reliance on synthetic, nature- and animal-based materials (e.g., polyester, cotton, natural fibers, cellulose, silk, leather, cashmere, etc.), and the use of water- and chemical-heavy processes at almost all stages of their supply chains, have a direct impact on society and on environmental ecosystems. Key concerns are workers’ health, land-use change, soil degradation, freshwater availability and chemical pollution, as well as waste production.

Manufacturing and production

In this stage fibers and other base materials are converted into finished goods. Natural fibers or synthetic polymers are spun into yarns and threads and may also be bonded, bleached and dyed using chemicals to create unique fabric colors, textures or functional attributes such as stretch and breathability. Conversion processes are often heat-, water-, and chemical-intensive while also generating air and water pollution. Fabrics are then cut, sewn and assembled by factory workers across the Global South, who, like their agricultural counterparts, often suffer socialinjustice, including child labor and poor work conditions.

Distribution and consumption

The consumption stage includes both the logistics of transporting products to physical stores and warehouses as well as what happens after items are bought, as many of the negative impacts occur post-purchase. Laundering over a garment’s lifetime consumes electricity and water. It also contaminates oceans, waterways, marine life and ultimately the food chain with microplastics shed from popular synthetic fibers such as polyester, nylon and acrylic.

End-of-life management

The vast majority of fashion items end up incinerated or landfilled, with only a small fraction downcycled into other materials (e.g., insulation or stuffing) and an even smaller portion (<1%) recycled back into clothing. What’s left is exported in the millions of tonnes to countries ill-equipped to manage it.

Driving change across the value chain

Sourcing

Opportunities:

Textiles: cotton, polyester, linen, viscose

Animal-derived: leather, silk, wool, down

Jewelry: gold, silver, platinum

Cosmetics: colors, fragrances

Engagement topic examples:

Unsafe working conditions, deforestation risks, high use of agrochemicals

Production

Opportunities:

Design software and visualization tools

Textile manufacturing equipment

Robotics, automation, 3D printing

Global logistics and distribution

Engagement topic examples:

Payment of living wages, phasing out of fossil fuels in production, wastewater and chemical management

Consumption

Opportunities:

Mass market, fast fashion, luxury brands

Online and offline retailers

Cleaning, washing, repairing products

Rental platforms

Engagement topic examples:

Responsible marketing practices, product labeling, repair services

End-of-life management

Opportunities:

Resale platforms and infrastructure

Recycling infrastructure players

Repurposing of landfill and incineration facilities

Engagement topic examples:

Non-destruction policy for unsold goods, scale circular services

Driving sustainable solutions

The Strategy invests in fashion companies that show potential in deploying sustainable practices in their operations and across their supply chains. It also invests in fashion’s ‘sustainability enablers’ – such as companies creating tracing tags to track and certify source inputs and finished products, recycling infrastructure to reduce and reuse waste, as well as next-generation materials that are naturally sourced or biodegradable.

Engagement and active ownership are equally critical components to the investment strategy. Engagements are designed to drive measurable improvements in companies’ sustainability performance over a three to five year period and focus on key ESG issues confronting all phases of fashion’s value chain (see Figure 2). They are carefully constructed by Robeco’s dedicated fashion engagement specialists based on rigorous analysis of a company’s sustainability profile, value chain position and progress potential. We also partner with key stakeholders from fashion and finance to help amplify impact and drive systemic change in the real economy.

Figure 2 – Key areas of engagement

Conclusion

Fashion is a formidable commercial and cultural force in modern society, whose power and influence are set to increase as discretionary incomes and living standards rise. But behind fashion’s glitz and glamor lie serious sustainability challenges in need of re-dress. Modern fashion needs a makeover, but the good news is that solutions are available and gaining traction.

Our strategy invests in companies that are future-proofing their business models by adopting sustainable practices and circular business models which are fair to workers and the environment.

Investing towards a sustainable fashion future

Our Fashion Engagement Equity strategy allows investors to capitalize on long-term growth opportunities in fashion and help drive its sustainability transition.

Footnotes

1 UN

2 Ellen MacArthur Foundation

3 Ibid.

4 The Business of Fashion, 2022. The Industry We Want Report, 2022

5 Euromonitor, Total sales revenue (USD), 2022

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.