Factor investing debates: Could factor premiums disappear?

With the increasing adoption of factor investing, one frequently heard criticism is that factor premiums may end up being arbitraged away. The underperformance of some key factors seen in recent years and evidence of mounting crowding issues also fuel these concerns.

Summary

- Unremarkable recent factor performance raises questions

- Little evidence of factor fading has been found so far

- Disentangling the rationale behind each factor is key

The anomalies that factor investing rests upon may disappear as money pours into the strategies designed to benefit from them. Or so the reasoning goes. For instance, if a growing number of investors start to realize that low-risk stocks tend to beat riskier ones over the long run, they may channel their investments towards these stocks, thereby reducing their return potential and lifting valuations.

Some research papers have indeed suggested that anomalies tend to become smaller once they have been published in academic journals.1 Over time, this could even mean the end of some well-known factor premiums. Meanwhile, the unremarkable performance of some factors, in particular value (see Box 1), over the past few years has also stirred considerable doubt among both academic researchers and investors.

Is size dead? Is value dead? We have seen these questions popping up with increased frequency in recent months, not just in financial media articles or in client notes put out by brokers and asset managers, but also in research papers published in peer-reviewed scientific journals.2 And although no factor death has been definitively declared so far, concerns over a potential demise of factors remain.

So, will factors inexorably end up being arbitraged away? Not so fast. Firstly, while some studies do suggest that anomalies tend to diminish once published in academic journals, others challenge this conclusion.3 And while some research papers indicate that factor premiums prove very persistent over time,4 others argue that some anomalies might just be becoming larger and larger.5

Secondly, while there may be anecdotal signs of overcrowding for some factor strategies, empirical evidence of widespread crowding of well-known factors, such as value, momentum, low risk or quality, remains conspicuously absent. Some research papers even suggest these fears are clearly exaggerated.6

Factors premiums vary over time

Thirdly, factors premiums vary over time. This explains why, while largely unexpected, value’s recent bad streak did not really come as a surprise for most experts. Long periods of poor performance have already taken place in a not-so-distant past. Value investing in US stocks notoriously failed for most of the 1930s, but in fact also failed to work for a significant part of the 1990s.7

Similar periods of lagging performance can also be identified for other well-known factors, such as low risk and momentum. For instance, while low volatility stocks have proved to outperform their high volatility counterparts in the long run, a closer analysis decade by decade also shows that US high volatility stocks outperformed low volatility stocks in the 1940s, 1950s and the 1990s.8

Ultimately, whether one should expect factor premiums to persist has to do with the economic rationale behind each anomaly. The existence of factors is generally attributed to either risk-based or behavioral explanations. Put differently, factor premiums are considered either as a compensation for risk or as the result of a mispricing due to irrational behavior of investors.

Were factor premiums a rational compensation for additional risk, they should not disappear. Investors who have until now been unwilling to take the risk that is supposed to give rise to the premium should indeed continue to rationally avoid the riskier securities, despite their higher expected returns. In doing so, this should keep prices down and the premium alive.

On the contrary, were factor premiums the result of irrational systematic mistakes made by the investment community as whole, some decrease would seem logical. In that case, at least some investors should be able to adjust their behavior and benefit from these irrational mistakes. This would push prices up and bring expected returns down.

A third explanation, however, has to do with rational behavior, due to so-called ‘limits to arbitrage’. Most investors are subject to strict investment constraints, for example, in terms of leverage, short selling or potential deviation relative to a benchmark. These limitations explain why mispricings exist, why most investors are not be able to benefit from them, and why the premiums would persist.

The debate over which explanation prevails still rages on

The debate over which explanation prevails still rages on. While advocates of the efficient markets theory can only envision the risk-based explanation, supporters of the behavioral cause are more inclined to consider mispricing. Meanwhile, a growing body of research points to some rational investor behavior as the source of most well-accepted factor premiums.9

A definitive answer to this question will probably not emerge any time soon and the debate over which explanations ought to prevail is likely to continue in the short term. However, as explained above, there are many viable and convincing candidate theories for their existence. The truth behind the source of these premiums probably contains a combination of elements of each explanation.

What should investors do about this? (the Robeco view)

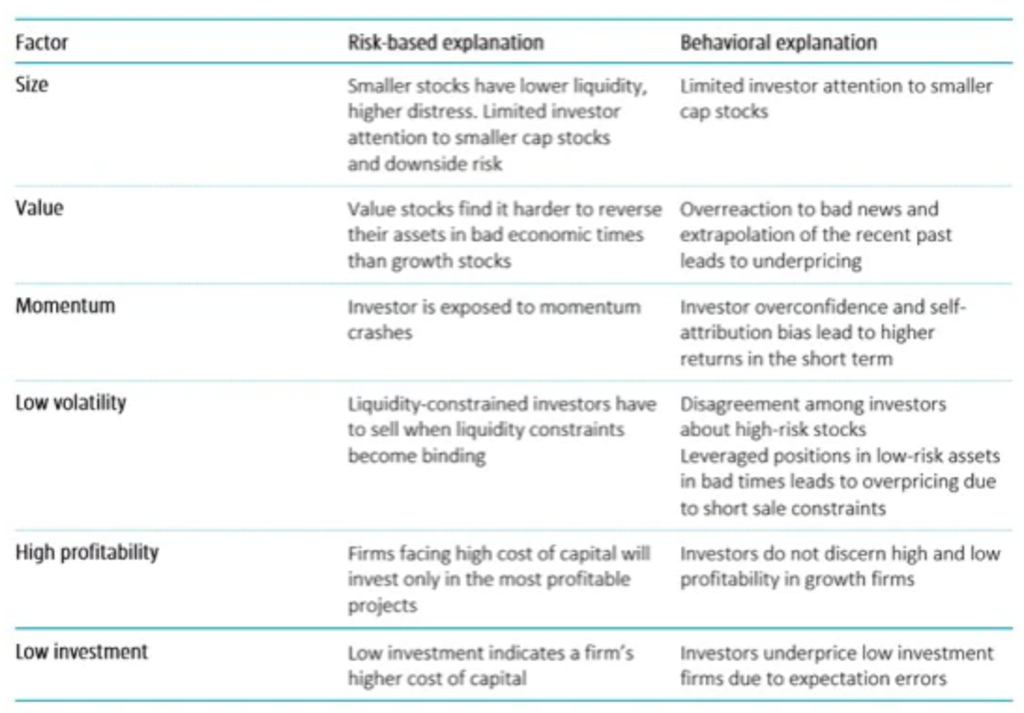

From a practical perspective, we think investors should stick to factors that have been well researched and documented and for which robust economic rationale - be it risk-based or behavioral – has been put forward to justify their persistence over time. The table below summarizes some of the most common explanations for six well-known equity factors.10

Table 1 | Six common equity factors explained

Source: ERI ScientificBeta, ‘Adding Value with factor indices: sound design choices and explicit risk-control options matter’, white paper, April 2019.

These theories suggest factor premiums should persist, even if investors are widely aware of them. Some investors will not exploit the premium even if they are convinced of its existence, simply because they are not willing to take the associated risks, or because they are prevented from going against biased behavior because of institutional constraints. In the meantime, potential crowding issues may surface. But that’s a different story and we’ll look into it in the next article of this series.

More stories - Factor investing debates:

Do big data and AI herald a new dawn for quant?

Should you time your factor exposures?

Footnotes

1 See for example: Schwert, G.W., 2002, “Anomalies and market efficiency”, NBER Working Paper No. 9277. See also: Mclean, R.D., Pontiff, J., 2016, “Does academic research destroy stock return predictability?”, The Journal of Finance.

2 See for example: Taylor, D., Bond, G., Lin, C. and Wang, S., “Is value dead (again)?”, Man Numeric note, Man Institute, September 2018.

3 See for example: Jacobs, H. and Müller, S., 2019, “Anomalies across the globe: once public, no longer existent?” Journal of Financial Economics, forthcoming.

4 See for example: Baltussen, G., Swinkels, L., Van Vliet, P., 2019, “Global Factor Premiums”, working paper.

5 See for example: Blitz, D., Pang, J. and Van Vliet, P., 2013, ”The volatility effect in emerging markets”, Emerging Markets Review.

6 See for example: Blitz, D., 2018, “Are hedge funds on the other side of the low-volatility trade?”, The Journal of Alternative Investments.

7 For more details, see our recently published article: ‘Uncovering the promises and challenges of factor investing’.

8 For more details see: Van Vliet, P., 2012, “Low-volatility investing: a long-term perspective”, Robeco Research Paper.

9 See for example: Baker, M., Bradley, B. and Wurgler, J., 2011, “Benchmarks as Limits to Arbitrage: Understanding the Low-Volatility Anomaly”, Financial Analyst Journal. See also: Li, X. and Sullivan, R. N., 2011, “The limits to arbitrage revisited: The accrual and asset growth anomalies” Financial Analyst Journal.

10 The list of factors each asset manager or index provider considers relevant can vary slightly depending on their own research and convictions. For instance, Robeco’s quantitative equity strategies exploit four factors: value, momentum, quality and low volatility.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Box 1: Demystifying Value’s recent poor performance

Value is one of the most vastly documented factors and value investing is among the most popular factor-based approaches. Yet recent poor performance raises questions over its persistence. Has this factor been arbitraged away? Or has the economy changed so drastically that the value factor has become irrelevant?

Certainly, the rise in popularity of value investing and the rising amount of money managed following this kind of approach, as well as a changing economic context, have had an effect on performance. But it is unlikely that value will become obsolete. For one, the most frequently raised explanations for the existence of value, be they risk-based or behavioral, still hold.

A second aspect is that factor performance, like the equity premium itself, tends to be erratic over time, with periods of underperformance that can last several years. Value is no exception. There are periods when growth firms are able to meet the high expectations that are priced in by investors. This has been the case in recent years, in particular for large US tech companies.

However, such periods of growth outperformance remain the exception, not the rule. Most of the time, highly priced growth stocks end up disappointing investors and underperforming their value counterparts. In fact, if growth did not have occasional upswings, everyone would be a value investor and there would be no value premium.

Finally, while the current rougher patch may be the longest in almost a century, it is by no means the most severe one. Value stocks started lagging in May 2010. This is already twice as long as the second longest period of underperformance on record, which took place between 1937 and 1940. But there have been periods when the cumulated underperformance was more dramatic, including the 1932-1935 period and the Tech Bubble of the 1990s.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.