Factor investing debates: Do big data and AI herald a new dawn for quant?

Factor investing is based on decades of publicly available empirical studies. To stand out from competition, asset managers invest significant resources in carrying out proprietary research, in an effort to enhance factor definitions or to optimize portfolio construction, for example. In this context, new tools such as alternative data and artificial intelligence (AI) are seen by some as a game changer. But is that really the case?

Summary

- Growing body of academic literature shows novel techniques are useful

- Caveat: these innovative tools should be considered with a dose of caution

- Basic principles – evidence-based, economic rationale and prudence – still apply

New tools such as big and alternative data, AI,1 and cloud computing have emerged as major developments for the financial industry. A 2019 survey by the Bank of England and the UK’s Financial Conduct Authority found, for instance, that two-thirds of all British financial firms were already using machine learning.2 Many of these parties expected the number of areas in which they use it to more than double in the next three years.

In asset management, although many players have publicly embraced these innovations and been beating their chests about it, practical applications have so far remained focused on areas such as process automation, and sales and marketing. Other domains, in particular investments, still stand to benefit more broadly from this kind of innovation.

According to a 2019 survey by the CFA Institute among global investment professionals,3 only 10% of the portfolio managers who responded had used AI or machine learning4 (ML) techniques to improve their investment process in the previous 12 months. In contrast, almost half of them indicated that they had used regression analysis to find a linear relationship.

But while most of these techniques are still in their infancy, a growing number of players – primarily but not exclusively hedge funds – have taken important steps to investigate how they can be used in an effort to design better quantitative investment strategies, heralding what some experts have called “the next wave of quant investing”.

At Robeco, for instance, we have invested significant resources over the past few years, leading to concrete advances in the integration of these innovative technologies into our investment processes. A case in point is the ‘news sentiment signal’ derived from advanced event-based text analytics, which is now used to enhance the momentum factor in our quantitative equity strategies.5

Other uses of AI and alternative and big data reported by asset managers and other investment service providers include the analysis of earnings conference calls, equity trading volumes predictions, and the use of publicly available geospatial data to estimate local market share in the aggregates industry – the mining of sand, gravel and crushed rock for the production of concrete.6

This leaves investors with a burning question, though. Should these tools be seen as a mere extension of traditional quant investment approaches, which are primarily based on decades of empirical research on factors, using signals such as accounting information, financial analyst estimates and past prices from equity, fixed income, options or lending markets? Or do they mean the drivers behind most of the existing quantitative strategies are at risk of becoming obsolete?

Innovation enthusiasts obviously argue that the latter is true.7 One common explanation is that, in a world where most active quantitative managers have access to the same data, such as stock prices or macroeconomic fundamentals, and apply the same methods, including classic linear regression analysis and mean-variance optimizations, such techniques have become the only way to stand out from both market indices and direct competitors.

At the other end of the spectrum, skeptics argue that while these innovations may be able to add marginal improvements to existing investment strategies, they should be viewed with a fair amount of caution8 and do not fundamentally call into question more traditional and transparent quantitative investment approaches.

These skeptics frequently contend that while a solid investment strategy requires extensive empirical testing and falsification on broad data samples and over long periods of time, the evidence for big and alternative data remains largely anecdotal. Alternative datasets generally have a very short history and often lack the necessary breadth and quality to draw strong conclusions.9 Sometimes, it is even questionable whether the data provider will still exist in five or ten years’ time.

Another common criticism is the lack of interpretability or ‘auditability’ of AI algorithms and machine learning models.10 As a result, investment strategies based mainly on these techniques often also lack the necessary foundation of a clear economic rationale that’s normally required of more traditional quantitative approaches.

This divide illustrates the struggle asset managers face in order to maintain their edge over time: stick to time-tested methods and eventually risk becoming obsolete, or embrace change and risk a major misstep into ill-fated innovation. This dilemma is exacerbated by the recent disappointing performance of several broadly accepted factors, in particular value.

The current drawdown has brought established quantitative managers under severe scrutiny, with many investors wondering whether factor investing might need a complete overhaul. In the meantime, however, the live investment results achieved by most hardcore AI and alternative data advocates remain largely unimpressive.11

This leaves investors with no obvious robust alternative to more traditional factors, for now at least. Things could of course change, as alternative datasets available to investors will inevitably improve over time and AI algorithms could become reliable enough to deliver on their goal of long-term outperformance on a standalone basis.

In the past, the issues surrounding the datasets that are now widely used by quantitative asset managers were similar to those surrounding big and alternative data today. Over the years the quality, breadth and history of these datasets have improved, and they have become usable. With the passage of time, and as more data becomes available, big and alternative data will likely also become increasingly usable.

At the same time, a growing body of academic literature confirms that AI techniques can be helpful tools to improve investment strategies.12 So, while machines will probably never fully replace humans, they can – under human supervision – help detect and explain new patterns. Machines can also make research production much more scalable.

What investors should do about it

Ultimately, investors should remain open-minded about new ideas. The fundamental issue for them may not necessarily be about choosing between one approach or the other. There is a wide array of possibilities, from sticking to traditional price and financial statement information at one extreme, to relying solely on information sources such as satellite imagery of parking lots and deep learning algorithms.

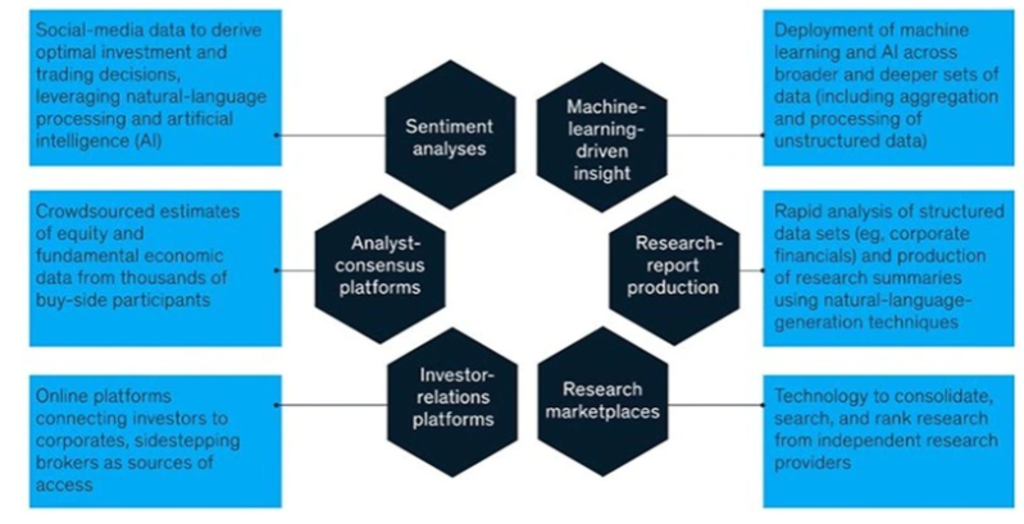

The answer could well be in using a blend of information resources. For example, big data and AI signals could be very useful to fundamental credit and equity analysts. This would feed through into our quantitative strategies that take analyst revisions into account. In this case, we would be using big data and AI information in an indirect manner. Figure 1 provides an overview of how leading asset managers use such advanced analytics.

Figure 1: New sources of investment research for asset managers

Source: Doshi, S., Kwek, J.-H. and Lai, J., 20 March 2019, “Advanced analytics in asset management: Beyond the buzz”, McKinsey & Company article.

That said, it is important to remember that while innovation can help, it should be applied carefully and sensibly. Basic principles – such as ensuring that investment decisions are evidence based, prudent and with a clear economic rationale – should always apply, even when considering avant-garde techniques like alternative data or AI.

Factor investing debates: More stories

Discover the value of quant

Subscribe for cutting-edge quant strategies and insights.

Footnotes

1AI can be defined as the use of computational tools to perform tasks that traditionally required human thinking. As a scientific field of research, AI is far from new. The term was coined in the mid-1950s by computer scientist John McCarthy, then assistant professor at Dartmouth College. However, recent improvements in computational power and the dramatic surge in the amount of data available in the digital age have significantly increased the scope of potential applications for these technologies.

2Jung, C., Mueller, H., Pedemonte, S., Plances, S. and Thew, O., October 2019, “Machine learning in UK financial services”, Bank of England and Financial Conduct Authority report.

3Cao, L., 2019, “AI pioneers in investment management”, CFA Institute report.

4Machine learning refers to the use of computer algorithms that improve their predictions automatically through experience. It can therefore be considered a subsegment of artificial intelligence.

5Marchesini, T. and Swinkels, L., July 2019, “Integrating news sentiment in quant equity strategies”, Robeco client note.

6The CFA Institute report mentioned in footnote 3 provides an interesting overview of pioneering, concrete applications.

7See for instance: Calvello, A., 15 January 2020, “Fund managers must embrace AI disruption”, Financial Times. See also: Rajan, A., 27 January 2020, “AI will rewrite the future of fund management”, Financial Times.

8Kirk, E., 3 March 2020, “Don’t believe the hype about AI and fund management”, Financial Times.

9See for example: Arnott, R., Harvey, C. R. and Markowitz, H., 2019, “Backtesting protocol in the era of machine learning”, The Journal of Financial Data Science.

10FSB 2017. Artificial intelligence and machine learning in financial services – Market developments and financial stability implications.

11See: Fletcher, L., 7 September 2020, “AI hedge fund Voleon suffers in choppy markets”, Financial Times.

12Simonian, J., Lopez de Prado, M., Fabozzi and F. J., 2018, “Order from chaos: How data science Is revolutionizing investment practice”, Invited editorial comment, The Journal of Portfolio Management. See also: Snow, D., 2020, “Machine learning in asset management – Part 1: Portfolio construction – Trading strategies”, The Journal of Financial Data Science. See also: Snow, D., 2020, “Machine learning in asset management—Part 2: Portfolio construction—Weight optimization”, The Journal of Financial Data Science.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.