Climate leaders outperform the laggards as solutions firms struggle

Mixed fortunes among companies combating climate change make a diversified approach essential, says portfolio manager Chris Berkouwer.

Summary

- Climate Investing Survey shows investors see higher returns in solutions

- Robeco equity research suggests that transition companies perform better

- Identifying the real leaders and laggards is crucial for portfolio construction

His team’s research shows that companies that are leading the climate transition with strong commitments to decarbonization are outperforming the laggards, while existing climate mitigation solution firms such as renewable energy have struggled in recent years. 1

Meanwhile, the 2025 Robeco Global Climate Investing Survey shows that investors still see higher returns in solutions than in the transition, requiring a diversified approach to capture all eventualities, says Berkouwer, Portfolio Manager of Robeco Global Climate Transition Equities.

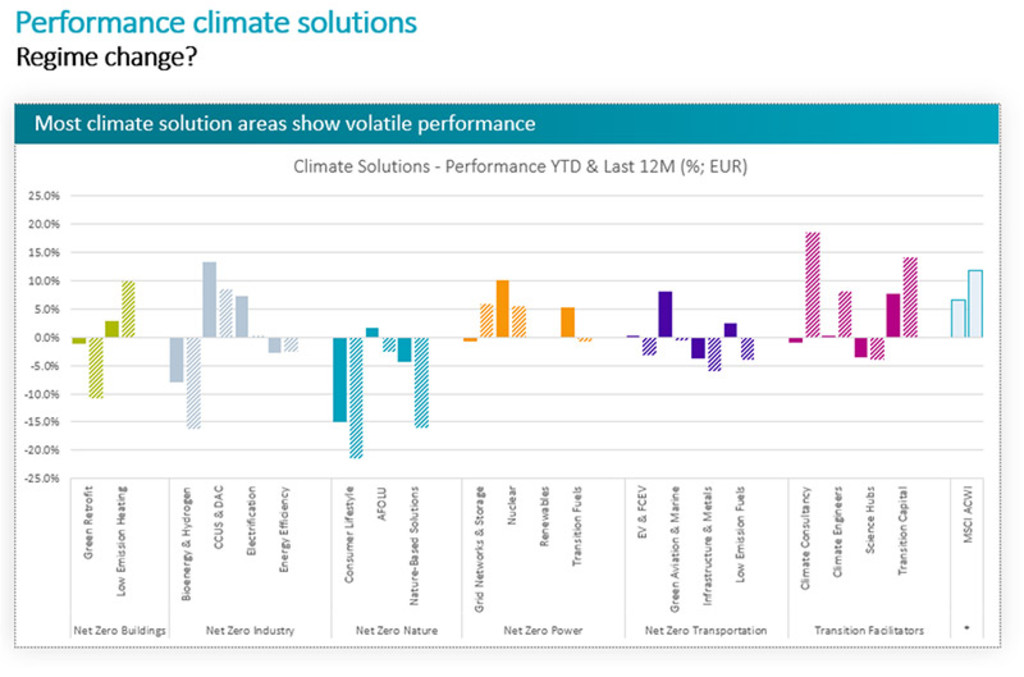

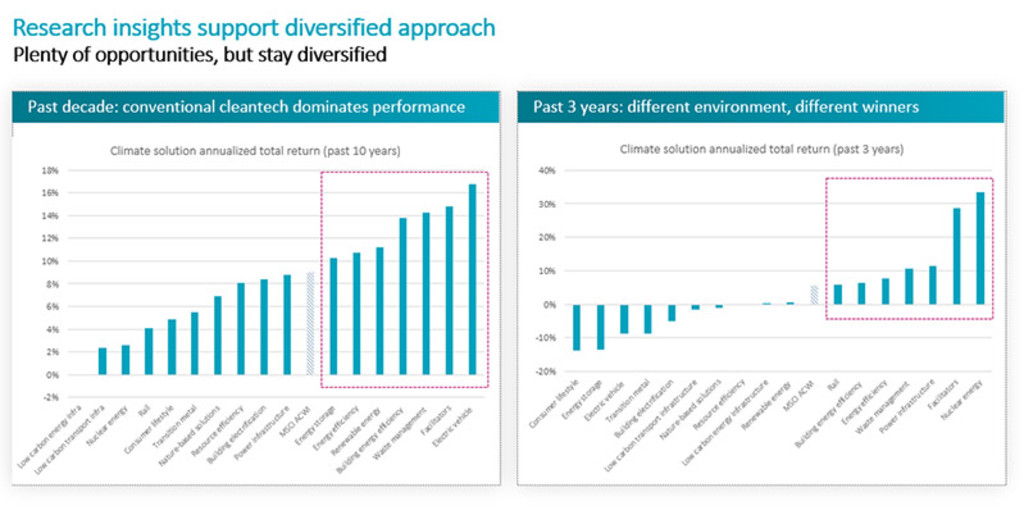

Solution providers are those already at the forefront of mitigating climate change, such as wind power suppliers and electric vehicle makers. Their performance has been strong over the past decade, though returns have slumped in the past three years and in the year-to-date, as many face pressure on business models due to interest rate changes, subsidies being removed, or other macroeconomic factors.

This pressure has led to companies engaged in sectors such as net-zero buildings, bioenergy and hydrogen, and consumer lifestyles underperforming, while sectors such as net-zero power and climate consultancy have enjoyed strong returns. This is shown in the charts below:

Past results are no guarantee of future performance. The value of your investments may fluctuate. All data to 30 June 2025. Source: Robeco, June 2025.

Past results are no guarantee of future performance. The value of your investments may fluctuate. All data to 30 June 2025. Source: Robeco, June 2025.

Transition leaders are those leading decarbonization efforts in an ongoing effort to achieve net-zero emissions. The key difference is that those leading the transition may be currently high emitters that are working toward net zero, but are not there yet. Some investors feel that ‘work-in-progress’ companies therefore offer greater opportunities than solution providers, but there are conflicting perceptions about which has the better potential.

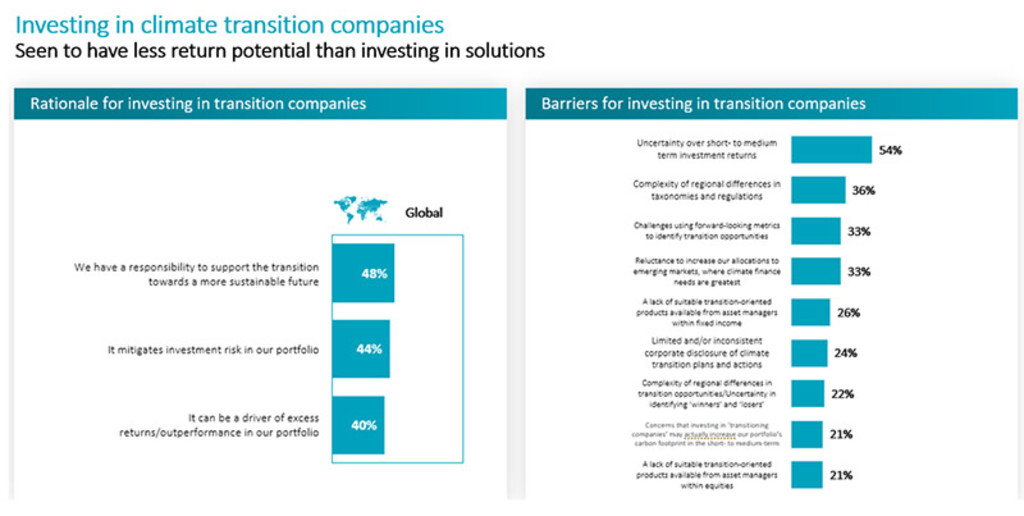

In the climate survey, investors clearly preferred the potential returns offered by solutions to those engaged in transition. Some 77% of global investors saw strong investment return potential for climate solutions, compared to 40% who thought that transition companies can be a driver for excess returns, or ‘alpha’. Some 63% aimed to invest in solutions through a quantifiable target or a general commitment.

But there was less enthusiasm for transition, where barriers to investing were led by uncertainty over short- to medium-term investment returns, cited by over half of survey respondents (54%). This was followed by a complexity of regional differences in taxonomies and regulations (36%) and challenges to forward-looking metrics to identify transitional companies (33%). There was also a reluctance to allocate to emerging markets (33%) where the transition is more profound. This is shown in the chart below:

Global Climate Transition Equities D EUR

- performance ytd (31-1)

- 1.25%

- Performance 3y (31-1)

- 13.39%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

“We can relate to the survey outcomes concerning the upside potential from climate solution providers,” says Berkouwer. “Valuation levels have cleansed by now, meaning little optimism is priced in at this stage. In fact, many solutions buckets are trading below pre-stimulus levels.”

“Hence, we simply need a little spark before the rerating can begin. That spark can be clarity from a policy perspective, interest rates ticking lower, or elevated oil prices. We know the transition happens in a stop-and-go pattern; today’s trading is not unusual in that sense. For rainbows we also need rain, and it has rained a lot lately, but our weather forecast points at more sunshine ahead!”

“One caveat, though, is that our research points at very volatile performances across the various buckets, cementing our view that we need to stay well-diversified across all solution categories. From a portfolio point of view, we always need to be pragmatic where we wanted to invest in depending on the different macro and rate backdrops, as not all business models have the same level of resilience.”

“Moreover, our analysis also indicates solution providers need to be mixed in with transition leaders as to have the best risk-return trade-off for the portfolio.”

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

Transition leaders and laggards

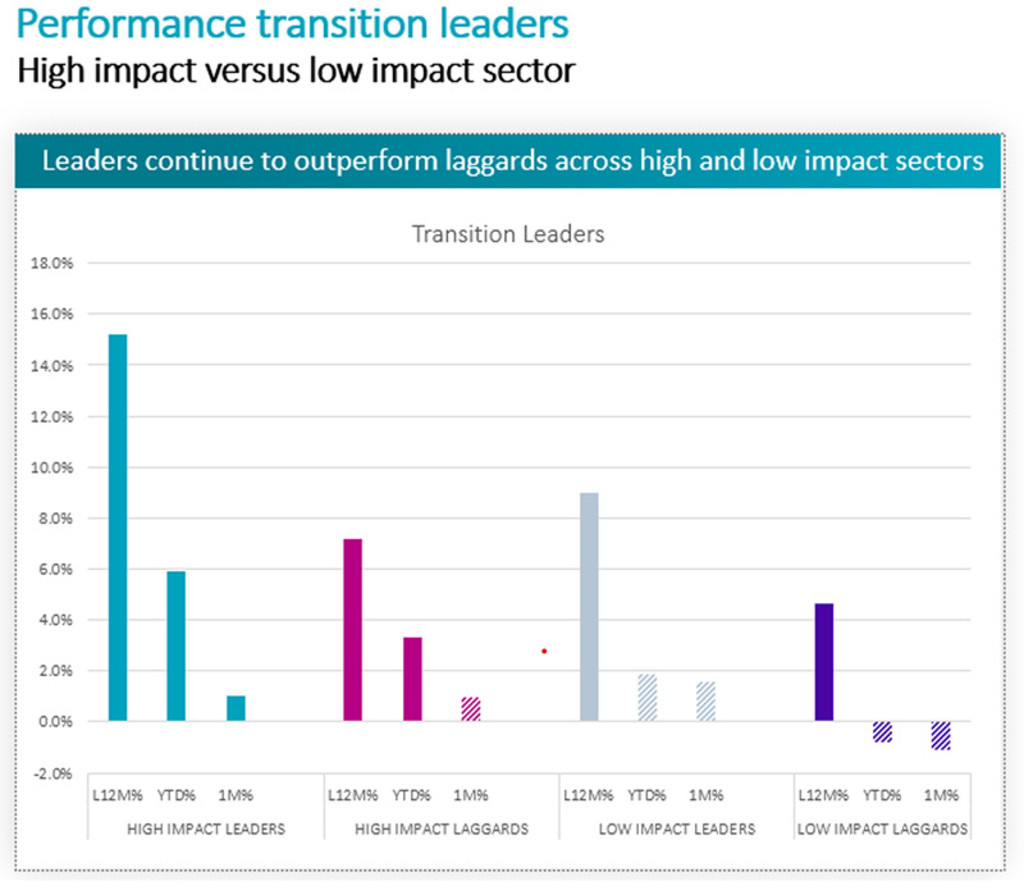

Research by the Robeco Global Climate Transition Equity team also highlights the potential future returns of transitional companies. Their work was highlighted in our June 2024 white paper, ‘Transition investing: Exploring alpha potential’, with performance figures updated in June 2025, which shows that the leaders are outperforming the laggards.

The team use Robeco’s proprietary Climate Analytics toolbox and Climate Traffic Light to identify transition leaders, which might include a cement company that backs up its net-zero target with a credible decarbonization investment plan that brings it on a pathway that is in-line or better than its sector would dictate. A laggard might be an industrial machinery company that fails to devise any plans to redirect capital flows toward what’s needed to become aligned with the Paris Agreement over time.

Over 80% of companies in the energy, materials, real estate and utility sectors are categorized as high impact. Since a large number of them are not yet aligned with the Paris goals, investing in them allows portfolio managers to capture the upside from their improved resource efficiency and reduced environmental footprints.

Outperformance by high-impact leaders

The white paper found that the high impact leaders had enjoyed double-digit returns over the past 12 months, compared to under 4% for the high-impact laggards. Similarly, the low-impact leaders had risen by above 4% over the same time, above the 2.5% achieved by the low-impact laggards.

And while climate transition leaders continue to outperform, the research shows that solutions providers have been struggling. As the chart below illustrates, in the year to June 2025 and the past 12 months to the end of June 2025, virtually all types of climate solution have seen negative returns.

Past results are no guarantee of future performance. The value of your investments may fluctuate. All data to 30 June 2025. Source: Robeco, June 2025.

The future economy

“Our research and this year’s climate survey confirm once again that the climate transition is non-linear and uneven, with many twists and turns on what is a long road,” says Lucian Peppelenbos, Climate and Biodiversity Strategist at Robeco.

“Still, net zero is the future economy, not the economy of the past. That means an active management approach using forward-looking metrics is well positioned to capture the alpha that can be targeted in the transition to the net-zero economy.”

“We strongly believe that using the right tools, in the right way, with the right sense of purpose can actively find the returns that clients seek in their portfolios, while also contributing to combating global warming.”

Footnote

1 Performance figures quoted as for illustrative purposes only. The value of your investments may fluctuate. Past results are no guarantee of future performance. All data to 30 June 2025.