Japan's Green Transformation Plan to boost smart energy investments

Japan’s Green Transformation (GX) Plan is a bold new strategy aimed at transitioning the world’s fourth largest economy away from fossil fuels and toward cleaner energy sources. Equally ambitious financing should catalyze investments across diverse smart energy solutions, from renewables and smart grids to smart cars and energy-saving equipment.

Summary

- Plan aims to both energize and decarbonize Japan’s economy

- The near 1 trillion-euro investment rivals the US IRA in size and ambition

- Substantial tailwinds expected for smart energy solutions in Asia and Japan

Japan’s momentous move was motivated by the need to decarbonize the economy to combat climate change, ensure energy security, spur green innovation and clean economic growth. Though it has made some progress in the two decades since the enactment of the Kyoto Protocol (the world’s first legally binding climate treaty), Japan still ranks fifth in global emissions and performs worse than China in emissions per capita.1

Part of the problem is a heavy reliance on fossil fuels (nearly 100% of which are imported) which the GX Plan aims to reduce through generous investments in clean technologies and negative taxes on carbon. 2

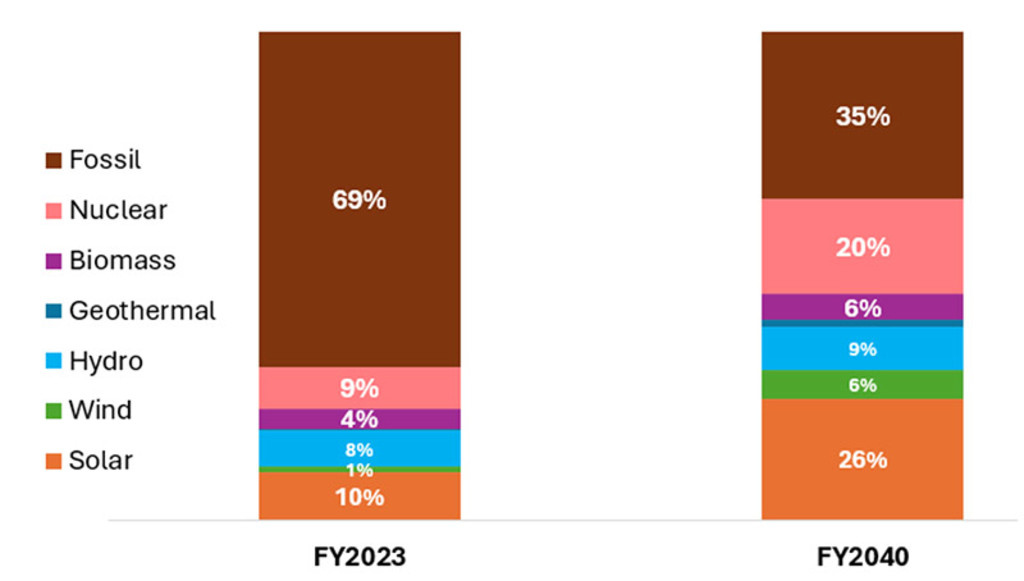

Figure 1 – Japan wants to kick its fossil fuel habit

The bulk of Japan’s energy supplies stems from fossil fuels, which are almost fully imported. Source: Energy mix from Japan’s 7th Strategic Energy Plan, Agency for Natural Resources and Energy, UBS, 2025. Climate Bonds Initiative, 2024.

To achieve its goals, nearly 1 trillion euros in investments will be raised over the next decade through public and private sources.3 The goal is to first incentivize companies to innovate their way toward a net-zero trajectory before applying penalties on laggards.

Nearly 1 trillion euros in investments will be raised over the next decade through public and private sources

Japan’s GX rivals US IRA

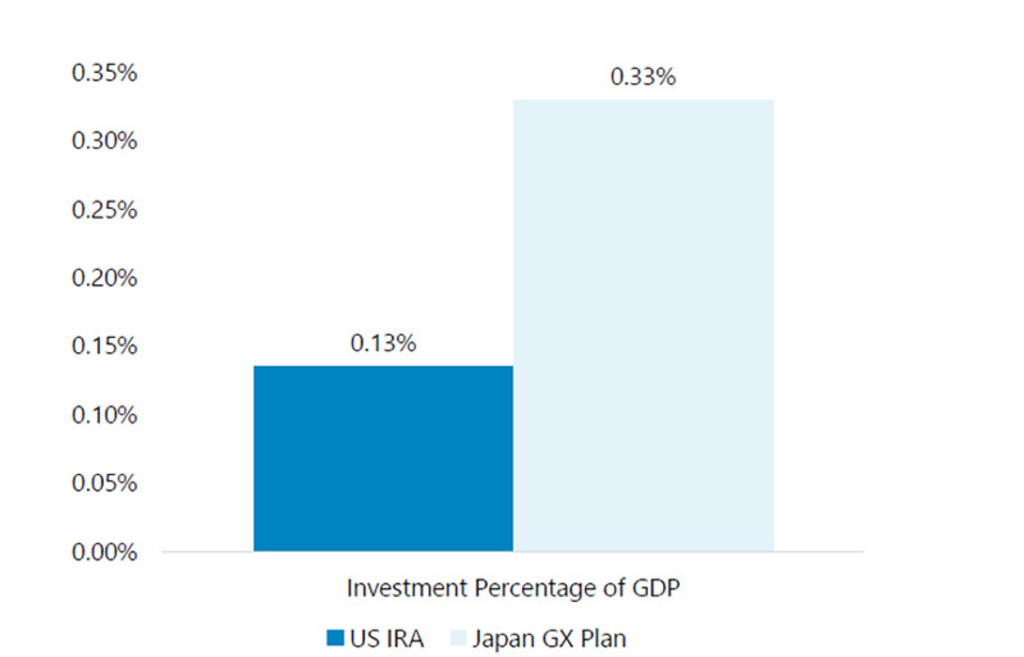

The comprehensiveness of the roadmap combined with extraordinary scale of financing – which is more than 3 times larger than the US Inflation Reduction Act (IRA) as a share of country GDP – demonstrates Japan’s credible commitment to using the net-zero transition to rev up innovation and future economic growth.

Figure 2 – Japan GX Plan vs US IRA

Japan’s annual public spending on clean energy investments is 3x larger than the US’s IRA in terms of GDP. Source: US Senate; Rhodium Group; GR Japan; Statista; Jefferies, 2024.

As with the IRA in the US, the GX plan is designed to facilitate the clean shift through substantial investments in renewable energy, electric vehicles, and improvements in energy efficiency for buildings and infrastructure. The IRA experience in the US suggests that Japan’s initiative could generate beneficial tailwinds for companies within these industries.

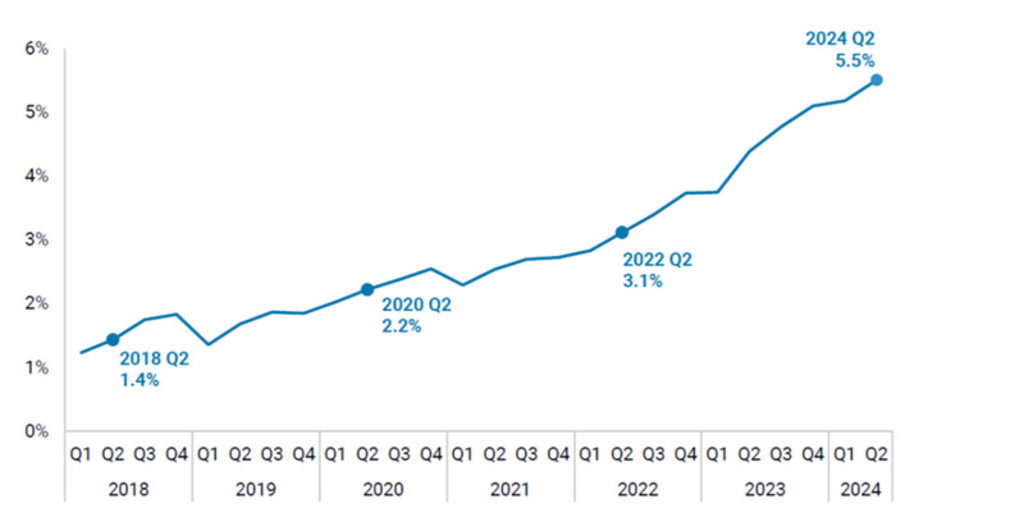

Since the IRA enactment, investments in manufacturing and deployment of clean technologies reached USD 493 billion – a 70% increase compared to pre-IRA levels.4 Investments in emissions-reducing technologies in Q2 2024 alone represented 5.5% of all US private investments (see Figure 3).5

Growth and earnings resulting from company capex into clean and emissions-reducing technologies should continue to steadily unfold as deployment and adoption increase in the years ahead.

Figure 3 – US IRA has helped push private investments into clean energy solutions

The graph shows clean investments as a share of total US private investment in structures, equipment and durable consumer goods. Source: Rhodium Group/MIT-CEEPR Clean Investment Monitor, 2024.

Japan issues world’s first ‘green govies’

A key component of the funding strategy is the issuance of EUR 131.5 billion in climate transition bonds over the next ten years.6 These transition bonds, or ‘green govies’, are meant to kickstart the investment cycle. All other financing (around EUR 855 billion) will come from a mixture of private financing, emissions pricing and a carbon levy on fossil fuel imports.

The plan is also noteworthy for its emphasis on transitioning without derailing Japan’s overall economic growth. It’s hoped that this strong initial signal combined with seed funding should help steer companies toward reducing emissions.

Proceeds from financing will be allocated to various green initiatives including decarbonizing the energy sector, supporting renewable technologies, and promoting energy efficiency in housing and buildings. Later funding will come from carbon pricing and fossil import levies which should also pressure companies to invest in decarbonizing solutions.

Leveraging its ‘league’ and leadership

Another unique twist is the creation of a ‘GX League’, a voluntary group of nearly 750 of Japan’s high-emitting companies, that will pilot the emissions pricing mechanism to work out kinks before it goes mandatory in 2026. The league could also be critical for unlocking capex toward decarbonizing strategies from key industry players across Japan’s economy.

It’s a smart move, as Japan’s lead in hydrogen fuels cells, automotive batteries, semiconductors, and electronic equipment gives it a head start in innovating and scaling low-carbon solutions across many industries. Japan intends to leverage its expertise to decarbonize its economy and also create a clean tech engine to spur economic growth and leadership in Asia – a space now dominated by China.

Smart Energy D EUR

- performance ytd (31-1)

- 4.43%

- Performance 3y (31-1)

- 11.95%

- morningstar (31-1)

- SFDR (31-1)

- Article 9

- Dividend Paying (31-1)

- No

One great investment strategy deserves another

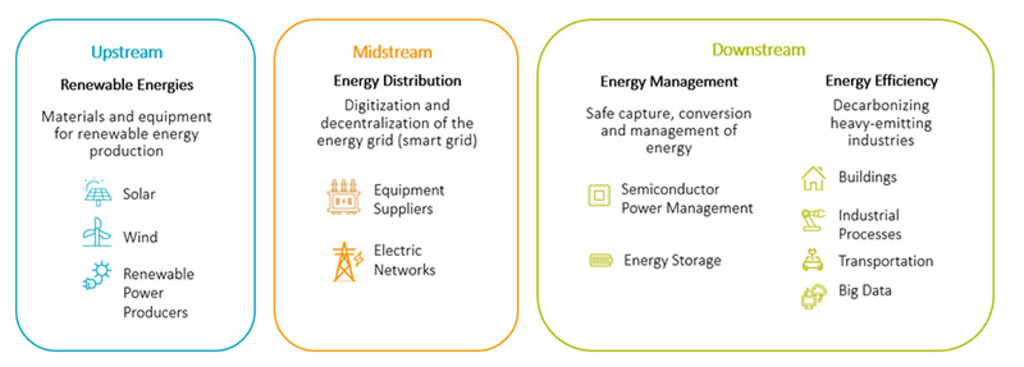

Like the GX Plan, the Robeco Smart Energy Strategy (the Strategy) applies a comprehensive, multi-sector approach to investing in decarbonization. From upstream energy generation via renewables to downstream consumption from consumers and industrial users, the Strategy invests in the same target areas and companies poised to benefit from the GX spending, many of which are local names and lesser known internationally.

Figure 4 – Investing along a multi-trillion-dollar clean energy value chain

Source: Robeco, Smart Energy Strategy, 2025

The GX Plan stipulates that electric vehicles must comprise 20% of all new car sales by 2030, which should notably advance the development and adoption of electric vehicles, batteries, and automotive semiconductors – key components of the Strategy’s energy efficiency and power management clusters. And with a goal of 36-38% renewables in the energy mix, renewable generation should also see substantial growth, lifting the performance potential of the Strategy’s renewable holdings.

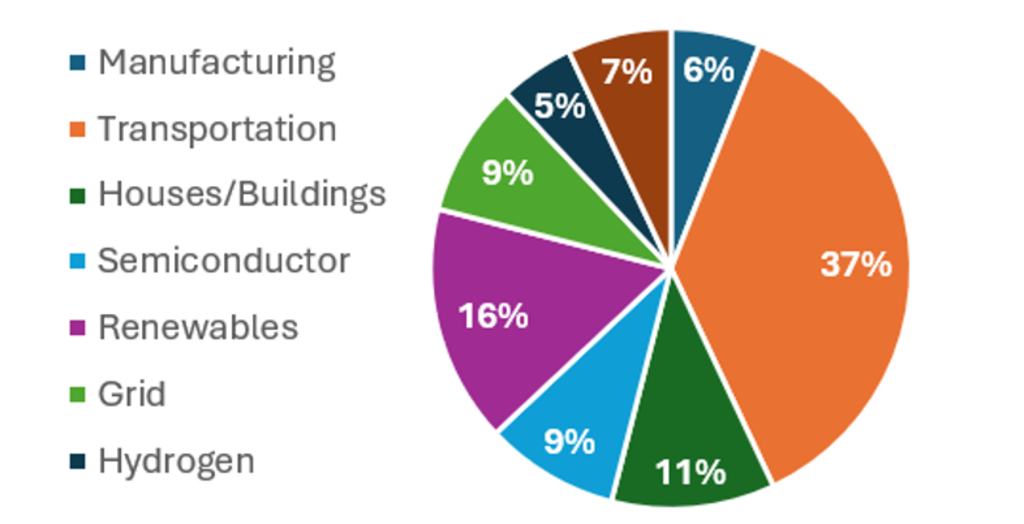

Figure 5 – GX Plan investments by sectors

Transportation and renewable energy generation account for over half of planned investments. Source: Jefferies, METI, GR Japan, 2024.

Grid operators and suppliers should benefit from upgrades and expansion that facilitate renewable integration as well as meet the rising power needs of next-generation chips and hyper-scaled data centers. Already in 2024 alone, no less than 27 grid-scale battery and energy storage projects valued at EUR 217 million were approved by municipalities to enhance transmission grids from Hokkaido, Tohoku, and Tokyo in the north, to Chubu, Kansai and Kyushu in the south.7

Promoting sustainable living environments is also a key GX-objective which will benefit companies specializing in energy-efficient construction materials, insulation, and smart-home technologies, providing tailwinds for companies within the Strategy’s energy efficiency cluster.

Conclusion

The GX plan is comprehensive, competitive, and sustainable. Robeco’s Smart Energy strategy employs a similar approach, leaving it well positioned to benefit from the attractive opportunities created by Japan’s once-in-a-century transformation.

Footnotes

1 Japan - Countries & Regions - IEA

2 Climate Bonds Initiative

3 EUR 986.5 billion or JPY 150 trillion. Converted using Japan’s average EUR/YEN exchange rate over FY 2023 (1 EUR = 152.04 JPY), the year the GX Plan was announced. Source: World Currency Exchange Rates

4 Investment reached USD 493 billion in the two years post-IRA compared to USD 288 billion in the two years pre-IRA.

5 Clean Investment Monitor, August 2024. Rhodium Group, MIT Center for Energy and Environmental Policy Research.

6 EUR 131.5 billion = JPY 20 trillion. The first issuance JPY 1.6 trillion with 5 and 10-year maturities was in February 2024. Conversion done using EUR/YEN exchange rate over FY 2023 (1 EUR = 152.04 JPY), the year the GX Plan was announced. Source: World Currency Exchange Rates

7 Japan Energy Hub. January 2025. 27 grid-scale BESS projects secure 34.6B yen through METI's FY2024 storage subsidy program. Conversion rate of 1 EUR = 159.28 JPY, the average rate over FY 2024. Source: World Currency Exchange Rates

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.