• Insight

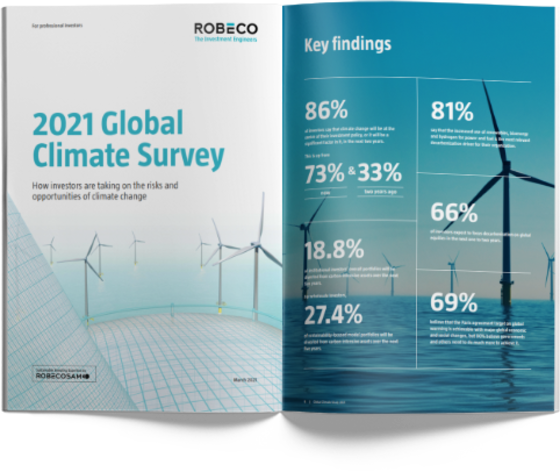

Global Climate Investing Survey 2021

Tackling climate change has become the number one priority for investors. But how is the asset management industry dealing with an issue that is both a threat and an opportunity? Are we ready for the biggest challenge facing humanity?

Summary

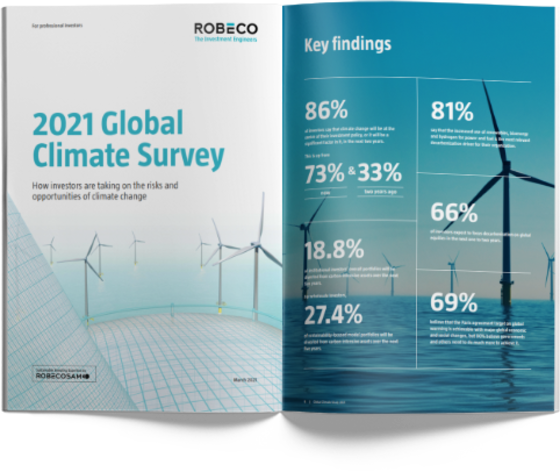

- 86% see climate change affecting their investment policy

- 81% see renewable energy leading decarbonization drive

- 66% will focus decarbonization on global equities in 1-2 years

To find out, Robeco commissioned a survey that asked probing questions to more than 300 institutional, wholesale and insurance investors accounting for about 20% of global assets. The results have been both encouraging and an indication that much still needs to be done.

Perhaps the biggest signal from those surveyed is that half of all assets under management will be committed to net zero in the coming years. Some 86% of investors saw climate change as a significant factor in their investment policy over the next two years, sending a massive message that decarbonization is well under way.

Most believe that renewable energy forms part of the solution: 81% said solar, wind and hydrogen power would lead the way in switching from fossil fuels. And 66% said they would focus portfolio decarbonization efforts on global equities as their preferred asset class for achieving this over the next one to two years.

But the results showed there is also a substantial knowledge gap when it comes to fully understanding the major issues, and many investors simply don’t knowing where to start with this, or how to make a difference.

The overall purpose of this survey is to show where we are as an industry and help investors understand the urgency of dealing with this. We hope it presents interesting insights into the current status of climate investing, as well as the challenges and opportunities that climate change presents.

Download the Global Climate Investing Survey report 2021