Fixed income

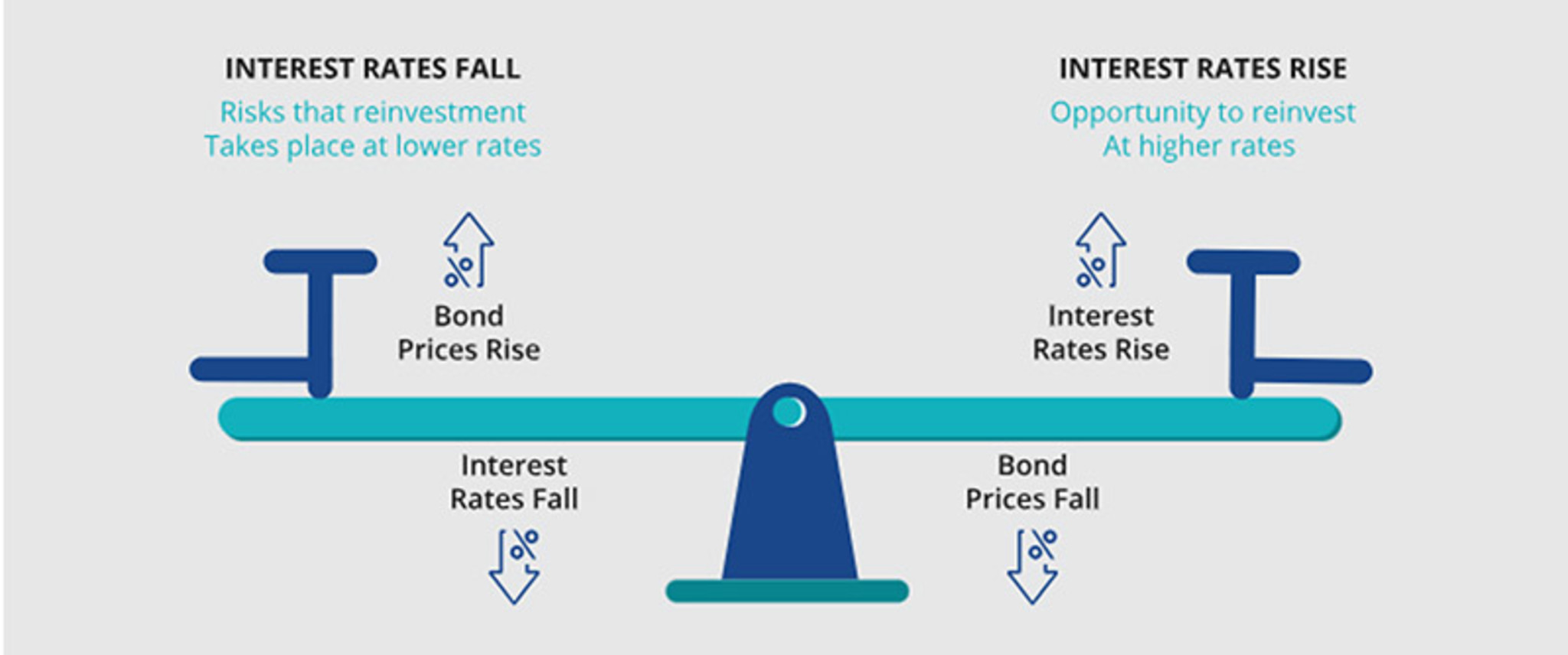

Interest rate risk refers to the potential for investment losses due to changes in interest rates. It primarily affects fixed-income investments, like bonds, as bond prices and interest rates have an inverse relationship: when interest rates rise, bond prices tend to fall, and vice versa.

This risk impacts the value of existing bonds because newer bonds might be issued with higher yields, making older, lower-yielding bonds less attractive to investors, which can lead to a decrease in their market value.

Impacts borrowers and lenders

Interest rate risk also affects borrowers and lenders, as changing rates can increase the cost of borrowing or reduce investment returns. Investors manage this risk through strategies like adjusting bond maturities, using hedging techniques, or diversifying their portfolio. In general, longer-term bonds are more sensitive to interest rate changes than shorter-term bonds, making them riskier in a fluctuating interest rate environment.

See also