High yield and credit added to Active ETF range

The new Active ETFs extend Robeco’s decades-long quantitative investment approach and 95 years of active investing experience to high yield and credit markets.

Summary

- Actively adjusts credit exposure to respond to changing market conditions

- Applies a multi-factor approach to improve risk-adjusted returns while staying close to benchmarks

- Combines Robeco’s fixed income and quantitative expertise with the cost efficiency of ETFs

Robeco is expanding its ETF range further with the launch of four new quant fixed income strategies: Dynamic High Yield ETFs and 3D Enhanced Index Credits ETFs, both available in global and euro versions. Together with our existing Climate Euro Government Bond UCITS ETF strategy, these launches broaden our fixed income ETFs, offering investors more ways to access credit markets through transparent, liquid and cost-efficient ETF solutions. The new active ETFs combine systematic portfolio construction with fixed income expertise.

The new Active ETFs combine systematic portfolio construction with fixed income expertise.

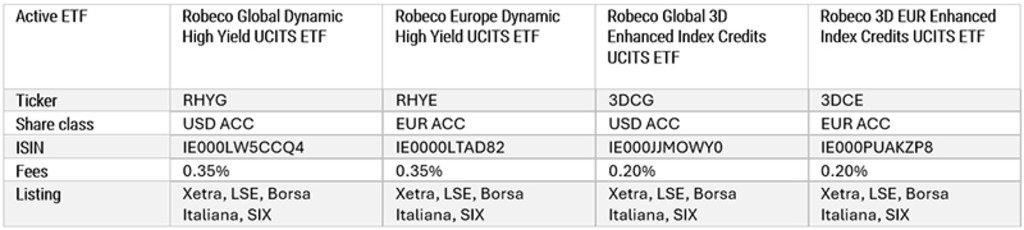

Table 1 – Key strategy details

Source: Robeco, January 2026

Dynamic High Yield ETFs

These Active ETFs use a range of market indicators, including spreads, volatility, macro data and momentum, to form an evidence-based view on credit risk. The ETFs actively increase or reduce high yield beta exposure using highly liquid CDS indices (derivative instruments that provide exposure to credit risk without holding the bonds). This allows the strategy to quickly adjust risk, aiming to capture attractive returns when conditions are expected to be favorable and reducing exposure during periods of market stress.

3D Enhanced Index Credits ETFs

The 3D Enhanced Index Credits ETFs are designed as a smarter alternative to passive credit investing, aiming to modestly enhance returns while remaining closely aligned with the benchmark.

Return: the strategy seeks to systematically improve risk-adjusted returns versus the index by exploiting well-researched credit factor premiums, including value, momentum, quality and low risk.

Risk: portfolio risk is carefully managed through tight tracking-error control, diversified factor exposures and robust portfolio construction, ensuring the strategy behaves like a core credit allocation.

Sustainability: selected sustainability objectives and metrics are explicitly incorporated, allowing them to be balanced alongside (and not at the expense of) financial goals.

Robeco’s active expertise in an ETF wrapper

All four ETFs are founded on the same quantitative investment process that Robeco already applies across its active and factor-based credit strategies, now delivered in a highly efficient ETF structure. By combining disciplined models and fundamental credit insight, Robeco aims to offer fixed income ETFs that do more than simply track the market, seeking to deliver attractive outcomes for investors across the credit cycle.