Quant Chart: Constructing corporate bond portfolios - mixed or integrated factor approach?

New research by Robeco Quant Fixed Income researchers Joris Blonk and Philip Messow1 compares two well-known methodologies used to construct corporate bond factor portfolios – the integrated approach and the mixed approach. We find that an integrated approach leads to higher and more robust information ratios across different spread and interest rate environments. Value traps in particular are to blame for the difference in performance between the two approaches.

When constructing a multi-factor portfolio, we can choose between two approaches. The first approach invests in several portfolios each formed on a single factor: the ‘mixed’ approach. The second constructs a portfolio using a multi-factor signal: the ‘integrated’ approach. To explore which approach is best, our new research builds on previous work done in the equity market2 and compares portfolios based on information ratios (IRs). This measures the stability of portfolio outperformance, where the higher the value the more stable the outperformance. 3

But in what way exactly do the two approaches lead to different portfolios? Let’s consider a two-factor example, taking value and momentum. A mixed approach would first construct a value portfolio and a momentum portfolio separately, and then invest in both. Therefore, a bond could be included that scored well on value, but poorly on momentum.

The integrated approach, on the other hand, first calculates a multi-factor score and then constructs a single portfolio based on that score. It therefore favors bonds that score at least moderately positively on both factors.

Active Quant: finding alpha with confidence

Blending data-driven insights, risk control and quant expertise to pursue reliable returns.

Data and methodology

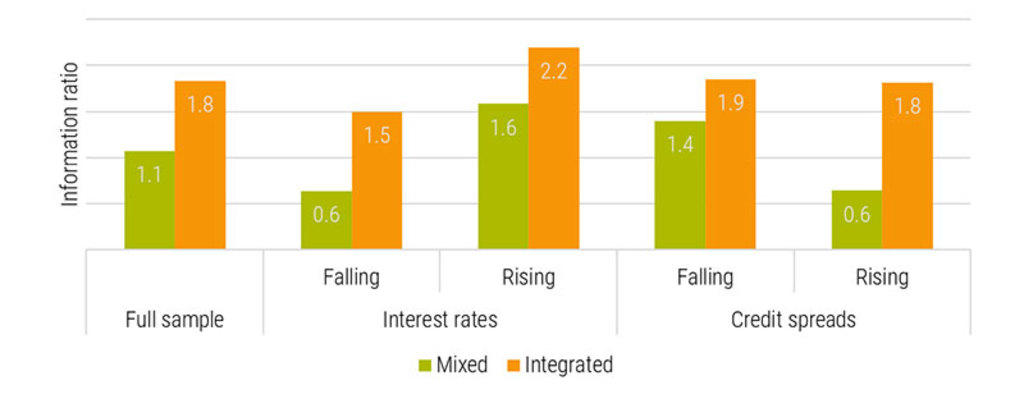

Our study evaluates the mixed and integrated approaches in the USD corporate bond market from 1994 to 2022. Looking first at the factor portfolios for these approaches in high yield, we see that both result in a positive IR above 1. Note that in periods of rising/falling interest rates or credit spreads, both approaches result in higher returns than the market. This indicates that multi-factor investing in credits is in any case found to be a robust strategy in different market environments, including the rising interest rates of recent years.

Figure 1: IR of value-momentum corporate bond portfolios in high yield market environments

Source: Robeco. * Backtest of combination of value and momentum strategies: ‘Mixed’ averages the positions of two univariate value and momentum long portfolios and ‘Integrated’ creates a long portfolio of an equal-weighted value and momentum signal. Portfolios are matched to have comparable factor exposure. The investable universe contains only USD bonds in Bloomberg US High Yield and Bloomberg US Aggregate Corporate indices respectively. One-month holding period and sample period 1994-2022. Sub-periods are defined by monthly changes in the 10y US treasury yield and index spread.

However, how bonds are selected matters and leads to a higher IR for the integrated approach across all market environments, i.e. more stable outperformance. By taking a closer look at the different bonds that each strategy buys, we find that bonds with offsetting factor exposures contribute to the lower performance of the mixed portfolios. Value traps in particular stand out, meaning bonds that look cheap but score poorly on momentum. In other words, they look like an attractive investment from a value perspective, but from a momentum perspective may deteriorate in credit quality. Note while these value traps can be bought under the mixed portfolio approach, the integrated approach would have likely ruled them out.

We find very similar results for investment grade (results are available in the paper). Both strategies have a positive information ratio in any market environment and the integrated approach outperforms its mixed counterpart. The latter faces its toughest challenge in rising spread environments, such as during the 2008-2009 global financial crisis when it experienced a large drawdown as a result of selecting some of the abovementioned value traps.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Conclusion

The existence of value traps in the corporate bond market highlights the importance of risk control in factor investing. This can be done either directly by improving the value factor, for example by using machine learning techniques as highlighted in our article ‘How machine learning enhances value investing in credits’, or through an integrated multi-factor portfolio construction approach as highlighted in our recent research.

Footnotes

1 Blonk and Messow (2024), ‘How to Construct a Long-Only Multifactor Credit Portfolio?’ Available at SSRN: https://ssrn.com/abstract=4775767

2 A large literature of papers on equity factor portfolio construction is available, for example: Blitz and Vidojevic (2018) or Ghayur et al. (2018)

3 The IR is calculated by dividing the outperformance by tracking error.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.