Catching a brea(d)th

Investors should tread warily as a tech-obsessed stock market is out of sync with economic reality, says strategist Peter van der Welle.

Summary

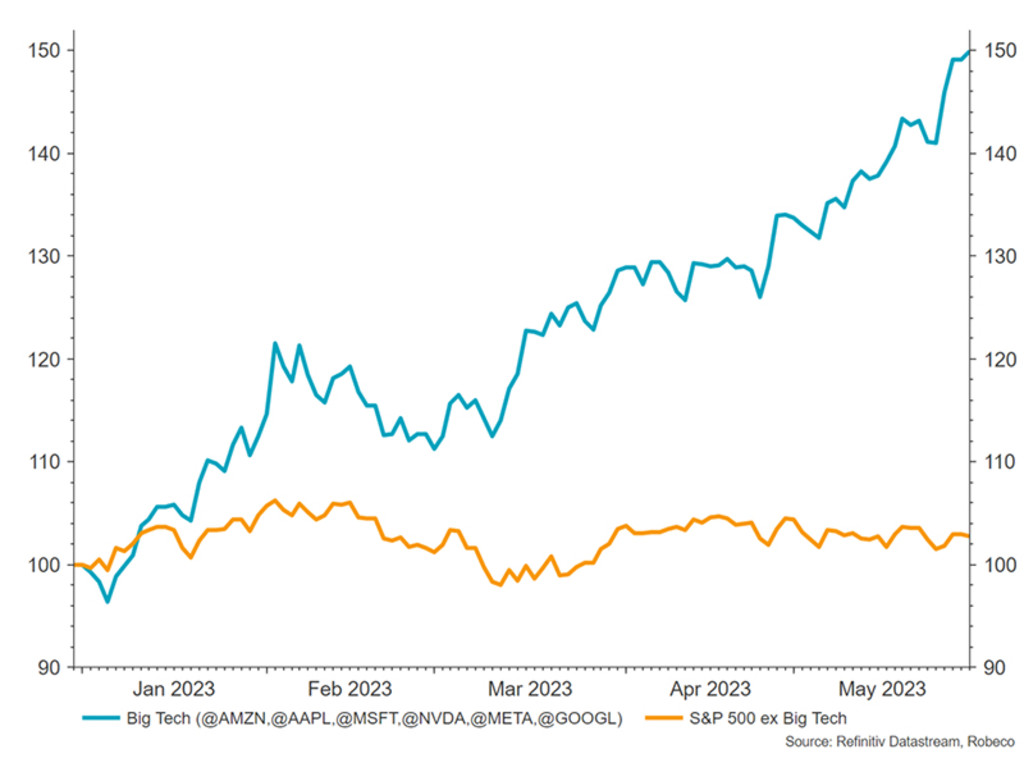

- Big tech led by AI theme has produced virtually all the S&P 500’s returns

- Economic data and cross-asset class performance also show contradictions

- US consumer is strong but data still points to a late cycle leading to recession

Equities are trading in a narrow range not seen since the 2000 tech bubble and the 2020 Covid crisis as the mega-tech stocks account for virtually all market returns. The artificial intelligence (AI) theme has particularly captured the imagination, sending ‘big tech’ share prices soaring.

Yet, economic indicators continue to signal that the world is in a late business cycle that is likely to bring a recession in 2024. This kind of bifurcation can trip up investors.

“After a dismal 2022, where aggressive rate hikes and rising discount rates set the tone for cross-asset performance, investors have been eagerly on the lookout for a cashflow-positive narrative,” says Van der Welle, strategist with Robeco Sustainable Multi-Asset Solutions.

“They have been served well, as the evolutionary jump in large-language models like ChatGPT took center stage. In 2022 the relative performance of technology stocks versus the broader index was closely knit with the change in US real yields.”

“But in the year to date, the story is completely different, as the relative technology stock performance has clearly defied the gravitational pull of higher real interest rates. Moreover, the big US tech stocks have even outperformed the S&P 500 ex-tech by a whopping 50%. If it were not for big tech, the S&P 500 would be up a meagre 1% over the same time.”

This bifurcation between the big tech stocks of Amazon, Apple, Microsoft, Meta (Facebook) and Google versus the rest of the S&P 500 can be seen in the chart below. “This narrow breadth in stock markets is intriguing,” Van der Welle says.

Perspective matters

“It may very well be true – as the latest performance in big tech suggests – that AI gets wings and triggers profound change across economic sectors. If a positive supply shock emerges from rapid AI technology diffusion, boosting productivity as well as benign disinflation, non-tech related S&P 500 performance could soon follow suit.”

“Yet, perspective matters in investing, and it is easy to conflate the secular with the cyclical outlook. It was American economist Robert Solow who famously remarked that he saw computers everywhere except in the productivity statistics. The pace of technology diffusion may have increased as we have entered an age of digitization, but still could underwhelm.”

“Though the strong AI-driven positive stock market momentum may continue for longer, the cyclical backdrop is darkening in our base case view, hinting that we are in a late phase of the business cycle which ultimately transitions into a recession in 2024.”

Seeing what you want to see

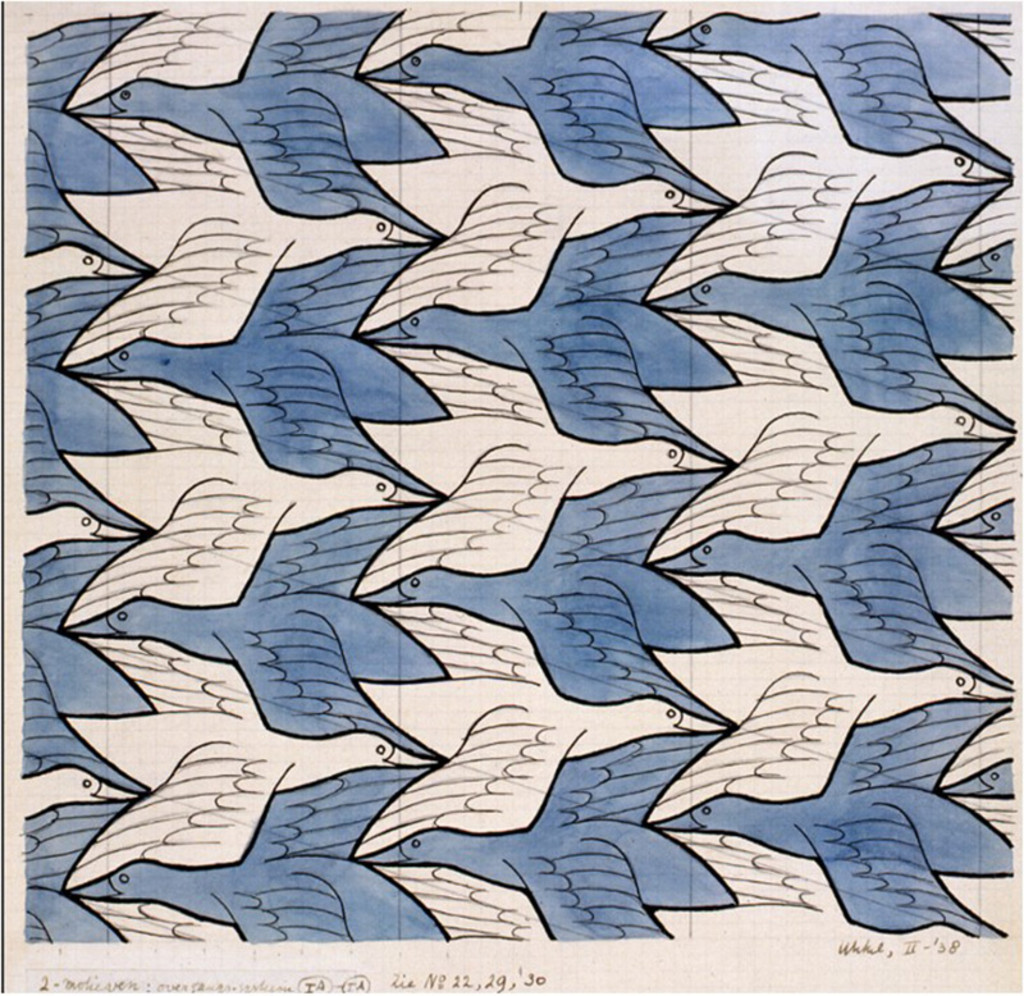

Van der Welle says the strong momentum of the AI theme resembles the white birds in M.C. Escher’s famous 1938 ‘Two birds’ lithograph, shown below. The white birds quickly catch the eye (and imagination), but upon closer inspection an identical bird with notably darker plumage symmetrically appears from the background, flying in the opposite direction.

And there are other remarkable bifurcations in the macro economy and markets next to the narrow breadth in the S&P 500’s YTD performance, Van der Welle says.

“Take for instance the divergence between consumer/producer survey data about where the economy is heading, and the so-called hard data (GDP, retail sales),” he says. “The former has been downbeat since Q4 last year, with the well-known ISM manufacturing indicator consistently hinting at a manufacturing recession for seven months in a row now.”

“While the ISM manufacturing usually does a decent job in capturing the swings in economic activity, broader economic activity in the US has failed to budge, with US GDP expanding over the past two quarters. A similar streak emerges from European macro data, even as the Eurozone has much more narrowly avoided a recession in the year to date.”

Post-Covid spending binge

Much of this was artificially created by the USD 2.5 trillion in Covid recovery funds that generated a spending binge in the US that is unsustainable, Van der Welle warns.

“In our view, habit formation on the side of the US consumer leading to an (over-)extended spending frenzy in the wake of huge post-pandemic fiscal support packages seems to be the main culprit here,” he says.

“The relationship between leading business cycle indicators and the real economy has not broken down, but the lags may be longer than usual, due to unexpected resilience from the consumer who has kept spending even as real income growth declined last year.”

“Yet, this strength is eroding as credit card data show the US consumer is stretched. Walmart’s CEO noted earlier this year that consumers have become more ‘thoughtful and discerning’. Retail sales data from Q1 2023 reveals that the US consumer has already begun to trade down, buying cheaper, less fancy stuff.”

“An increase in household price elasticity of demand flags trouble for corporate pricing power and earnings. However, there are safe havens. While overall retail spending volumes have flattened, spending patterns do show a wedge between income cohorts, as global demand for (ultra-)luxury goods is still strong.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Commodities versus equities

Another bifurcation can be seen across asset classes. “Commodities and equities seemingly tell a different story about what’s going on in the global economy,” Van der Welle says. “While both risky assets are susceptible for business cycle turning points and are normally positively correlated, commodities are in a bear market, down 10% in the year to date, while the MSCI AC World is up by 7.9% over the same time.”

“Another recessionary signal from commodities comes from the copper/gold ratio (a cyclical growth proxy) which has trended downwards in the year to date, and now is clearly out of whack with real long-term bond yields and equity performance.”

“In addition, we observe a historically stretched MOVE/VIX ratio, with equity options traders appearing unusually more sanguine about their asset class than their fixed income counterparts, signaling yet another bifurcation.”

Signals to noise

What to make of all of this? “In our view, the current degree of bifurcation suggests we are in a low signal-to-noise situation, with investors judging they have enough evidence at hand to stick to either the bull or the bear case, creating these significant cross-asset dealignments,” Van der Welle says.

“Like Escher’s lithograph, the current environment allows you to see only the bird you want to see, as the other one easily vanishes into the background. This narrow market breadth calls for multi-asset investors to catch a breath in order to grasp the full picture of what is going on.”

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.