Equities realize better returns if their current value is higher than their current price. A value strategy makes use of valuation ratios to select stocks that are attractively priced relative to their fundamentals.

The price-to-book and price-earnings ratios are both frequently used. Stocks with low prices relative to their fundamentals are expected to appreciate in the future to properly reflect the real value of the company. However, the pitfall here is that an increased risk of insolvency can be the reason for a low valuation. A company that has an outdated business model, for instance, runs a greater risk of becoming insolvent, and its stock price will reflect this by having an apparently low valuation relative to its book value.

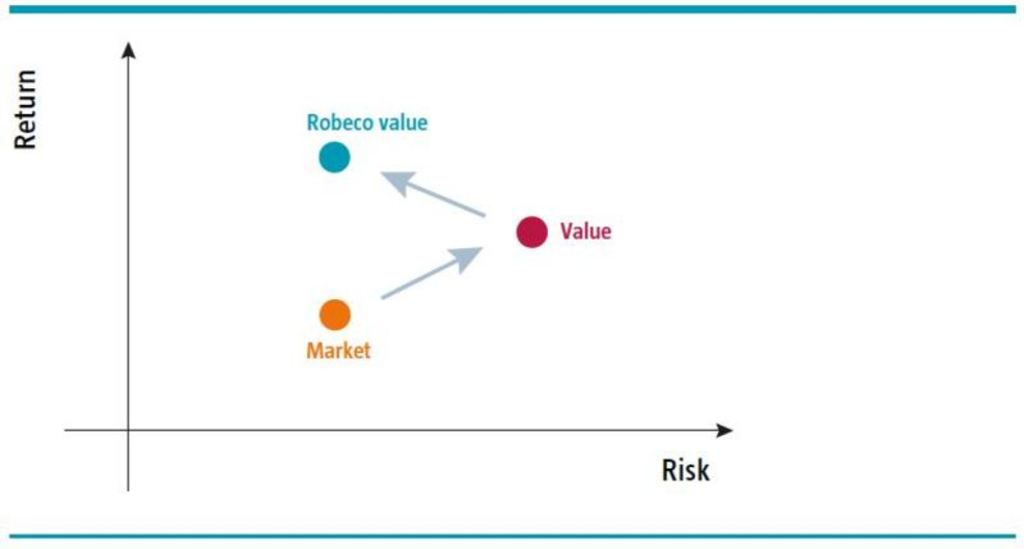

Figure 10. Improved risk-return ratio with Robeco's Value factor approach

Source: Robeco, Quantitative Research, 2014

Robeco’s approach to value investing is to make stock-selection adjustments that take a higher level of risk into account. This means that stocks that are indeed undervalued are selected, in contrast to companies whose low valuation merely reflects their higher level of risk.

See also