8 out of 9: Conservative Equities scores

In a decade dominated by the relentless rise of US Big Tech, defensive equities have faced tough headwinds. Yet Robeco’s Conservative Equities strategies have continued to prove their worth since inception. Our review shows that they have met performance expectations in eight out of nine major drawdowns – a strong track record of reducing risk while still delivering equity-like returns.

Summary

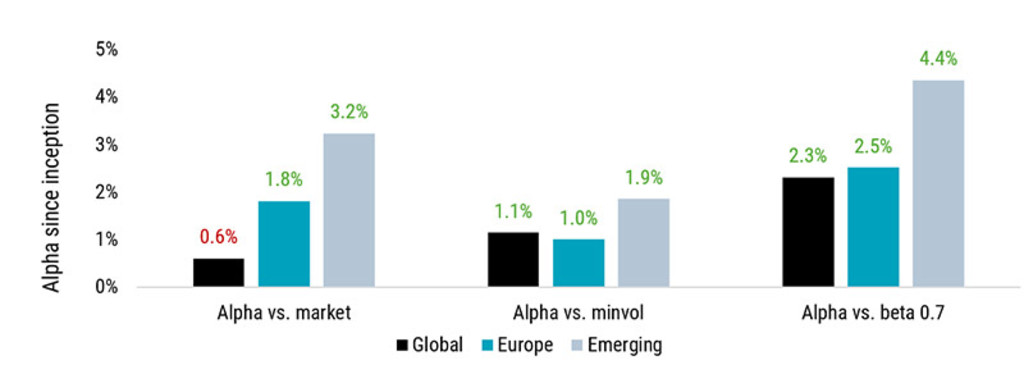

To evaluate Robeco’s Conservative Equities strategies, we review performance since inception across three major regions: global developed markets, Europe, and emerging markets. Each strategy was assessed using three metrics:

Alpha vs. the market index

Alpha vs. the minimum volatility index (minvol)

Alpha vs. the market index, adjusted for a target beta of 0.7

That makes nine scores in total. Eight of them were positive. The only exception was the developed markets strategy relative to the MSCI World Index, where 20 basis points of outperformance over 18 years is not economically significant.

Figure 1 I Global, Europe and Emerging Conservative Equities strategies’ alphas since inception

Past performance is no guarantee of future results. The value of your investments may fluctuate. Source: Robeco Performance Measurement. Index: MSCI World, MSCI Europe, MSCI Emerging Markets, and corresponding MSCI Minimum Volatility indices. Portfolio, share class and inception date: Robeco QI Institutional Developed Conservative Equities (“Global”), September 2006; Robeco QI European Conservative Equities B EUR (“Europe”) , August 2007; Robeco QI Emerging Conservative Equities I EUR (“Emerging”), February 2011. All figures in EUR. Data as of 30 April 2025. Returns gross of fees, based on gross asset value. If the currency in which the past performance is displayed differs from the currency of the country in which you reside, then you should be aware that due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. Performance since inception is as of the first full month. Periods shorter than one year are not annualized. Values and returns indicated here are before cost; the performance data does not take account of the commissions and costs incurred on the issue and redemption of units. These have a negative effect on the returns shown.

Reducing drawdowns, enhancing compounding

The hallmark of the Conservative Equities strategies is ‘winning by losing less.’ By focusing on downside protection, the strategies aim to smooth the investment journey. When markets dropped more than 10%, Robeco’s Global Conservative strategy reduced losses by an average of 31%, compared to the MSCI World Index. The European and Emerging strategies showed similar results.

This matters more than it might seem: for example, a -22% loss requires an asymmetrical +28% gain to break even. Reducing drawdowns enhances long-term compounding – the core of robust portfolio growth.

Over a full cycle, defensive equities should deliver equity-like returns with lower risk. Robeco targets at least 2.0% outperformance versus the market on a beta-adjusted basis. That bar was cleared in all three strategies. In fact, in emerging markets, the strategy exceeded expectations by a wide margin, thanks to stronger alpha signals and a favorable environment for low-risk stocks.

Two decades, two stories

From inception through 2014, the Conservative Equities strategies thrived in a low-return world. Our Global, European, and Emerging strategies all posted wide-margin outperformance versus both market and minvol indices. The prudent integration of valuation factors helped mitigate the risk of defensive stocks becoming too expensive as their popularity rose among investors.

But from 2015 to 2024, markets shifted dramatically. Fueled especially by the rise of Big Tech, developed markets surged. The MSCI World’s +11.7% annualized return created a tough benchmark for defensive strategies. While Robeco’s Global Conservative strategy returned a strong +9.4% annually, it fell short of the index.

Even so, the strategy still outperformed the Minvol index and maintained its downside protection. Europe and Emerging held up even better, with Emerging outperforming both the market and Minvol indices during this high-return period.

Why the lag in developed markets?

The dominance of a handful of large US tech stocks – the so-called “Magnificent Seven” – explains much of the developed market shortfall. These stocks tend to have high volatility and are often excluded or underweighted in low-risk portfolios. While some, like Apple and Microsoft, are more stable and often included in Robeco’s portfolio, others like Tesla or NVIDIA typically do not score well on low-risk or valuation metrics.

This skew in index composition created an unusually difficult environment for low-risk strategies. But that tide may now be turning.

Outlook: Favoring a defensive approach

We believe that the current outlook for low-risk stocks is quite favorable, based on three observations. The first is that the duration of current market leadership for cyclicals (including Big Tech) over defensive stocks has been unusually long: history suggests a reversal is likely – and when that comes, low-risk strategies typically shine.

The second observation is that, with US markets trading at historically high valuation multiples, the potential for a market correction has increased. Robeco’s research shows that in scenarios of multiple contraction, defensive equities strategies are likely to outperform.

Our third observation is that we see our Conservative Equities strategies trade at a discount compared to their respective market index – expectations for low-risk stocks are rather low, while fundamentals seem solid. We expect this valuation gap, or margin of safety, to be a tailwind for long-term investors in Conservative Equities, and see a similar discount for Emerging Conservative Equities, and a lower discount for our European strategy.

Positioning for resilience

While investor sentiment for defensive equities has waned in the era of US Big Tech dominance, elevated US equity valuations, rising concentration risks, and increasing volatility suggest the tide may turn. Market leadership is cyclical and Robeco’s Conservative Equities strategies has historically thrived in environments of moderate equity returns and heightened volatility.

With a disciplined focus on risk reduction, stable fundamentals, and valuation awareness, the strategy remains well-positioned for those seeking resilience and a time-tested solution: winning by losing less.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.