Seizing quant and fundamental alpha in developed equity markets

Building on the success of our previous exploration into combining fundamental and quantitative strategies in emerging markets, we now shift our focus to developed markets. Our latest research investigates how these distinct investment styles can be leveraged, both individually and in tandem, to navigate the challenges posed by high valuations and market concentration, aiming to uncover new avenues for alpha generation.

Summary

- To keep enjoying high equity returns, investors need to rely increasingly on active alpha

- Quant and fundamental investing styles presents two distinct routes to target alpha

- Diversifying across genuine quant and fundamental strategies can offer significant benefits

Equity investors face a dilemma in developed markets. While equity markets have mostly been going up following the global financial crisis in 2009, their high valuations and concentration indicate lower future expected returns and increased risks. To illustrate, the forward price-to-earnings ratio of the MSCI World traded at 18.09, hence at the higher end of the historical range. This high valuation resonates with Robeco’s 5-year Expected Returns forecast of 6.5% (EUR, nominal), which is not even half of the 13.6% annual realized developed market return over the previous five years.

To compensate for this potential future return gap, investors have to rely more on alpha from active management. However, active management comes in various forms and degrees of activeness. To this end, we investigate the performance of quantitative and fundamental equity investment styles. Which of the two is better suited to outperform in developed markets? Are there differences in factor exposures and risk-taking? And what happens when the two approaches are combined?1

Distinct and complementary

From first principles, it is natural to expect quant and fundamental investment styles to be complementary in nature. On the one hand, the fundamental approach typically thrives on very deep knowledge about a select set of companies. On the other hand, quant investing uses data-driven insights to rank the whole stock universe, based on company characteristics corresponding to rewarded factors. Given this distinct nature of building investment signals, portfolio construction calls for very different approaches as well: a high-conviction fundamental portfolio consisting of few stocks versus a broadly diversified quant portfolio to harvest the targeted factor premiums.

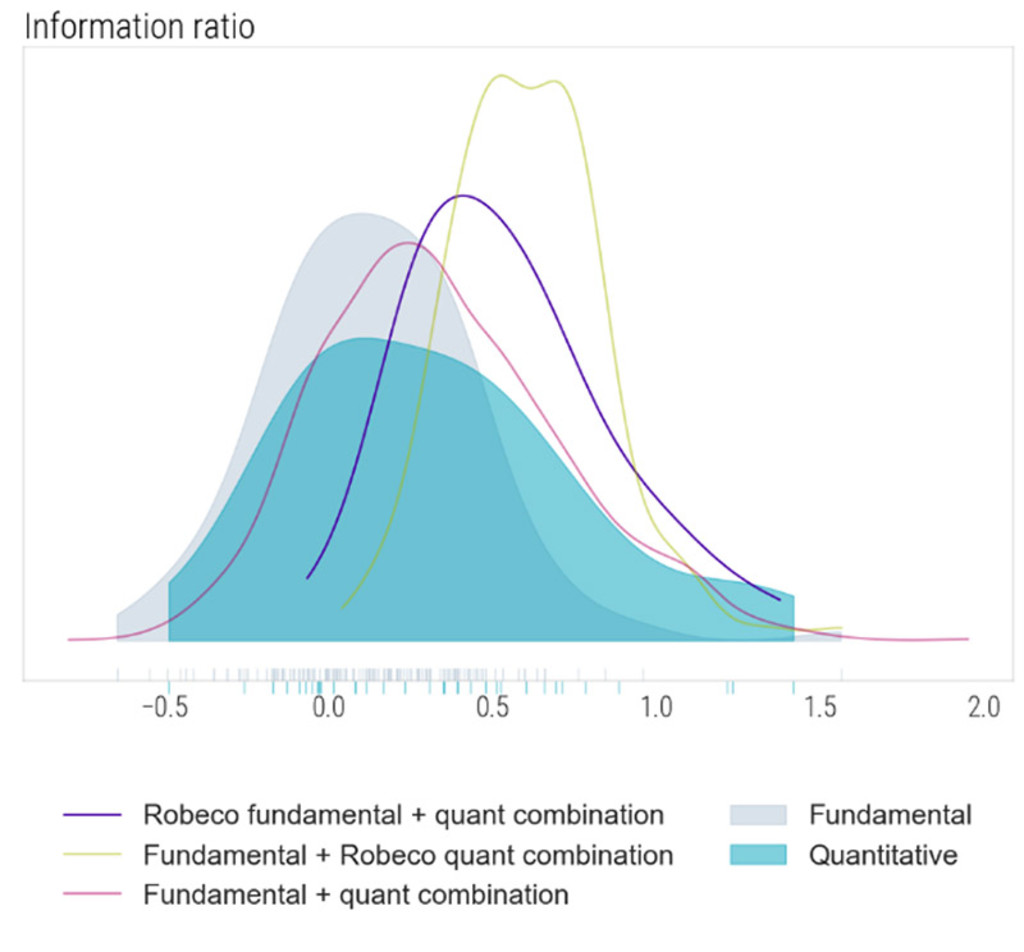

In our study spanning from November 2004 to March 2025, we show that both quant and fundamental managers listed in the eVestment database have outperformed the market. While fundamental strategies show a higher average outperformance, their managers also typically take higher active risks relative to their benchmark, in other words, have a higher tracking error (TE). Considering these two dimensions jointly, we document relatively higher information ratios (IRs) for quant strategies (0.29 vs. 0.22).

From an investment style perspective, quant strategies typically exhibit exposure to salient style factors, such as value, momentum, and quality, while fundamental strategies do not. This characterization highlights the difference between the two approaches and suggests that portfolio diversification can be strategically enhanced by combining quantitative and fundamental styles. Indeed, over the period spanning from January 2008 to March 2025, a risk parity combination of quant and fundamental strategies increases the IR to 0.34 on average, which is around 50% higher than the average of the two subgroups (0.23).2

Robeco style stars

When combining the different fundamental strategies with the Robeco Global Developed Enhanced Indexing strategy or the various quantitative strategies with the Robeco Global Stars Equities strategy, we find average IRs of 0.61 and 0.54, respectively.

Figure 1 – Information ratio for risk parity combinations of quant and fundamental strategies

Past performance is no guarantee of future results. The value of your investments may fluctuate. Source: Robeco, eVestment. The figure shows density plots for the annualized information ratio of risk parity combinations of quant and fundamental strategies. The densities for the quantitative strategies are shown in blue, for fundamental ones in grey, and for the risk parity combinations in pink (using all strategies), green (combining only Robeco Global Developed Enhanced Indexing with all fundamental strategies) and purple (combining only Robeco Global Stars Equities with all quant strategies). We include strategies that were active from January 2008 to March 2025. This results in 135 fundamental strategies, 36 quant ones, and 135*36 = 4860 combinations.

Given their good track record a combination of these two strategies yields an IR of 0.88. Apparently, the opportunity set of strategy style diversification is considerable, especially if one relies on contenders that genuinely live up to their targeted investment style, be it quant or fundamental. Moreover, at Robeco, we can also create tailor-made solutions that combine our quantitative and fundamental strategies into a single strategy, providing customized solutions to meet each client’s specific investment goals.

Footnotes

1This study complements our January 2024 emerging markets study, ‘Embracing fundamental and quant investing in emerging markets’.

2We start this analysis only in 2008 to have both a fundamental and quantitative Robeco strategy included

Download the publication

Discover the value of quant

Subscribe for cutting-edge quant strategies and insights.