What increased index concentration means for active investors

Mega-cap dominance has reshaped the landscape of active investing, creating both opportunities and risks. While their meteoric growth has driven innovation as well as outsized returns, tech giants have also made markets more vulnerable. In recent research we zoom in on the implications of increased index concentration for active investors.

Summary

- Mega-tech dominance has increased risks and opportunities

- Smart beta strategies especially face challenges from index concentration

- Tracking error-controlled multi-factor strategies help mitigate risks

Over the past decade, the stock market has undergone a dramatic transformation, with market value increasingly concentrated in a small number of giants related to the technology sector. The group’s composition and nickname has evolved over the years, from FAANG to the Magnificent Seven to the latest, BATMMAAN.

This growing dominance has had a profound impact on index composition and market behavior. The weight of the five biggest stocks in the MSCI World index has grown from around 6% in 2015 to nearly 20% nowadays. Similarly, the weight of the top ten has risen from less than 10% to over 25% today.

Discover the value of quant

Subscribe for cutting-edge quant strategies and insights.

Smart beta challenges

The concentration of market returns in a handful of mega caps has created a dilemma for single-factor ‘smart beta’ strategies. These indices often take large overweight or underweight positions in individual stocks – either doubling up on a stock that is already significant in the market index or taking no position at all.

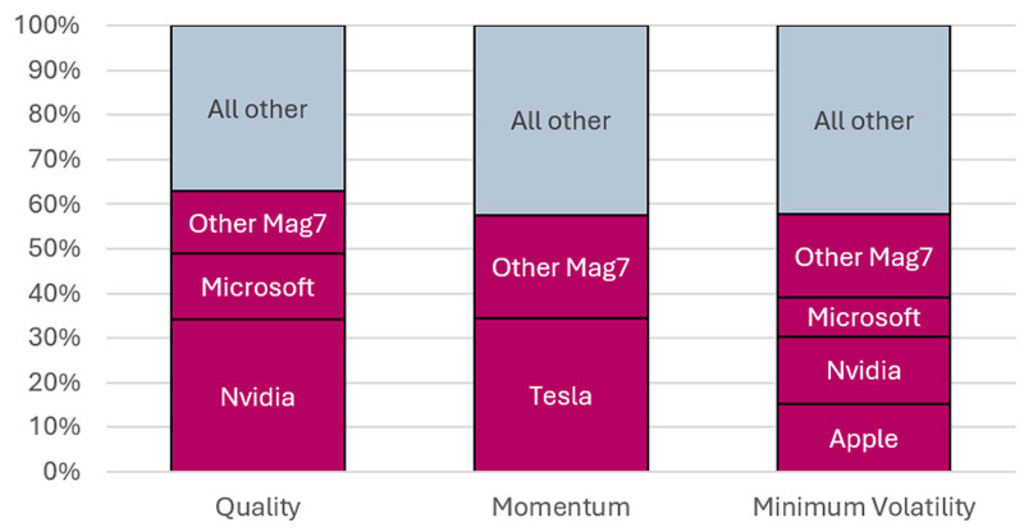

To illustrate the implications of smart beta portfolio design choices, we consider the MSCI World Quality, Momentum, and Minimum Volatility indices over the seven-year period from 2018 to 2024. The Quality index was the best performer over this period, with a cumulative outperformance of around 50%, followed by the Momentum index with almost 30% outperformance. Notably, Figure 1 shows that over 60% of the outperformance of the Quality index can be attributed to the Magnificent Seven stocks, and over 50% for the Momentum index.

In contrast, the Minimum Volatility index underperformed by 55%, as its methodology largely ignored these mega-cap stocks. This illustrates how factor strategies that do not carefully handle index concentration risk may end up primarily exposed to idiosyncratic risk rather than true factor premiums, raising questions about whether their returns are truly factor-driven.

Figure 1 | Outperformance decomposition MSCI Quality, Momentum and Minimum Volatility indices, 2018-2024

Source: Robeco, MSCI. This chart is for illustrative purposes only.

The case for tracking error-controlled multi-factor strategies

Given the challenges posed by increased index concentration, a more resilient approach is needed. We find that multi-factor strategies with tracking error management, such as enhanced indexing, provided risk-adjusted performance that should be largely immune to increased index concentration.

Enhanced indexing portfolios typically achieve this by taking a large number of small overweight positions in stocks with attractive factor characteristics, together with a large number of small underweight positions in unattractive stocks. By tightly limiting the active position in each individual stock, the idiosyncratic risk of the portfolio is contained.

Although a slight reduction of the transfer coefficient cannot be avoided as index concentration increases, the impact on bottom-line performance is comparatively minor. We conclude that tracking error control is crucial to prevent active management from degenerating into a binary bet on the fortunes of a few dominant tech stocks.

Conclusion

The rise of mega tech stocks has created new dynamics in active portfolio management. Smart beta indices have not adapted their methodologies to the increased concentration of the market index and take big over- and underweights in mega caps that can make or break their performance.

By contrast, the performance of diversified factor strategies with tracking error management is largely unaffected by increased index concentration. While it has become slightly more difficult to implement ideal underweights, the impact on overall performance is minor.

We conclude that no active strategy is completely immune to the effects of increased index concentration, but proper tracking error control is essential. This ensures that active management does not become a binary bet on the fortunes of a few tech giants.