E-commerce logistics: going the extra mile

E-commerce is booming, exposing its logistic backbone to an ever increasing bill. The industry is therefore trying to find cheaper solutions with the help of innovative tools, such as robots that are learning to see and pick stuff, artificial intelligence, drones and many other devices that are brought to us by Industry 4.0.

概要

- Explosive growth in e-commerce is pushing up logistic costs

- The industry needs innovative solutions to increase efficiency and reduce costs

- Investment opportunities: warehouse automation providers, prime warehouse owners, software companies

E-commerce amounts to 10% of global retail sales. DHL, the world’s largest logistics company, expects e-commerce to grow around 19% per year, to become 15.5% of overall commerce in 2021. We think there is room to go even higher; for example in China, e-commerce penetration is already at 22% today. Trust in online shopping has increased, both in terms of payment security and quality of product.

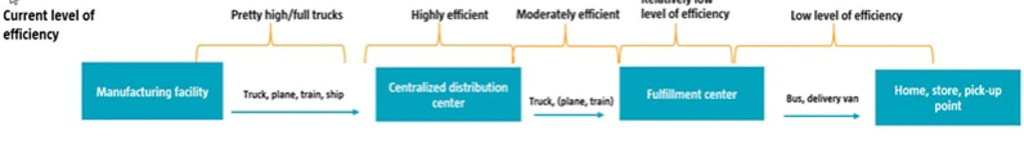

The massive growth in e-commerce has quite an impact on the underlying logistics. Figure 1 shows a simplified visualization of a logistic set-up for e-commerce: goods are transported from a manufacturing facility to a centralized distribution center (DC) in what is called line haul. This mode of transportation is generally still pretty efficient. From the DC, goods continue further to fulfillment centers (FC), which are closer to demand centers and therefore generally smaller and less efficient. This set-up is known as a ‘hub and spoke’ model. From the fulfillment center, goods are finally transported to consumers’ front doors, pick-up points or stores. This is generally done by small delivery vans and is often much less efficient.

Figure 1 | E-commerce logistic flows

As goods travel further to the right in the chart, efficiency decreases – which is also reflected in the costs. AT Kearney estimates the last mile to account for nearly half of total logistics costs. The industry is therefore trying to find cheaper solutions.

The right industrial real estate at the right location can reduce last-mile cost, improve service and enable fast delivery. As warehouse rental costs are only a small portion of the overall logistics bill, warehouse owners are often able to enjoy substantial rent increases. We therefore see owners of prime industrial real estate assets as major beneficiaries of e-commerce growth.

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Warehouse automation

One of our favorite ways to benefit from growing e-commerce is through warehouse automation. This is crucial for success. One specific automation technology will bring about the inflection point: as robots learn to see through vision technology, they get ready to enter the warehouse.

To be able to work in a warehouse, robots have to learn something new: the perception and recognition of objects. In other words, they have to learn to see. This ‘vision technology’ includes cameras, laser sensors, Radio-frequency (RF) ID devices and barcode readers. They are found along a warehouse’s whole process chain and make sure that hardware can effectively signal to software, or the Warehouse Control System. The producers of these vision systems are among the most interesting investment opportunities related to e-commerce growth.

The holy grail of warehouse automation is picking. Currently, half of all labor time is spent on picking and packing, as 90% of the picks in a warehouse are still done by a human hand. This has been termed Moravec’s paradox: it is very easy to teach robots adult skills but incredibly difficult to let them perform tasks a two-year old already masters – such as picking from a cluttered bin with overlapping items. Nevertheless, we think solving this challenge is possible and will be done through a combination of machine 3D vision and deep learning.

Patchwork solution

As the last mile is the biggest cost item, it is the main battleground for incumbents and start-ups alike. There won’t be a ‘one-size-fits-all-solution’, and we think the last mile will become an ever more fragmented mix of many solutions. Start-up companies will bring technologies such as cloud platforms or crowd sharing to the logistics industry to make clever use of free capacity elsewhere. Incumbents will experiment with automatically guided vehicles (AGVs), drones, self-driving robots or even delivery tunnels. While many sound and probably are far out in the future, others - or at least pre-forms of them - will be with us quite soon.

Barcodes, RFID tags and lasers alike are generating and collecting vast amounts of data - which are worth nothing unless turned into insights for better decision-making. This is the domain of software companies offering (inter)-enterprise software for supply chain management. With the help of cloud solutions and artificial intelligence, logistics can become just-in-time and efficient.

Industrial innovation to upgrade e-commerce

While e-commerce introduces a lot of challenges to logistics, ‘Industry 4.0’ brings a lot of tools to offset costs in what has historically been a low-tech and often very inefficient industry. Connecting the supply chain from one end to the other will significantly benefit suppliers of Automatic Data Capture devices, including sensors, lasers, connectors, cameras and tags. Asset owners will enjoy better utilization rates and, last but not least, the environment will benefit from lower emissions.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.