We’re ‘a big world on a small planet’ – the role of sustainability in finance

The world is consuming natural resources and polluting the environment beyond what the planet can reasonably manage. In the words of award-winning climate scientist, Johan Rockström, we are indeed ‘a big world on a small planet’.1 Sustainable finance can help forge a path to economic growth that is socially and environmentally fair for present and future generations.

まとめ

- The world is depleting natural resources at a dangerous pace

- Population growth will exacerbate an already precarious position

- Finance can help channel capital to companies generating sustainable profits and growth

The rapid rise in industrialization, material wealth and consumption has blinded us to the fact that we live in a world of shared and finite resources. The Tragedy of the Commons is an apt metaphor for this dilemma. If common goods such as air, water and many of nature’s other services are available free of cost, they will be consumed indiscriminately by self-interested parties without regard for other stakeholders (in the present or future). As the global population approaches ten billion by 2050 and emerging countries demand Western living standards, the tragedy of the commons will only intensify.2

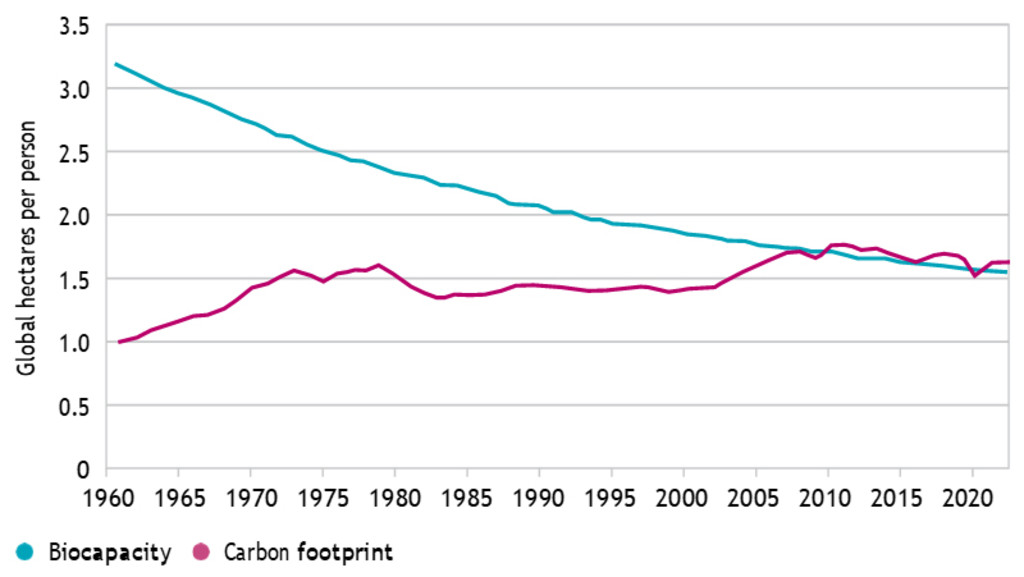

Research from the Global Footprint Network estimates that humanity is currently using natural resources 1.75 times faster than our planet’s ecosystems can regenerate them.3 This means that 1.75 Earths are needed to maintain current living standards, which is clearly unsustainable. If ‘business as usual’ scenarios continue, by 2050 three Earths will be needed to sustain the standards of living to which we have grown accustomed.4 The cost of this global ecological overspending is becoming increasingly evident in the form of deforestation, soil erosion, biodiversity loss, and the build-up of carbon dioxide and other greenhouse gases in the atmosphere.

Figure 1: The Earth’s biological productivity is in a decades’ long decline

World ecological footprint and biocapacity from 1961-2022 in global hectares per person. Biocapacity refers to nature’s ability to provide products and services for human demand and consumption including food, fibers, timber, energy production, carbon capture etc.

Source: Global Footprint Network, Overshoot Day Initiative. Earth Overshoot Day 2022 Nowcast Report.

The challenge for businesses and economies is to efficiently use Earth’s resources without depleting them. This will require a shift away from wasteful production-consumption models toward circular ones where resources are recycled, reused, and repurposed.

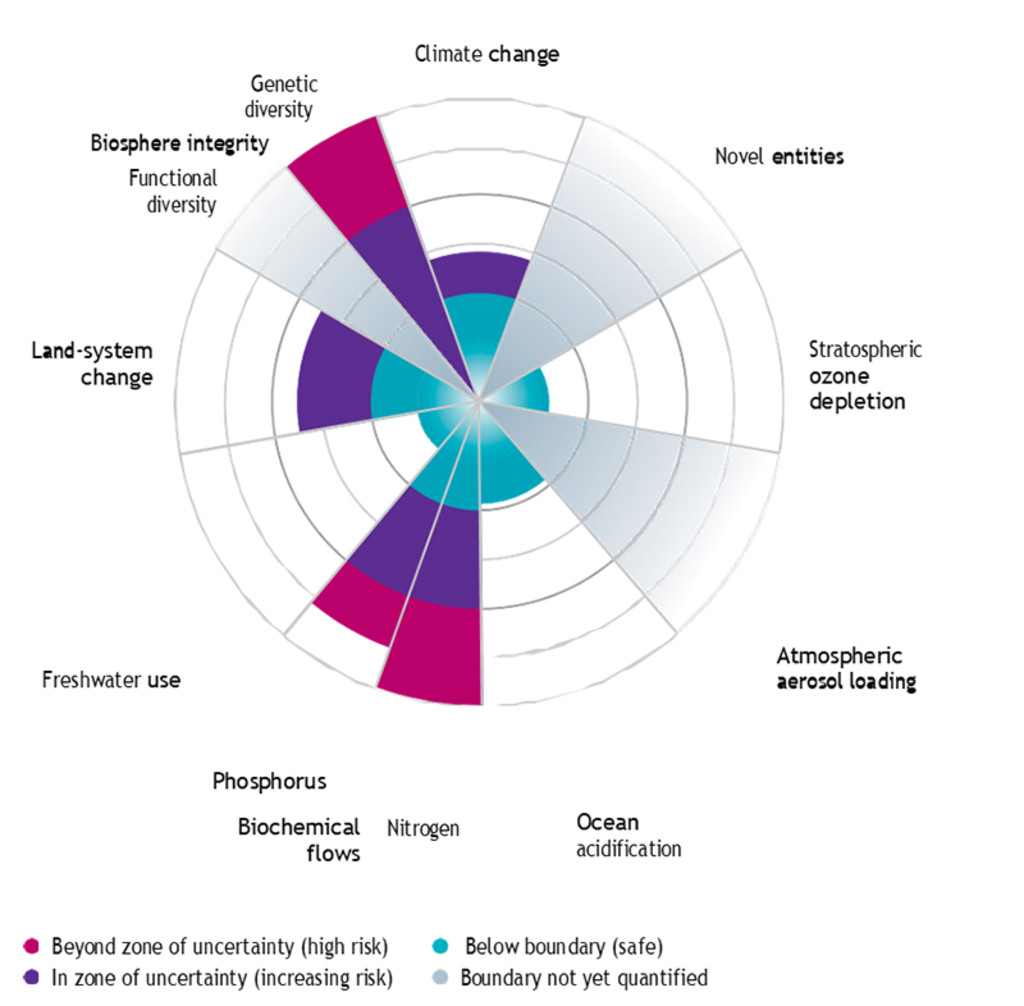

Figure 2: Science-based planetary boundaries

Source: Robeco, Stockholm Resilience Centre, Stockholm University. 2015.

Planetary boundaries

Resource scarcity is just one of a series of crises that must be addressed for humanity and the planet to survive and thrive. In 2009, a team of internationally renowned scientists introduced the Planetary Boundaries Framework which identifies nine critical processes that work in unison to regulate and stabilize life on Earth (see Figure 2). For each of these processes, the boundaries quantify the levels that are acceptable and safe for life on the planet.

Disturbingly, recent scientific studies show that human activity has already pushed us beyond the ‘safe zone’ and into states of ‘high uncertainty and risk’ for at least five out of nine of these critical maintenance systems, including climate change, biodiversity loss, vital nutrient flows, land use and novel entities (a group that includes plastics).5

The impact of climate change is already beginning to demonstrate that the risk of breaching these planetary boundaries for businesses and investors is large. They will cause scarcity of raw materials, supply chain disruptions, shifts in consumer preferences, increased regulation and more generally, higher costs overall.6

Accounting for social costs

Sustainability encompasses much more than preserving natural resources and ecological boundaries, it also aims to protect social capital.

The doughnut economy is a conceptual framework that offers a means of integrating the human element into frameworks dominated by ecological metrics. Much like the UN Sustainable Development Goals (SDGs), it recognizes that people on the planet should have access to life’s essentials, including food, shelter, education, and healthcare. In short, the framework maintains that sustainable economic development should not overshoot planetary boundaries or undercut human needs and well-being.7

More recently, a team of scientists combined the social aspects of the doughnut economy with the planetary boundaries to construct a set of new Earth System Boundaries.8 These are designed to minimize harm caused by boundary breaches on human health and well-being as well as to address issues of fairness and justice. In a 2023 report, the group revealed that when both human well-being and social justice factors are considered alongside planetary health, numerous boundaries have already been exceeded.9

Finance can play a key role

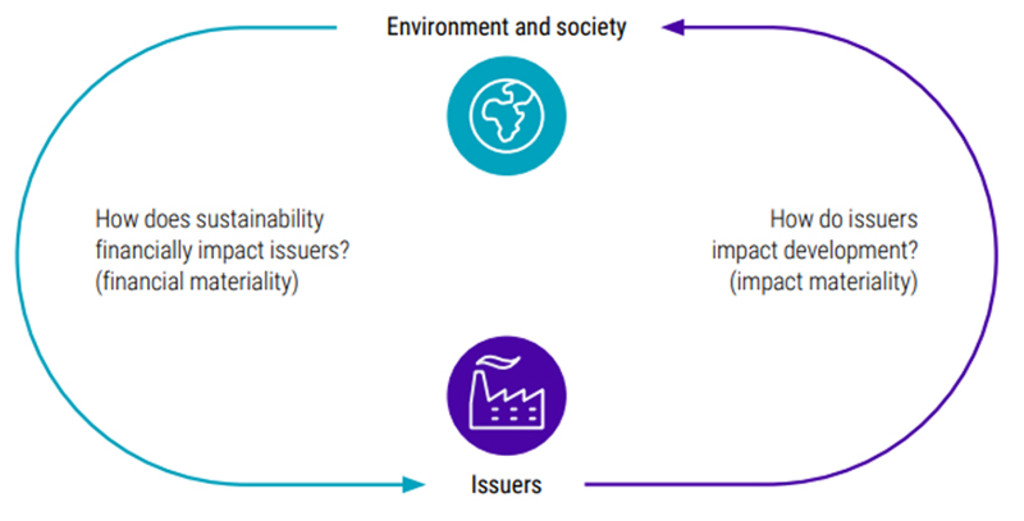

While direct government intervention can help ensure that economic prosperity is long-lasting, sustainable finance also has an essential role to play. It can help ensure that financial capital is efficiently allocated to companies that are making products in a sustainable way. Investors can use ESG scores to evaluate companies on a full range of sustainability factors – spanning everything from water quality, waste management, and carbon emissions to more social factors such as board diversity, talent retention and employee safety – all of which can impact a company’s competitive position and long-term financial performance (financial materiality).

Next to assessing financially material issues to make better-informed investment decisions, regulators are now using the principle of ‘double materiality’ to measure a firm’s sustainability. Double materiality broadens the material scope of sustainability to include the impact of a company’s products/services on society and the environment (impact materiality). Measuring impact materiality is critical because it accounts for the external costs of polluting and depleting common goods.

The concept of double materiality for measuring the sustainability in business and finance is at the heart of the EU’s Sustainable Finance Plan. It is also central to the achievement of the UN SDGs and the climate goals of the Paris Agreement.

Figure 3: The two faces of materiality

Source: Robeco, 2023.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Conclusion

The Tragedy of the Commons would be solved if companies began to financially internalize the full costs that their operations and supply chains pose to society and the environment. Unfortunately, although conceptual frameworks such as the doughnut economy and planetary boundaries are helpful for framing the problem, there is still a lack of functional tools to help investors practically address external costs in their investment research and valuation models.

Given the difficulty of assigning a monetary value to things like human life or access to clean water, rigorously applying sustainability to industries, companies and investments will be a thorny challenge for years to come.

Footnotes

1Johan Rockström, chief scientist on the team that developed the Planetary Boundaries framework and a pioneer in sustainability, was awarded the 2024 Tyler Prize, the ‘Nobel Prize for the Environment’.

2UN Department of Economic and Social Affairs, Population Division. World Population Prospects 2022.

3Global Footprint Network, Overshoot Day Initiative. Earth Overshoot Day 2022 Nowcast Report.

4https://www.un.org/ sustainabledevelopment/sustainable- consumption-production/

5L. Persson, B. M. Carney Almroth, et al. “Outside the Safe Operating Space of the Planetary Boundary for Novel Entities”. Environmental Science & Technology. 2022, 56, 3, 1510-1521. An updated study, “Earth beyond six of nine planetary boundaries,” published in a division of Science in September 2023, added freshwater use to growing list of breached planetary processes.

6“Linking planetary boundaries to business”, University of Cambridge Institute for Sustainability Leadership. https://www.cisl.cam.ac.uk/system/files/documents/

7“A Safe and Just Space for Humanity: Can we live within the Doughnut?”. Oxfam Discussion Papers. 2012; “Doughnut Economics: Seven Ways to Think Like a 21st Century Economist.” 2017. Random House Publishing.

8The Earth Commission, Global Commons Alliance

9Rockström, J., Gupta, J., Qin, D. et al. “Safe and just Earth system boundaries.” Nature. 2023.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会