We’re not on track to limit global warming despite having the tools and know-how

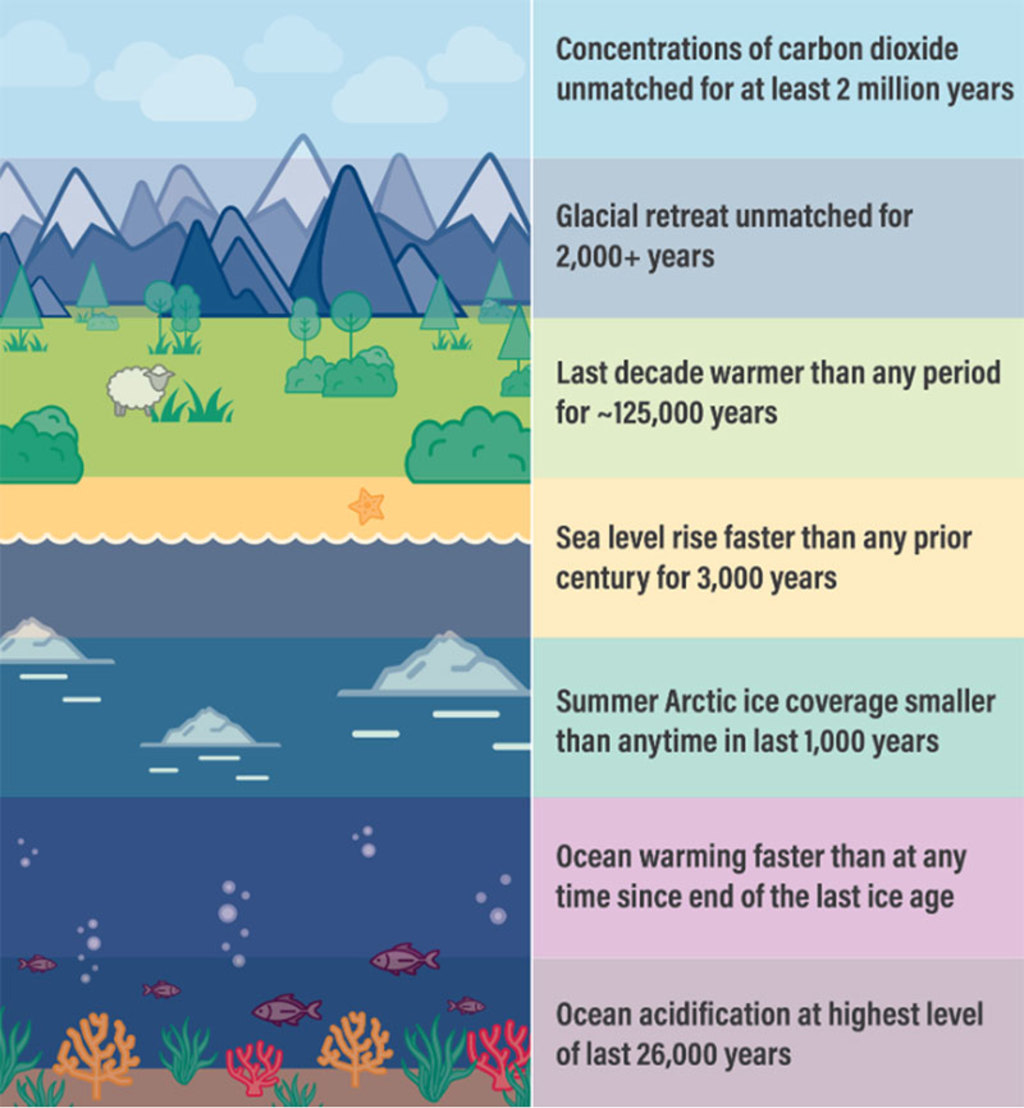

We are not on track in tackling global warming, despite better efforts to combat it with net zero 2050 implementation plans. That’s the key message from the 2023 UN Intergovernmental Panel on Climate Change (IPCC) report.

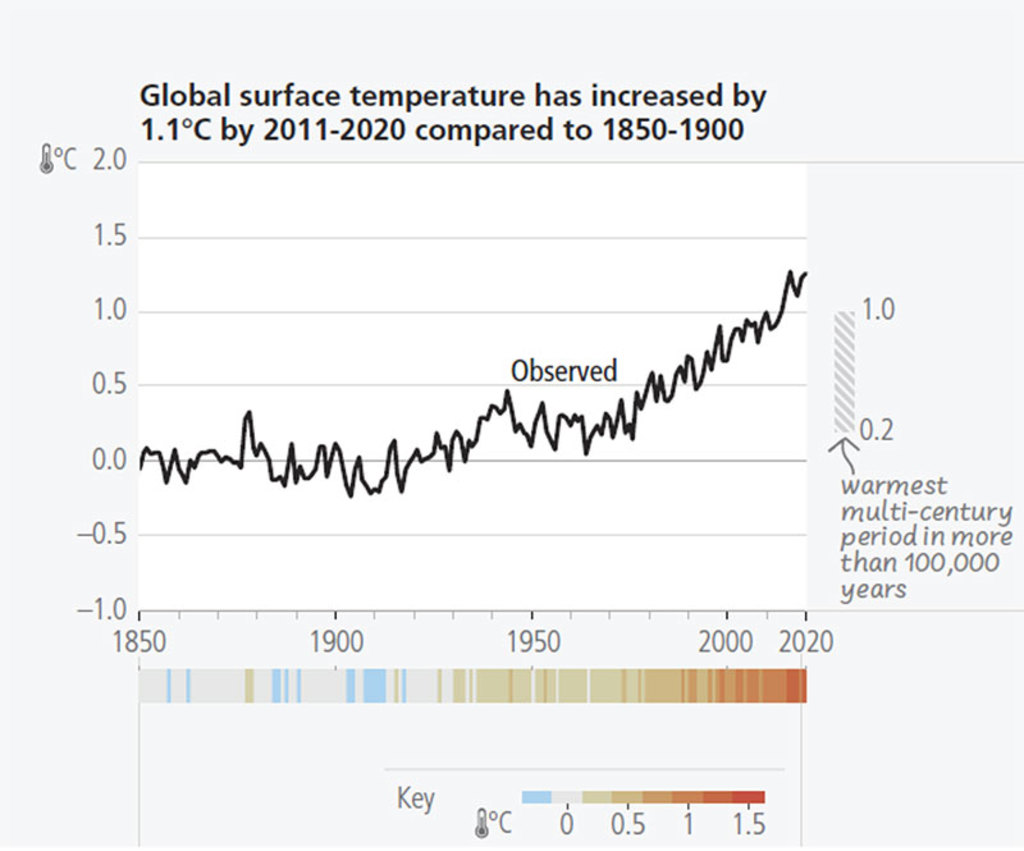

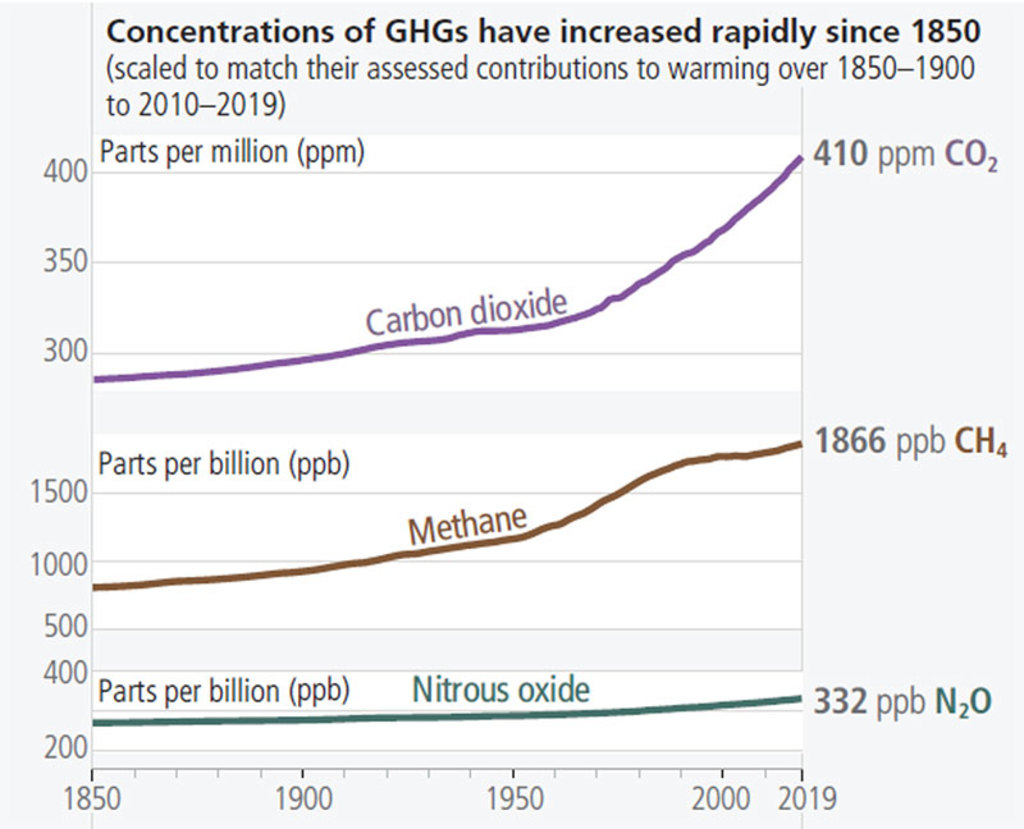

“Human activities, principally through emissions of greenhouse gases, have unequivocally caused global warming, with global surface temperature reaching 1.1°C above 1850–1900 in 2011–2020,” the report says.

“Global greenhouse gas emissions have continued to increase, with unequal historical and ongoing contributions arising from unsustainable energy use, land use and land-use change, lifestyles and patterns of consumption and production across regions, between and within countries, and among individuals.”

“Global greenhouse gas emissions in 2030 implied by nationally determined contributions (NDCs) announced by October 2021 make it likely that warming will exceed 1.5°C during the 21st century, and make it harder to limit warming below 2°C.”