Global reach

With investment teams across Europe, the US, and Asia, we cover the full spectrum of fixed income – from developed to emerging markets, from sovereigns to corporates, and from traditional strategies to innovative credit solutions.

In a world of rising dispersion and shifting macro regimes, fixed income offers timely opportunities.

In today's market environment, fixed income is reclaiming its role as a core portfolio allocation. Yields have reset higher, credit markets are becoming more dispersed, and global monetary policies are diverging. This creates fresh opportunities for active managers.

With investment teams across Europe, the US, and Asia, we cover the full spectrum of fixed income – from developed to emerging markets, from sovereigns to corporates, and from traditional strategies to innovative credit solutions.

We offer expertise across core credit solutions as well as niche segments, including corporate hybrids, financial institution bonds, green bonds, and Dutch private debt.

We apply research-driven insights to identify opportunities and manage risk, across both fundamental and quant-driven fixed income strategies.

We aim to target alpha by identifying market dislocations and mispricing using fundamental analysis and a global perspective.

Beyond our time-tested strategies, we provide bespoke solutions such as buy & maintain, benchmark-agnostic portfolios, and client-specific mandates.

Incorporating sustainable investing (SI) factors into the investment process enhances decision-making by providing insights into long-term risks and opportunities.

We bring together five decades of experience with innovation, managing over EUR 44 billion in fixed income assets.

Fixed income stands out because it generally offers stability and steady income. While stocks can rise or fall sharply, fixed income investments deliver regular payments with typically less day-to-day ups and downs.

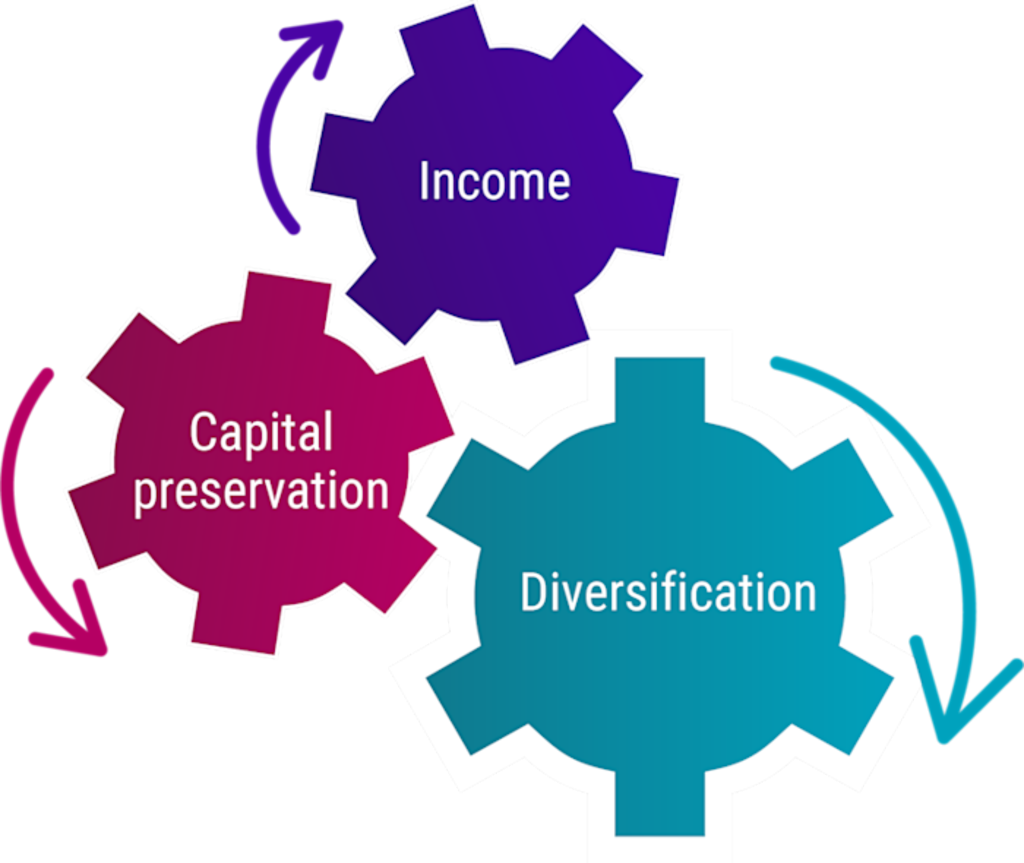

Fixed income plays an important role in helping balance a portfolio. It provides steady income, helps cushion against market ups and downs, and reduces overall risk. By combining fixed income with stocks and other investments, you can create a more stable and resilient portfolio that’s better prepared for changing market conditions.

At Robeco, fixed income is a dynamic allocation – whether the goal is capital preservation, yield enhancement, or sustainable impact, we offer strategies designed to meet diverse objectives.

Flexible bond solutions not bound by traditional benchmarks, allowing for active positioning across sectors and regions.

Actively managed euro and global credit strategies focused on investment grade bonds, with flexibility to tap high yield and emerging markets.

Actively managed euro and global high yield strategies targeting income and capital growth by investing in high-quality high yield bonds across regions and sectors.

Private debt strategy providing tailored loans to mid-sized companies in the Netherlands and wider Europe, supporting sustainable growth through direct lending and SDG-aligned impact.

Broad-based euro and global bond strategies investing in government, agency, and investment grade credit markets.

Green bond strategies focused on financing climate and environmental projects, with options for global exposure or enhanced income through high yield allocation.

Actively managed strategies capturing opportunities across emerging market sovereign, corporate debt and local currency, combining fundamental insights with local market expertise.

Focused exposure to Asia’s fast-growing fixed income markets, blending sovereign and corporate bonds to harness regional growth and diversification.

Fixed income strategies aligned with sustainability goals, targeting measurable impact through SDG alignment, climate-focused bonds, and ESG integration.

Data-driven fixed income solutions using systematic models to uncover return opportunities, manage risk, and enhance portfolio efficiency.

Customized fixed income strategies designed to meet specific client objectives, including return targets, sustainability preferences, and regulatory requirements.

Long-term strategies focused on holding high-quality government and corporate bonds to maturity, offering predictable cash flows and efficient cost management.

Interest rate risk

Rising rates can lower bond prices. We manage duration actively, tilting exposure to reflect macro conditions and risk appetite.

Credit/default risk

This refers to the possibility that issuers may fail to repay their debt. Our credit platform addresses this through a combination of quantitative and fundamental research – both top-down and bottom-up – alongside advanced risk modeling and selective position sizing. We also apply active FX management, using dynamic hedging strategies and currency overlays to help mitigate credit risks.

In 2003, we developed DTS (duration times spread), a proprietary metric designed to better predict credit volatility. DTS is integrated into our portfolio management process to assess relative value, manage risk exposure, and support performance attribution.

Inflation risk

Inflation erodes real returns. We offset this with exposure to credit segments that carry yield premiums and benefit from economic growth, while avoiding vulnerable sectors.

*Risk management approaches vary across our fixed income strategies and are tailored to the specific objectives, instruments, and risk profiles of each strategy.

If you have any questions, or would like to arrange a meeting, please reach out to us.