In the AI race, electricity grids are showing their age

Bottlenecks are building as clean energy goals coupled with the speed and scale of AI’s electricity demands have blindsided unprepared and ill-equipped utilities. That leaves next-generation data centers racing to find electricity. But what may look like an energy dilemma is turning out to be a deluge of opportunities for smart energy investments.

Summary

- Digitization, electrification and now AI are overwhelming electricity markets

- Securing power now will determine the winners and losers in the AI arms race

- The AI race is accelerating investments across the data center value chain

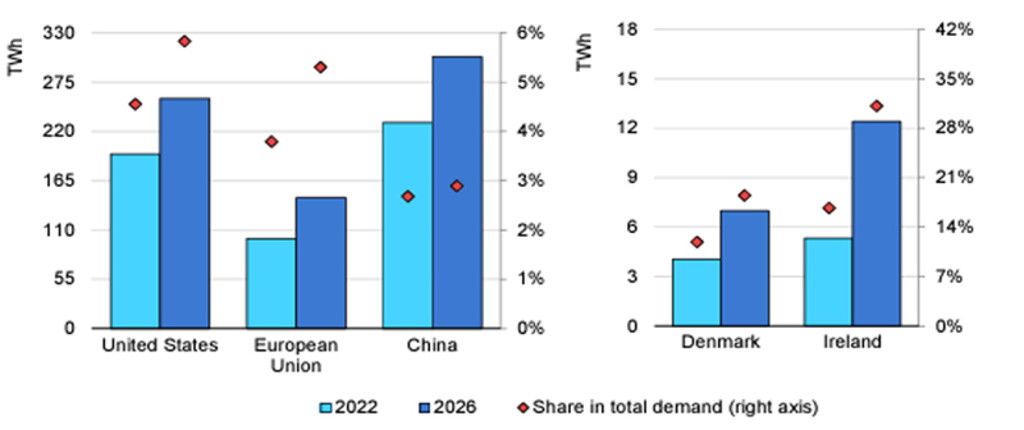

Electricity demand has been remarkably stable over the last two decades. However, the electrification of the economy and intensifying processing in data centers, are driving demand unexpectedly higher (see Figure 1). In Ireland data centers already gobble up more than 22% of total electricity and that’s expected to inflate to a third in just a few short years.1

In Asia, Malaysia is planning to increase data capacity ten-fold through 2026 in a bid to become a critical digital hub, a move that will intensify electricity consumption by up to 128%.2,3 The IEA predicts that by 2026 global data centers will consume as much energy annually as the entire country of Japan. After years of incremental growth, by the end of the decade, global data center power demand is poised to expand around 15% annually.4

Figure 1 – Data centers’ share of grid power is rising globally

Source: IEA, 2023. Data center energy demands are consuming more grid resources globally.

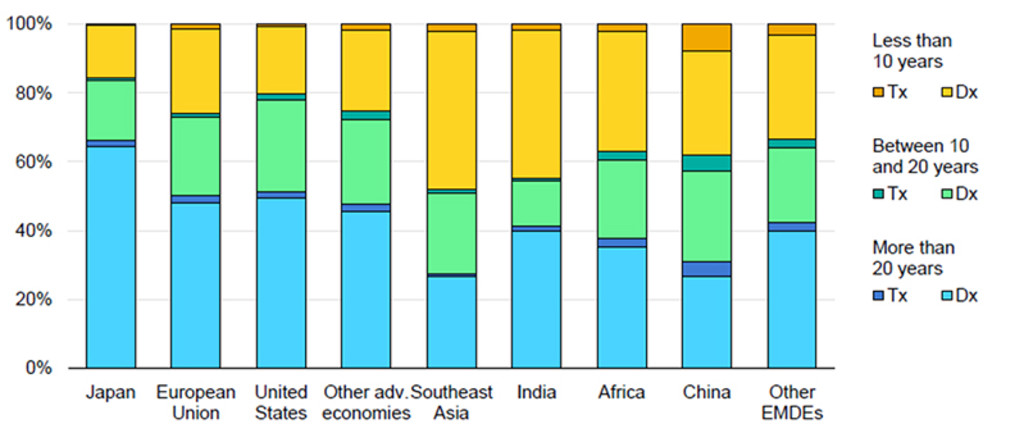

Utilities and network operators now face higher electricity demand while also combating aging and unpredictable grids (see Figure 2). Grids in countries globally are in desperate need of an overhaul as energy generation moves from dispatchable units from centralized power plants to intermittent ones from decentralized renewable sites. The majority of distribution lines are more than twenty years old in industrialized countries.

The majority of distribution lines are more than twenty years old in industrialized countries

Figure 2 – Aging grids are old and ill-equipped for next-generation electricity demand

Source: IEA, October 2023. The graphic shows the age of different parts of the energy grid. Transmission infrastructure (Tx) carries power from generation plants. Distribution infrastructure (Dx) is the last mile to end users.

The race for energy

The growth surge significantly resets the dynamics of power consumption trends, with implications for data centers and power supply chains globally. Big Tech players are feverish to establish an early foothold in AI’s game-changing potential. But that means building more data centers filled with cutting-edge GPU chips which need up to five times more electricity than CPU chips used for traditional data center processing.5

Mark Zuckerberg summed up the problem when he said, “energy, not compute, will be the number one bottleneck to AI progress.” A major concern around the highly anticipated growth in data center computing capacity is the availability of grid connections. Key issues include limited power lines, substations, and voltage transformers as well as delays in planning and permitting. Lead times for power projects are typically over five years in some regions in Europe and the US.

Explore the future of AI in investing

Learn how AI is shaping tomorrow’s investment landscape – learn the basics or dive into our AI course.

Energy, not compute, will be the number one bottleneck to AI progress.” – M. Zuckerberg

This is a race for energy. A recent study from Morgan Stanley showed operators would double the price they would pay local operators for electricity in order to gain access ahead of competitors. These scenarios are playing out globally and the press for power is reflected in Nvidia* CEO’s prophetic analysis that many nations will push to build their own “sovereign” AI systems to stay competitive and process data locally.

Many nations will push to build their own ‘sovereign’ AI systems to stay competitive and process data locally

Capacity constraints and climate goals challenge grids

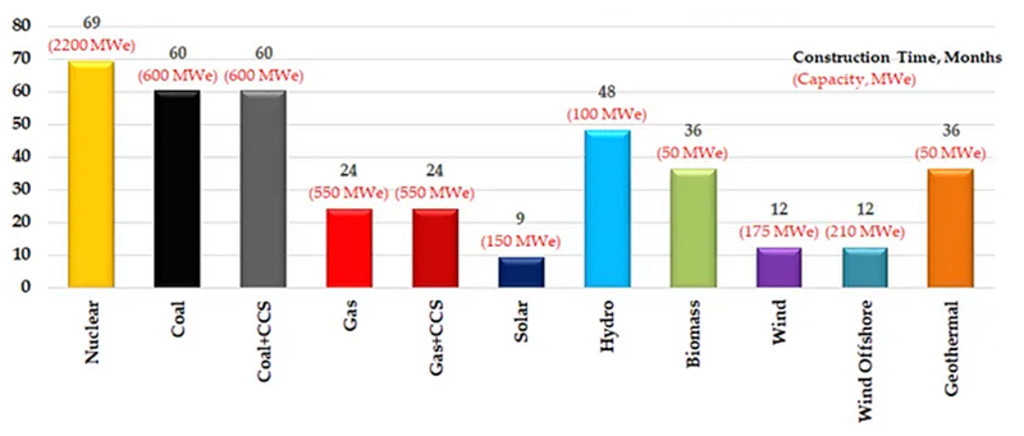

Net-zero goals complicate the plot further. Governments and companies have pledged to decarbonize by 2050 which limits power generation to low-carbon energy sources. Solar is seen as clean and is quickly built relative to other energy source. A solar farm can be built in less than a year, compared to nearly six years for nuclear (see Figure 3).

Figure 3 – Construction time needed for energy sources (in months, expected megawatts of power)

Source: Lazard, 2021. EIA, 2022.

Smart Energy I GBP

- performance ytd (31-1)

- 3.76%

- Performance 3y (31-1)

- 12.17%

- morningstar (31-1)

- SFDR (31-1)

- Article 9

- Dividend Paying (31-1)

- No

Moreover, even if enough renewable sites could be built, intermittency of power production and fragmentation of power distribution across remote sites make renewables unsuitable for providing steady baseline power needed by not only data centers but the entire grid.

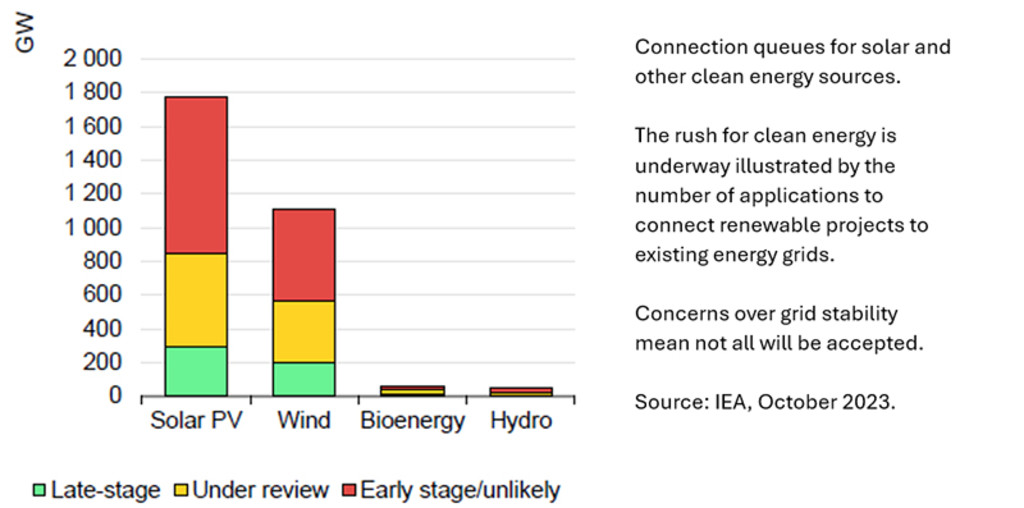

As a result, utilities are combining renewables with natural gas generation to balance long-term transition goals with short-term demands (see Figure 4). The large number of renewable project applications reaching late-stage connection-studies with grid operators testifies to the strong interest of developers. While not all of these projects are guaranteed connections, the high levels of new capacity from those that do connect will further strain transmission capacity.

Figure 4 – Renewable interest is exploding, pressuring grid stability

How does this impact Smart Energy investments?

We view the coming AI race as a multi-year trend with broad-based investment opportunities across industrials, technology, renewables and utilities.

Electrical grid equipment providers are among the first positively impacted segments, with global annual electrical grid capex expected to grow at 8% CAGR from 2022 to 2032. Within this group, one of the most promising industries are high-voltage cable manufacturers. These so-called ‘interconnectors’ carry electricity over long distances (including between countries) with minimal losses. They are also better suited to manage energy from different sources which helps maintain synchronicity across different networks.

Energy-efficiency of end-use equipment is also a key solution. Cooling is already emerging as the biggest opportunity for making data centers more energy efficient. GPU chips used for AI are heat-intensive and tightly packed by the tens of thousands into hyperscalers. Newer liquid-based solutions such as direct-to-chip cooling (DTC) offer huge energy savings compared to traditional air cooling.6

And while less than 25% of data centers currently use low-carbon energy, pressure from regulators makes renewable power generation mission critical and are driving investments across the energy value chain. And the biggest data center customers – Amazon, Meta, Microsoft and Google* – are already leading by example. All have set ambitious climate goals in the near and long term so it’s unsurprising that they also are the largest corporate purchasers of renewables from utilities and network operators.

* The Robeco Smart Energy strategy is not invested in any of the stocks listed, nor should these references be considered as recommendations to buy, sell, or hold these or any securities.

Sustainable energy

Footnotes

1Financial Times. February 2024. ‘Data centres curbed as pressure grows on electricity grids.’

2Ten-fold data center increase through 2026, Bloomberg, June 2024. ‘AI is already wreaking havoc on global power systems.’

3Electricity consumption growth calculated from a base year of 2022 through 2026, Malaysian Investment Development Authority, April 2024. ‘Data centres, AI initiatives to boost electricity demand.’

4Annual growth in CAGR, Goldman Sachs, April 2024. ‘Generational growth in AI data centers and the coming US power surge.’

5Robeco, November 2023. ‘The energy challenge of powering AI chips.’

6Air based cooling consumes on average 40% of a data centers’ total electricity.