Quant chart: Shifting tides – Detecting the turning points in investment themes

Thematic strategies have become a core building block in many investor portfolios, offering exposure to long-term structural trends such as technological innovation, demographic shifts, and geopolitical developments.

However, many of these products are launched only after a theme has already gained mainstream attention — in other words, once related securities have become overpriced and momentum is fading. As a result, the strategies frequently underperform post-launch.1

To avoid this pitfall, it is crucial for thematic investors to identify emerging themes early — before they become mainstream — and to divest as soon as themes lose relevance or become overvalued. This is the principle behind our Dynamic Theme Machine strategy, which continuously scans global developments to dynamically adjust exposure to the most relevant themes.

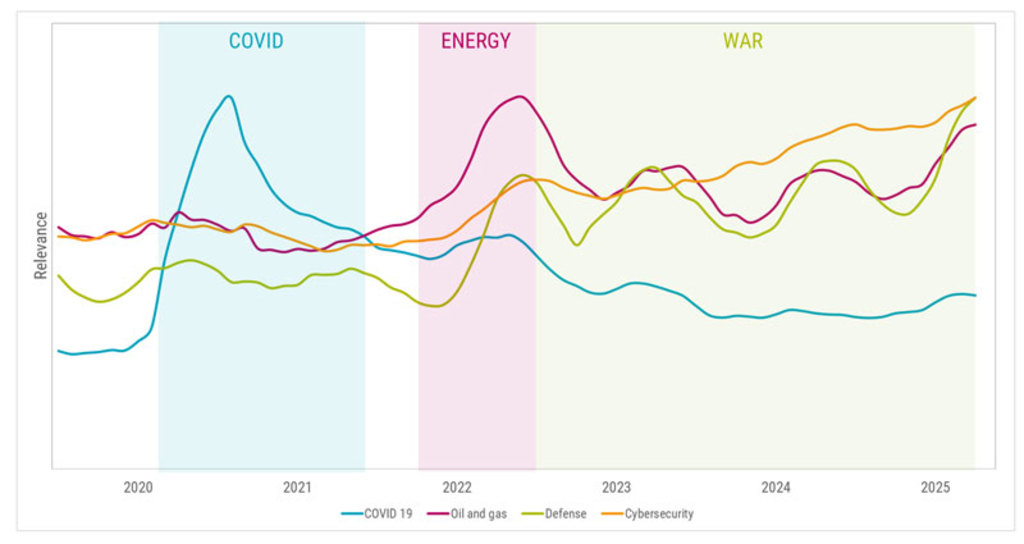

Figure 1 | Example of theme detection

Source: Robeco.

This chart is for illustrative purposes only and does not represent any particular product or strategy. The figure shows the relevance of themes based on a proprietary measure. The analysis includes proprietary datasets from July 2019 to April 2025.

The chart above illustrates how theme dynamics evolve over time in response to major global events:

Covid pandemic: Earlier in the timeline, the Covid pandemic surged in relevance. Initial concerns centered on lockdowns, public health measures, and retail disruption. As the crisis evolved, attention shifted toward vaccine development and distribution.

Energy crisis: The initial surge in thematic relevance was driven by Russia’s invasion of Ukraine, which triggered a multifaceted crisis. Energy security became a dominant concern as Europe faced supply disruptions and soaring prices.

Russia-Ukraine war: This conflict triggered sharp increases in both defense and energy themes driven by geopolitical instability and efforts to reduce dependence on Russian energy. At the same time, cybersecurity began a steady upward trend, reflecting heightened concerns over digital threats. Notably, this rise closely correlates with the AI theme. AI technologies are increasingly deployed to enhance cybersecurity capabilities — through threat detection, anomaly analysis, and automated response — but they also introduce new vulnerabilities, reinforcing the dual relevance of both themes.

With the Dynamic Theme Machine strategy, we aim to catch the right waves — capturing emerging opportunities early and stepping off with agility when the swell begins to fade. This dynamic approach keeps our thematic allocations aligned with the strongest market currents.

1See, for example, Ben-David, I., Franzoni, F., Kim, B., & Moussawi, R. (2023). ‘Competition for attention in the ETF space’. The Review of Financial Studies.