Water systems and climate change put cities at heightened risk

For many, water stress equates with physical water shortages, but too much water may be an even bigger problem. Rising flood frequency and costs are drowning municipalities across the globe; the OECD estimates that by 2030 investments in water infrastructure should reach USD 6.7 trillion annually to help cities and communities stay afloat.

Summary

- Climate change is contributing to the cost and frequency of catastrophic flooding

- Aging infrastructure and chronic underinvestment mean municipal water systems at risk

- Water suppliers offer cities diverse solutions to dampen climate risk

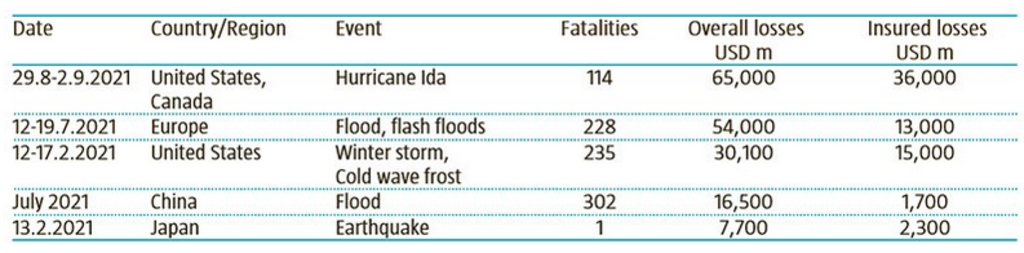

2021 added one more year of extremes to the record book. Mid-summer, devastating floods hit Germany, France and Belgium costing hundreds of lives and causing billions of euros in damage to residential homes, commercial buildings and municipal infrastructure. In the Henan province of central China, flood waters pushed reservoirs to overflowing, inundated streets and even gushed into underground carparks and subway tunnels, overtaking vehicles and commuters.1 Hurricane Ida hammered the US and ranked as the costliest natural disaster of 2021. Ida’s impact was felt as far north as Canada which again suffered unprecedented flooding just a few months later when storms hit its western province of British Columbia. Extreme rains and catastrophic floods also swelled in Japan, Indonesia, Nepal, Pakistan and India.2

2022 is looking to be a repeat, with record rains and ferocious floods are already wrecking lands and lives in southeastern Australia.

Table 1 | The 5 largest natural catastrophes in 2021 (ranking by overall losses)

Source: Munich Re, NatCatSERVICE, 2022

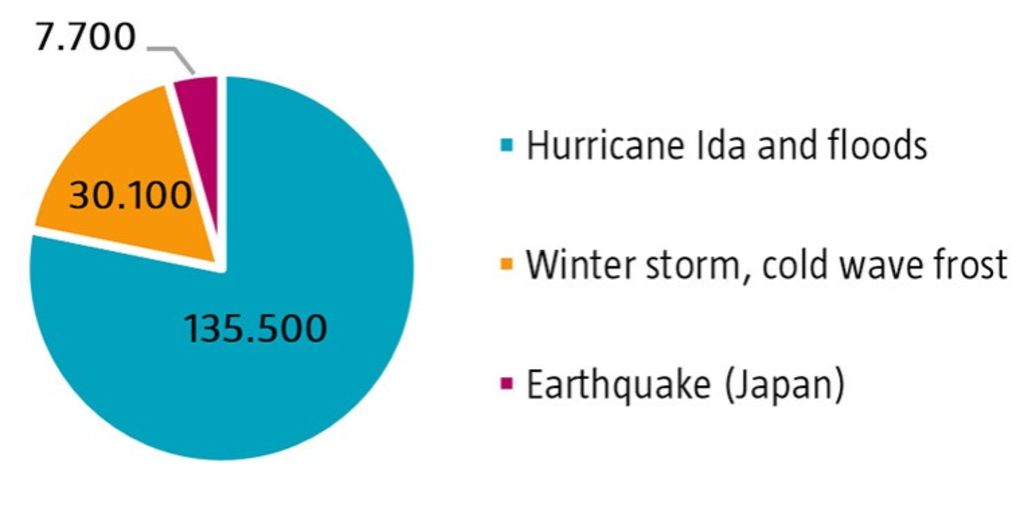

Climate scientists predict that global warming is changing weather patterns, making catastrophic flooding more unpredictable, more frequent and more costly. Since 2000, flood-related disasters have increased by 134%, compared with the two previous decades.3 Flood incidence, damage and costs are rising amounting to losses in the double-digit billions, and overall economic losses totaling in the hundreds of billions, annually.4 With USD 135 billion in damages, floods and storms caused the most economic losses in 2021.5

Figure 1 | Overall losses of 2021’s top 5 catastrophes (USD m)

Source: Munich Re, NatCatSERVICE, 2022

Outdated assets and investment shortfalls

The mounting costs of extreme weather expose the vulnerability of many municipal water systems and underscore the need for investments in water infrastructure. Over the years many urban areas have underinvested in water infrastructure; building flood and climate resilience will mean reversing that trend.

The average age of 2.6 million kilometers of water and sewer pipes in the United States is almost 50 years old, with portions stretching back more than a century.6 The American Society of Civil Engineers gave the US stormwater infrastructure a dismal D on a scale of A to F and estimates an investment gap of 8 billion annually just to comply with current regulations.7 Investments in climate resilience will run even higher. System-wide, to close the water infrastructure gap, investments will need to reach USD 109 billion annually, or over 2 trillion by 2040.8 Biden’s recently passed infrastructure bill which devotes nearly USD 50 billion in funding to modernize aging drinking water, stormwater, and wastewater systems will help but still falls short.9,10

The US is not alone. Segments of the EU’s seven million kilometers of pipes have been in operation since the first World War. Policymakers complain that investment in water infrastructure is not keeping pace with 21st century challenges which in addition to climate change, include population growth and rapid urbanization. An EU report from 2019 estimated flood-related losses in member states to range between EUR 20-30 billion in the 2020s. Losses from 2021 floods in Germany alone were EUR 40 billion, meaning member states have woefully underestimated the cost of future damage.11,12

All told, the OECD estimates that to achieve sustainable economic growth and development (from flood protection to safe and equitable access), global investments in water infrastructure should reach USD 6.7 trillion by 2030.13

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

In coastal cities, greater risks push accelerated adaption

The rising incidence of hurricanes, cyclones and typhoons along with rising sea levels, mean the risk of inaction for urban areas along coastlines are accelerating faster then the average.

The island city-state of Singapore is one of the world’s most advanced in developing water management solutions. In addition to a dense network of drains, reservoirs and catchment areas that collect and re-distribute rain waters, local water utilities are also investing in state-of-the-art technologies to help monitor and react to storms in real-time. Storm radar tracks offshore rain volumes while sensors in pipes and valves monitor water network pressure, volume, and quality so loads in mains, pipes and reservoirs can be shifted to maintain system balance. Similar approaches are being advocated in the US, EU to ensure the municipal water infrastructure is climate prepared.

As an alternative to traditional flood resistance infrastructure, coastal cities like Hong Kong and San Francisco are implementing natural solutions to improve climate resilience. Both are developing open green spaces inside city interiors as well as on waterfront borders that act as parks in the dry season but function as massive sponges to soak up excess waters in stormy ones. Washington DC’s water utility recently completed a massive USD 2.6 billion project that combined both innovative green and traditional gray water management measures to keep floodwaters from polluting the Chesapeake Bay. Gray measures included installing underground diversion tunnels while green methods included installing vegetated roofs, permeable pavements, and bioswales (entrenchments along borders to collect runoff) in key areas throughout the city.

Water investments dampen climate risk

Whether green or gray, investing in water infrastructure is capital-intensive early on but given the exponential costs related to climate change, the cost of inaction far exceeds the cost of prevention. Extreme events, together with their extreme costs, are moving from outliers to the norm. To protect not only water supplies but public and private assets, municipalities and companies (many of which operation their own water utilities) should fortify their defenses now.

From smart sensors and precision analytics to massive mains and tunnels, advanced wastewater management to natural watershed maintenance, companies all along the water value chain are providing private companies and public utilities with climate-adaptive solutions that protect water supplies, public infrastructure and human health. Investments in water help dampen climate risk, strengthen climate resilience and keep urban growth and development safely afloat.

Footnotes

1“Death toll triples to more than 300 in recent China flooding.” Associated Press, 2. August 2021.

2“The State of Climate Services 2021: Water.” World Meteorological Organization. https://public.wmo.int/en/media/press-release/wake-looming-water-crisis-report-warns

3Ibid.

4Swiss Re. News Release. 14. Dec 2021. “Global insured catastrophe losses rise to USD 112 billion in 2021.” https://www.swissre.com/media/news-releases/nr-20211214-sigma-full-year-2021-preliminary-natcat-loss-estimates.html

5Munich Re, NatCat Service, Report on Natural Catastrophes 2021.

6“The $300 Billion War Beneath the Street. Fighting to Replace America’s Water Pipes” 10 November 2017. New York Times. https://www.nytimes.com/2017/11/10/climate/water-pipes-plastic-lead.html

7“2021 Report Card for America’s Infrastructure.” 2021. https://stormwater.wef.org/2021/03/stormwater-receives-a-d-in-first-ever-asce-report-card-appearance/

8“The Economic Benefits of Investing in Water Infrastructure.” Report 2020. Value of Water Campaign, 2020. US Water Alliance, American Society of Civil Engineers, EBP, Downstream Strategies.

9“Biden Signs Infrastructure Bill with Funding Boosts for the Water Sector.” 12 Nov 2021. Water Finance and Management.

10“Major US Infrastructure Package to Address Stormwater Sector Needs.” 1. September 2021. Water Environment Federation (WEF) Stormwater Report. https://stormwater.wef.org/2021/09/major-u-s-infrastructure-package-to-address-stormwater-sector-needs/

11Z.W. Kundzewicz, P. Licznar. “Climate change adjustments in engineering design standards: European perspective.” Water Policy 2021. https://iwaponline.com/wp/article/23/S1/85/84955/Climate-change-adjustments-in-engineering-design

12“German Floods Cost a Record USD 40 Billion, Munich Re Estimates.” Bloomberg. 10. Jan. 2022. https://www.bloomberg.com/news/articles/2022-01-10/german-floods-cost-a-record-40-billion-munich-re-estimates

13“Financing Water: Investing in sustainable growth.” OECD Environment Policy Paper, No. 11. 2018.