Innovation remains the engine of growth

Despite global uncertainty, innovation is thriving. AI, nuclear fusion, and quantum computing are advancing rapidly, driving significant investments and automation, reshaping industries, and generating revenues.

Summary

- Innovation remains the key driver of economic growth

- Artificial intelligence advancements continue despite market turmoil

- Geopolitical tensions renew focus on automation and cybersecurity

Although the evolving trade war has fueled uncertainty over the world economic order and roiled markets, humanity’s knack for overcoming hurdles through innovation persists. From the agrarian age’s gristmill to the information age’s integrated circuit, humankind is continuously reshaping the world around us. As the late economist Robert Solow observed, “Innovation is the driving force behind sustained economic growth. Without new ideas, economies stagnate.” While macroeconomic factors may, at times, accelerate technological investment and at other times forestall plans, the direction of travel is inexorably forward.

Recent developments in artificial intelligence (AI), nuclear fusion, and quantum computing demonstrate the pace of innovation is accelerating. In particular, investments and progress in AI have remained undeterred by market turmoil as corporations and nations alike race to gain an edge. Advancements in automation and robotic technologies will also play a key role in renewed efforts to reshore manufacturing. At the same time, rising geopolitical tensions place increased focus on cybersecurity systems as risks to critical infrastructure expand.

AI is revolutionizing industries and reshaping the future of technology. Even as stocks have faltered so far in 2025, global competition has spurred continued investments into new AI models, digital infrastructure, and new applications. Notably, speaking at the World Economic Forum in January, Demis Hassabis, CEO of Google DeepMind said the company was on track to submit AI-designed drug candidates into clinical trials in 2025. More mundanely, but no less impactfully, AI agents are poised to shift from merely answering questions to taking action, as the technology seeks to fulfill its productivity-enhancing promise.

Building the foundation

While investors were concerned that the pace of investment into AI infrastructure might slow following the release of DeepSeek’s model in China in November 2024, increased usage of AI applications has spurred capital spending plans higher. Morgan Stanley estimates that global cloud computing capital spending will reach USD 353 billion in 2025, a figure that is nearly USD 38 billion greater than their previous estimate. AI has also driven an acceleration in venture activity, as funding to the sector jumped 79% in 2024 to more than USD 100 billion, according to CB Insights.

Putting AI agents to work

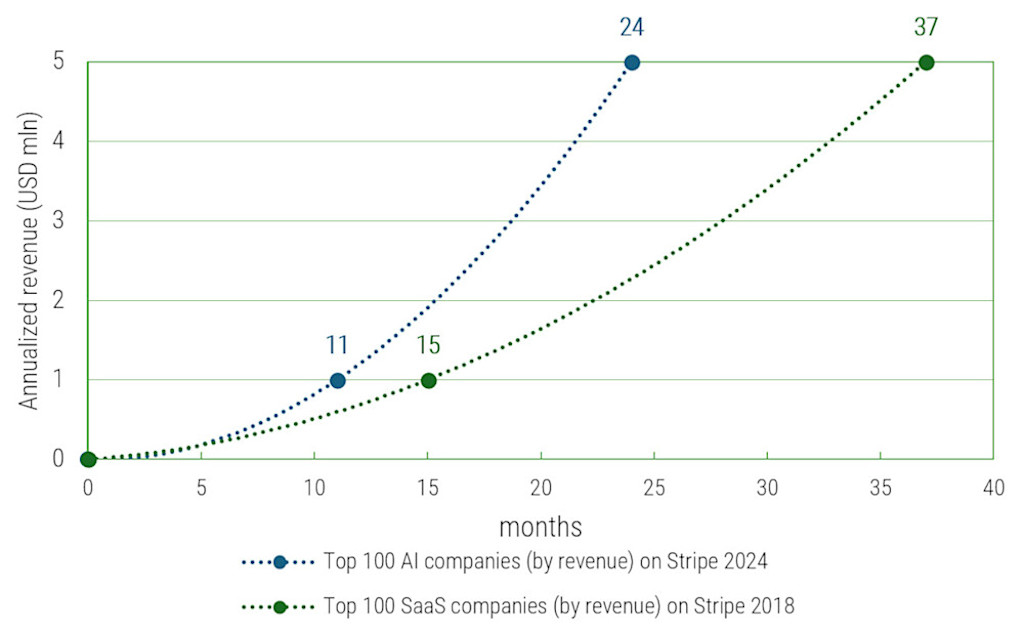

While AI is still early in the adoption phase, the technology is already generating meaningful revenues. For instance, Microsoft reported in January this year that annualized AI revenues had grown 175% year-on-year to USD 13 billion. Notably, in just two years since the launch of ChatGPT, OpenAI reported revenues of USD 3.7 billion in 2024, placing the young firm within the top 20 software companies. AI is also accelerating the growth of smaller firms too. According to the payments processor Stripe, in 2024, the median time for AI startups to reach annualized revenues of USD 5 million was 24 months, compared to 37 months for Software as a Service (SaaS) startups in 2018.

Figure 1: SaaS and AI startups’ median time to annualized revenue milestone

Source: Stripe, February 2025

AI agents and tech applications that can take action rather than merely answer questions should continue the trend. These AI agents are working their way into existing software to automate tasks that often involve data entry or the manual process of integrating information from multiple applications. McKinsey estimates that AI could enable the automation of up to 70% of business activities.

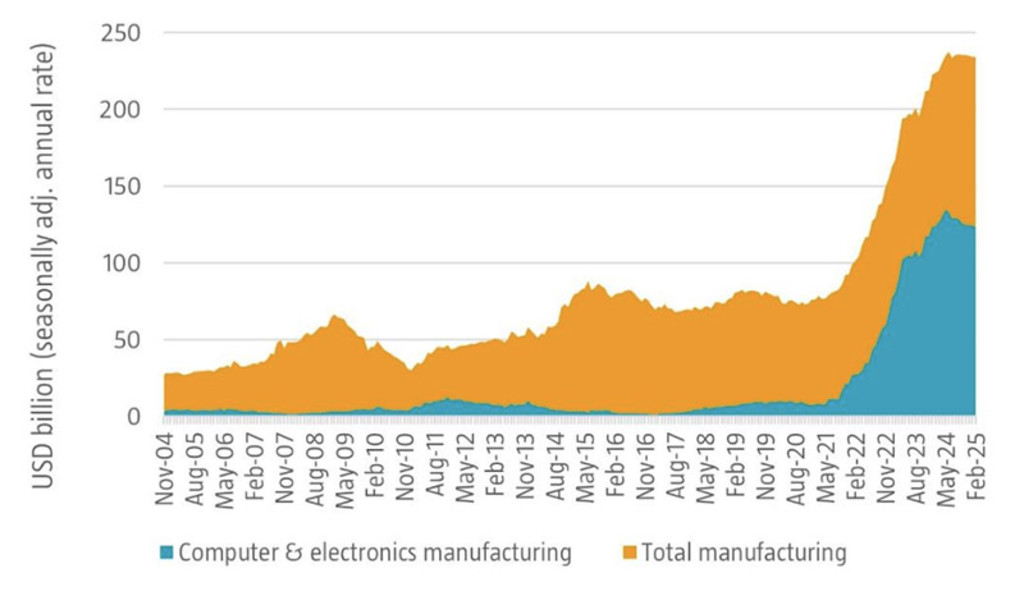

US investment in technology manufacturing facilities rose 15-fold over four years

Build it here

Production bottlenecks, labor shortages, and security considerations have renewed interest in automation and reshoring manufacturing closer to home long before US President Trump introduced his unprecedented import tariffs. While the desire to reinvigorate domestic manufacturing is not new, follow-through with significant investment spending has been less robust until recently. In the US, investment in manufacturing facilities expanded by more than threefold over the last four years reaching nearly USD 235 billion in 2024. According to the Peterson Institute for International Economics, the US invested more on technology manufacturing facilities in 2024 than it did in the prior 20 years combined. Importantly, those figures include only the structures and facilities, not the capital equipment used in production. Given the typical lag between construction and the outfitting of new sites with machinery and labor, the runway is now set for an acceleration in robotics, automation and capital equipment spending. Although the Trump administration has shifted focus to tariffs rather than fiscal policy to spur manufacturing, many key investments are already well underway.

Figure 2: Private construction spending on manufacturing facilities in the US

Source: US Census Bureau, April 2025

Rise of smarter robots

These investments seek to not only bring on new capacity, but to also modernize the manufacturing process. In addition to providing margin improvements through increased efficiency, industrial automation systems address a critical issue – a shortfall of talent as the workforce ages. According to Deloitte and The Manufacturing Institute, 1.9 million manufacturing jobs could go unfilled over the next ten years if talent challenges are not addressed.1 As a result, robotics have continued their steady advancement across the factory floor. Over the last five years, the globally installed base of industrial robots has expanded at a steady 11.3% CAGR.

Robots are not only getting more plentiful; driven by AI they are getting smarter too. During a presentation in January 2025, Nvidia CEO Jensen Huang declared robotics a ‘multi-trillion-dollar opportunity’ as the company announced its Cosmos foundation model platform for what the company dubs ‘physical AI.’ AI coupled with advancements in mechanical engineering have also renewed hopes for developing humanoid robots which could be trained to work in numerous environments rather than fixed locations. CB Insights notes that the venture investment into industrial humanoid robotics tripled in 2024 to USD 1.2 billion.

Nvidia CEO Jensen Huang declared robotics a ‘multi-trillion-dollar’ opportunity

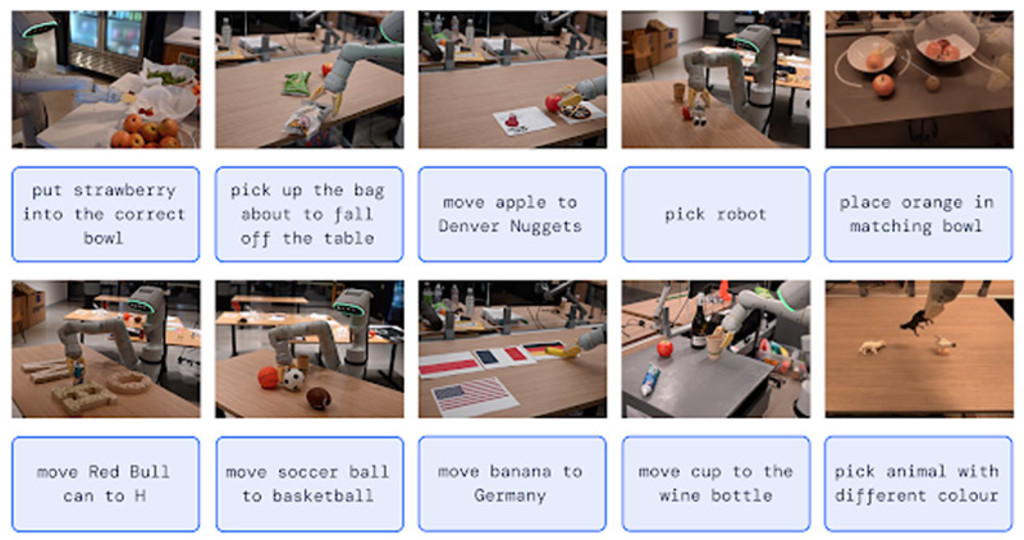

Currently robots are either human controlled or follow pre-defined programming to operate. More recently, autonomous and semi-autonomous robotics enable dynamic actions that factor circumstance and real-time conditions. By learning from human controls and taking input from sensors and cameras, robotic production is poised to become more efficient and more flexible. For instance, Google DeepMind’s RT-2 model was trained on both robotic-specific data, as well as from the web. This system enables machine vision equipped robots to perform tasks that were not preprogrammed.

Figure 3: Google DeepMind robotic arm performs tasks not contained in pre-defined instructions

Source: Google DeepMind, 2024

Secure everything

Increased digitalization, fragmented systems, and rising geopolitical tensions have more than doubled cyberattacks over the last four years according to the International Monetary Fund. Alarmingly, cyberattacks have increasingly targeted government networks and critical infrastructure. Although digital transformation offers the potential for increased efficiency, connected systems are subject to an increasingly hostile cyber threat environment. While AI is also enabling more adaptive and efficient security systems, bad actors have also proven adept at incorporating the technology. Similarly, recent breakthroughs in quantum computing have sparked concern the technology could break existing cryptography algorithms. With cybersecurity concerns remaining a top priority, the IDC forecasts global spending on the sector will accelerate modestly from 13% growth in 2024 to 14% in 2025, reaching USD 274 billion.

The cost of cybersecurity complacency is rising

The cost of complacency is also rising as cyberattacks inflict measurable damage. According to an analysis by Allianz, in cyber insurance claims exceeding EUR 1 million, cases of stolen data rose from 40% in 2019 to more than 77% in 2023. The World Economic Forum estimates the total cost of cybercrime will rise from USD 6 trillion in 2021 to USD 10.5 trillion in 2025.

Infrastructure, a matter of national security

Cyber threats have also escalated on the national security agenda as state-sponsored actors appear to have been behind a myriad of recent attacks. For instance, according to the US Cybersecurity & Infrastructure Security Agency in December 2024, state-sponsored Chinese hackers breached the US Treasury Department’s network, stole documents, and even accessed the computer of Treasury Secretary Janet Yellen. Governments around the world including Canada, Germany, Japan, and the UK have reported similar state-sponsored cyber breach incidents over the last year, according to the Center for Strategic International Studies.

Concerningly, critical infrastructure has also come under attack. Unlike cybercrime motivated by profit, or espionage extracting state secrets, attacks on infrastructure portend debilitating disruption. At a time of increased geopolitical tension, experts warn cyber attacks on infrastructure could not only disrupt daily life, but also the ability to respond in the event of military conflict. Along those lines, in January 2024, the US Federal Bureau of Investigations announced the agency had extracted malware that the US says was planted within the networks of communications, transportation, and energy hubs.

Footnote

1 Taking charge: Manufacturers support growth with active workforce strategies, Deloitte, April 2024

What’s trending?

All the latest thematic investing trends just one newsletter subscription away.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.